Two major U.S. drugstores have turned off their NFC payment terminals to stop Apple Pay transactions in an effort to make their own "CurrentC" app-based payment system— which is designed to collect and track information on their customers— the only option, even though it's not actually finished yet.

U.S. drugstore chains CVS and Rite Aid initially supported Apple Pay— at least unofficially— because both chains had installed NFC payment terminals years ago to work with Google Wallet and other specially designed credit cards supporting NFC tap-to-pay transactions. Google's NFC-based Wallet never took off however.

When Apple launched iOS 8.1 with Apple Pay support earlier this month, customers found that iPhone 6 and iPhone 6 Plus could not only make NFC purchases among Apple's launch partners (including Walgreens, McDonalds, Whole Foods, Macys and a couple dozen other major retailers and restaurants) but also at virtually any existing NFC payment terminal, including the thousands of locations set up by Google Wallet years ago. A series of retailers are opposed to the success of Apple Pay because the new system keeps user's transactions private and doesn't collect or track their purchasing history, providing the store with little more than the funds to cover the sale

However, a series of retailers are opposed to the success of Apple Pay because the new system keeps user's transactions private and doesn't collect or track their purchasing history, providing the store with little more than the funds to cover the sale.

Some retailers, including Best Buy, appear to have removed their NFC terminals, while CVS and Rite Aid have turned them off to disable customers from using Apple Pay (turning off NFC also prevents Google Wallet from working).

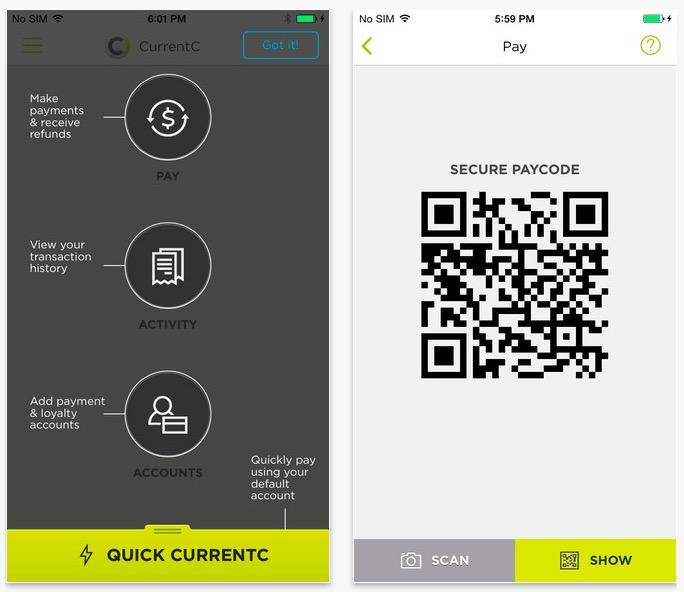

CVS and Rite Aid belong to a consortium of retailers, led by Walmart, Best Buy, Kmart and 7 Eleven, that has been working since 2012 on CurrentC, a plan to enable payments through a mobile app. Rather than replicating Apple Pay's "fingerprint and tap," the CurrentC app for iOS and Android will require users to launch the app at checkout. The app will then produce a QR bar code that retailers have to scan.

Similar to Google's newer version of Wallet using Host Card Emulation rather than a Secure Element, CurrentC will also require users to have data service while using the app. Apple Pay does not.

Can't wait for the mobile payments app from the company that designed this receipt. pic.twitter.com/nBLbBs7Z4U

— Dan Frommer (@fromedome) October 25, 2014The CurrentC app is already available to download from the iOS App Store, although its description notes "CurrentC is invite-only at the moment. But sign up, and we'll put you on the list!" The app currently has no user reviews.

The app description states that "with CurrentC you'll be able to use your phone to pay for things through your checking account, and select merchant gift cards, credit and debit accounts. Add your existing merchant program rewards accounts and you'll continue earning loyalty points and rewards with every purchase. It'll help you keep track of all your receipts and make returns easier. And in the not-so-distant future, it'll even carry all your coupons and deliver exclusive offers to help you save.

"CurrentC processes every transaction across multiple secure checkpoints— each meeting or exceeding industry security standards. Sensitive financial data is never stored on your phone or shared during a merchant transaction— so you can pay with peace of mind."

Rather than working with users' existing credit cards, the QR code will debit the user's checking account or a configured gift card or cards issued under the program. Apple Pay was expressly designed to work with existing banks and accounts in order to allow users to continue to earn the reward points, airline miles or other perks they already do.

Additionally, a series of major retailers have reported massive leaks of customer data and account information, creating poor timing for CurrentC's launch with assurances that "you can pay with peace of mind," given that users' transaction data will be collected and stored by the retailers' consortium.

CurrentC hopes to have its barcode app ready to use by early next year. But some of its partners are blocking already Apple Pay in the hope that users will set up new accounts to continue shopping with them. In addition to gaining access to more data on their customers, CurrentC also wants to avoid the transaction costs of conventional credit cards by directly making payments that bypass banks.

Addressing the subject, John Gruber of Daring Fireball wrote, "I don't know that CVS and Rite Aid disabling Apple Pay out of spite is going to drive customers to switch pharmacies (Walgreens is an Apple Pay partner), but I do know that CurrentC is unlikely to ever gain any traction whatsoever."

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Amber Neely

Amber Neely

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

Malcolm Owen

Malcolm Owen

502 Comments

Slimeball retailers, all of them.

Excuse me, but I have to go move my prescriptions to Walgreen’s.

I would not mind any of them disappearing from the face of the earth, especially walmart.

Walgreens here I come. I wonder how many people will take action to avoid retailers who block Apple pay.

[quote name="Chick" url="/t/183054/cvs-joins-rite-aid-in-blocking-apple-pay-in-currentc-plan-to-collect-more-customer-data#post_2627111"]Walgreens here I come. I wonder how many people will take action to avoid retailers who block Apple pay.[/quote] The funny thing is that most of the companies involved in MCX are failing badly. Sears, Olive Garden, Best Buy...it's like they don't want to make money. And I'll certainly take action to avoid retailers that block it. Not supporting it is one thing, actively fighting it is another.