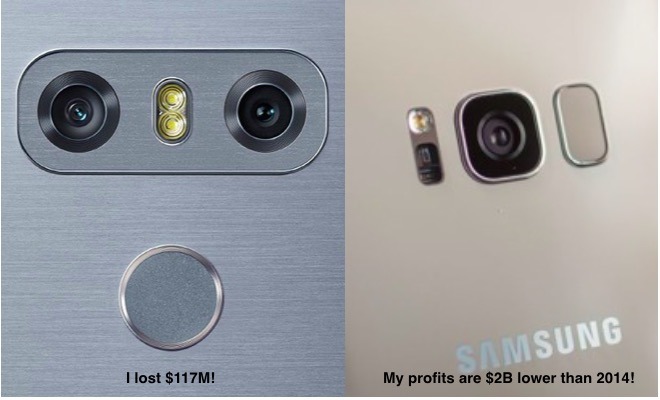

LG blamed a "challenging quarter for mobiles" for the $117.27 million quarterly loss posted by its mobile unit, even as the company posted slightly higher year-over-year revenues across its other businesses. Samsung similarly reported strong overall earnings— primarily from its semiconductor segment— while its mobile unit turned in revenues and profits better than last year but still below its Galaxy heyday back in 2014.

LG noted "weaker than expected premium smartphone sales and increase in component costs" for its mobile segment losses, despite the release of its new G6 flagship phone.

Since 2014, Samsung has been hit hard by a series of Galaxy S flops that attracted more negative reviews than new buyers, culminating in the mobile world's worst brand implosion ever suffered in last fall's Note 7 imbroglio.

Samsung S8 sales to slide, middle/low tier phones already in decline

While media sources have sought to peddle the narrative that Samsung's problems are no big deal and that the company will win back the customers it literally burned with its defective batteries, the reality is that Samsung's Galaxy sales have not only failed to rebound to previous highs on the premium end but are also being hit hard by new Chinese models on the low and medium tiers. Samsung's Galaxy sales have not only failed to rebound to previous highs on the premium end but are also being hit hard by new Chinese models on the low and medium tiers

Samsung's earnings report noted that "Revenue/OP [operating profit] increased significantly driven by increased global sales of S8," but acknowledged that "shipments of mid to low-end smartphones declined."

Further, the company noted that the profit bump from the S8 introduction would be short-lived, stating that in the next quarter "earnings are projected to decline QoQ due to increased marketing costs with the launch of new Note product, and reduced new product launch effect of S8."

Samsung burned by heeding Apple Pundit advice

Apple's critics have long insisted that the iPhone-maker needed to start selling higher volumes of lower-end iPhones to compete in "market share metrics" with Chinese producers, none of whom actually make very much money producing large quantities of mid to low-end phones.

However, Apple has continued to maintain world-leading profitability even as it dramatically boosted its iPhone shipments numbers since the introduction of 2015's premium iPhone 6 and 6 Plus models. In contrast, Samsung has relied on shipping larger numbers of lower priced phones, a far less effective strategy for generating profits and one that has made it much easier for Chinese companies to steal away sales.

Like Samsung, Chinese brands have also achieved shipping larger numbers of phones than Apple, but none have come anywhere close to matching Apple's profitability. Last quarter, Apple's iPhone sales earned more than 5.4x as much as Samsung Mobile, and more than 15 times as much as Huawei; BBK Electronics' subsidiary brands Oppo and Vivo; Xiaomi and ZTE put together.

Apple is slated to announce its earnings for the second calendar quarter of 2017 next Tuesday, August 1.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

11 Comments

Commodity Android OS devices are flooding into a buyers market with little real differentiation.

Hubris leads to a grab for marketshare by many participants that will drive down prices.

It will be a financial bloodbath.

There's no love for Samsung...

for which I'm grateful.

I'd love to see the knockoff manufacturers tumble one by one.