With Tuesday's earnings report, Apple has officially met its projections of its services alone being the equivalent to a Fortune 100 company.

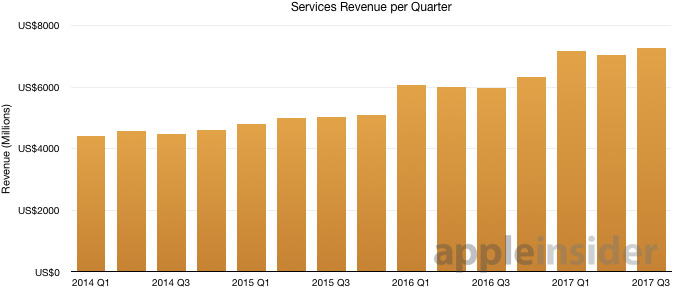

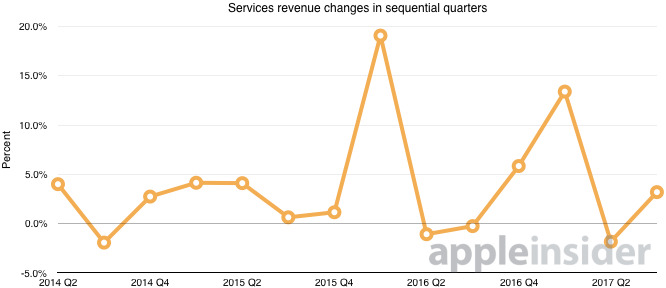

In the third fiscal quarter of 2017, Apple reported $7.27 billion in revenue, up from $7.04 from the last quarter, and $5.98 billion in the year-ago quarter. Apple's services revenue is gleaned from iTunes, iCloud, Apple Music, Apple Pay, Apple Care and the various App Stores.

Apple's last four quarters of service revenue total $27.804 billion. That figure puts it in 97th place ahead of Facebook's entire business at $27.64 billion, and just ahead of Northwestern Mutual's $27.8 billion

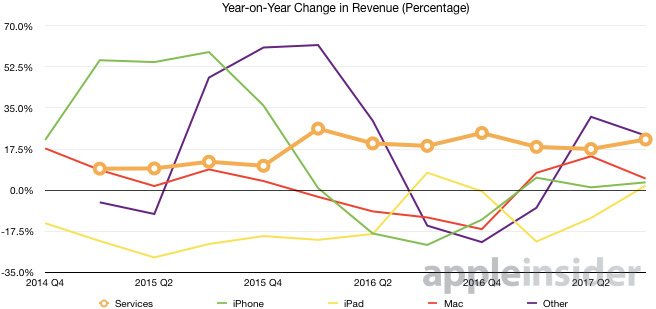

Apple's services business division's income has escalated rapidly along with the company's iPhone sales. In 2016, investment bank Piper Jaffray estimated gross margins on Apple's services business hovered at 60 percent for fiscal 2015, nearly doubling the percentage gleaned from the company's hardware — and there is no indication that the gross margin has decreased.

Analysts predict that services revenue is expected to grow 17 percent per year through 2021, with a growth in hardware revenue of 2.4 percent, with a continuation of about 30 percent annual growth in Apple's App Stores per year. One analyst called the App Store which is currently the prime mover of Apple's services revenue "one of the best business models ever created."

The upcoming "super cycle," releases of the "iPhone 7s" and "iPhone 8" this fall, more acquisitions, and other product launches are also seen by analysts as factors that are likely to bolster services revenue growth.

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

Christine McKee

Christine McKee

-m.jpg)

10 Comments

1) Remember when Cook said "[The cloud] is just not a product. It is a strategy for the next decade," 5 years ago? I wonder what aspect of their services division involves cloud computing.

2) I hope this can translate into boosting the default iCloud storage.

Hang on!

Isn't that the outfit run by that sandle-wearing no-hoper, Eddy Cue?

So while he's busy doing nothing, he's running a division making more money than the whole of Facebook?

'Bout time Eddy got off his can!

There were so many arrogant a**holes who called Tim Cook a liar when he spoke of services growth. They said it wouldn't be possible for Apple to do such a thing. I'm still willing to bet those same people will claim Apple's services growth won't last. I must admit even I had my doubts but I still took a wait-and-see attitude. I wasn't given the power to see into the future, so I figured anything could happen one way or the other. It's just that some people are so adamant that Apple won't survive as a company and it doesn't make any sort of sense at all.

What I do know is I'm quite relieved that this quarter turned out as well as it did. I would have been satisfied as long as the stock didn't tank hard. The share gains are icing on the cake. I hope these gains hold for a couple of weeks. Netflix and Facebook's share gains have already left Apple in the dust but at least as an Apple shareholder I'm getting my dividends and they're not.