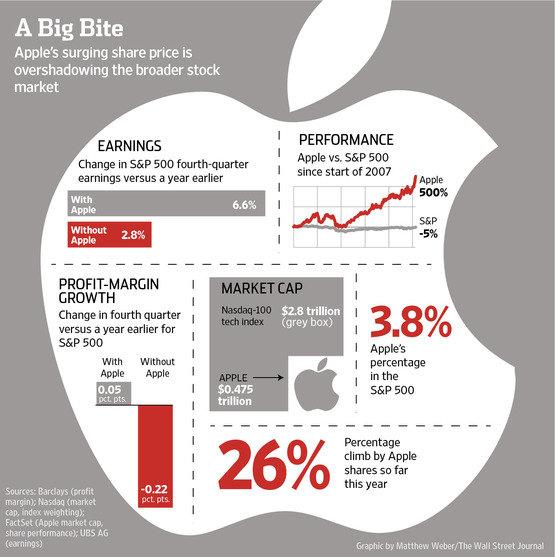

In an attempt to provide a clearer picture of American corporate earnings, a report by the Wall Street Journal notes that UBS analyst Jonathan Golub has published two versions of his quarterly earnings picture for the S&P 500, one including Apple, and one without.

The contrast highlights how much Apple contributed to the index's 6.6 percent year over year increase in the winter quarter; without the company, the gain drops to just 2.8 percent. With Apple, the S&P 500's profit margins were up 0.05 percent; without they were down 0.22 percent.

Golub wrote, that "by stripping away that one single company, it is like seeing light through a prism—you see things more clearly."

The report cited analyst Barry Knapp of Barclays Capital as saying, "what's happening with Apple is real, because Apple's earnings are real and any wealth accruing to Apple gets into the hands of U.S. shareholders. But to actually be able to look at trends and look at what's happening to [other companies], not just the one that's so exceptional, it is important to strip Apple out."

Were Apple in the Dow Jones Industrial Average

Alternatively, blogger Adam Nash of Greylock Partners notes that, had Apple been added to the Dow Jones Industrial Average rather than Cisco back in the summer of 2009 when the DJIA was last redefined, the Dow would be up over 2,000 points.

Nash noted on Monday that Dow closed at 12,874.04, and had it included Apple rather than Cisco, it would instead be at 14,926.95, 800 points higher than its peak set in April 2008.

"Can you imagine what the daily financial news of this country would be if every day the Dow Jones was hitting an all-time high? How would it change the tone of our politics? Would we all be counting the moments to Dow 15,000?" Nash wrote.

"Look, I’m just going to say it. The Dow Jones Industrial Average is ridiculous," he observed, adding, "You may not realize this, but the Dow Jones Industrial Average, the “Dow†that everyone quotes as representative of the US stock market, and sometimes even a barometer of the US economy, is a mathematical farce."

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

41 Comments

The rapid escalation of Apple's profits and corporate valuation are overshadowing the performance of other companies so much that analysts are highlighting how different the market would look like without Apple.

This shit is surreal.

Well, that's it! I finally made my move and I opened a trading account today.

In a few days, when the money clears and other matters are taken care of, like sending in my signature, I will be putting some of my money where my mouth is and I'll be picking up some AAPL for the first time ever.

From now on, I'll not just be some guy with a bunch of Apple computers and devices who likes their products, but I will have a vested interest in the company as a shareholder.

This has been discussed in some financial circles when the question is posed "Why isn't Apple in the Dow Jones Industrial Average", in other words the top 30 stocks traded. Apple certainly falls into that category as the world's most valuable company. The problem is that Apple's growth has been so ridiculously out of what is normal for a big cap stock that apparently there wasn't a way to add Apple to the index and keep from radically distorting it. In other words, Apple's success isn't the same as all the other companies...its moving much faster than the rest of the economy and it would seem like the Dow was far better than the rest of the economy.

I was asked in 1999 by a group of guys at work who wanted to pool their money and buy a good stock, if Apple would be a good investment (if you remember many people had written Apple back off then). I said that there is no way that Apple would die, they are too innovative, more so than the average person realizes. I recommended that they invest in Apple. A few of them did, some later got scared and pulled out. The 2 that stayed in are soo happy! I wish I had a few bucks to rub together back then. I was just a broke tech lover and Apple was trading at around $50.

Wow... I knew it was a significant impact, but didn't realize it was that dramatic. It almost gives credence to "short the market, go long on AAPL" strategies. Unfortunately, it is hard to figure out how long-term it will work for AAPL to be so dominant. There has to be a backlash in a few years...