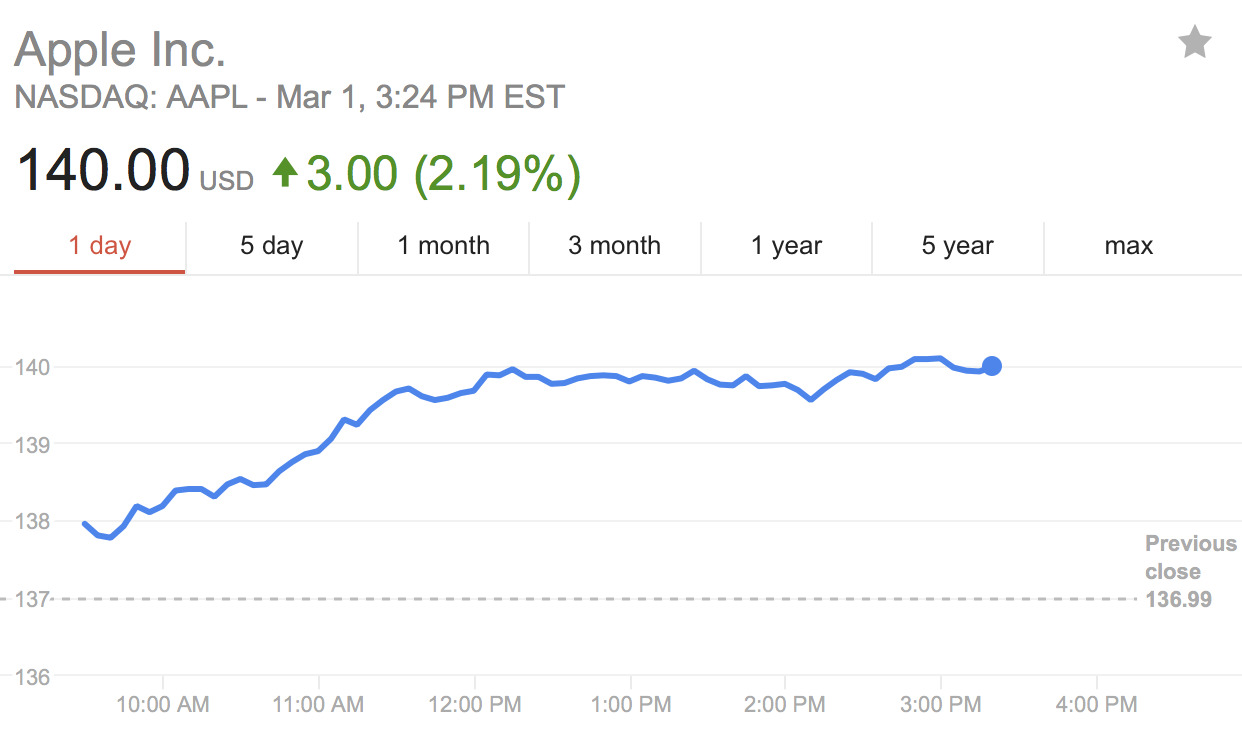

Apple's stock price on Wednesday afternoon broke $140 per share and is only a few dollars short of both a pre-split $1000 valuation and breaking the company's previous market capitalization record of $774.69 billion set in 2015.

At $140, Apple's stock price is $7.82 away from breaking the old market capitalization record, briefly reached on Feb 23, 2015. At the same price, the oft-discussed $1000 per-share valuation corrected for the split is only a $2.86 rise away.

On Wednesday, the stock sat at $137.95 at the start of business, after jumping up nearly $1 in after-hours trading from Tuesday's active session.

Apple's market capitalization broke $700 billion on Feb. 14. In the last 30 days, AAPL has jumped from $128.75.

The week's AAPL gains seem to be related to remarks made by Warren Buffett to the press on Monday, with the financial head claiming that Berkshire Hathaway had purchased 133 million shares in the stock in 2016 and 2017. Apple wasn't the biggest point contributor to Wednesday's 1000-point DOW gains, with 35% of the total gain split between Apple, Goldman Sachs, and Boeing.

It is likely investors will keep the rising price trend going, with analysts suggesting it can go far higher in fiscal year 2017. While some suggest Apple could climb to between $140 and $150 per share, with Goldman Sachs' confidence in the fall iPhone refresh prompting it to raise its target price to $150, some analysts believe the price could go as high as $156 per share.

UBS analyst Steven Milunovich said in a research note that Apple's Services arm is undervalued by investors, compared to other parts of the company. After generating $7.17 billion in revenue in the last quarter and demonstrating steady revenue growth, Milunovich suggests "If Apple services were valued similarly to PayPal, the stock would be at least 10 percent higher."

Mike Wuerthele

Mike Wuerthele

Chip Loder

Chip Loder

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

William Gallagher

William Gallagher

-m.jpg)

35 Comments

Oh Collin Gillis...if only you would reappear ...

Trump bump!

Winning.

Apple isn't the biggest point contributor to the DJIA's gains today (and it hasn't been for most of the day). Goldman Sachs is, and as of right now Boeing and JP Morgan are also bigger points contributors to the DJIA's gains. Combined, I think the three you mentioned (AAPL, GS, and BA) account for about 25% of today's increase in the DJIA.

For those that don't know, the (30) component stocks of the DJIA aren't weighted by market cap. All that matters is the change in their stock prices (in dollars) and the divisor used for the DJIA. Right now the DJIA divisor is about 0.146. So to get the DJIA you just add the current prices of the 30 stocks and divide the total by that number (that isn't the exact number, but it's close). If a given stock's price rises $5, it increases the DJIA by about 34 points. And that's true whether the stock started at $40 or at $200.