After monumental delays, the Coin "smart" credit card finally started shipping out to customers in April, offering users the flexibility of carrying up to eight swipeable credit, debit a rewards cards that — for now — are accepted at more locations than touchless NFC solutions like Apple Pay.

The first thing we noticed out of the box is Coin's strikingly thin profile. Coin, the company, managed to stuff an e-ink display, Bluetooth radio, functional electronics and a battery good for two years of normal use into a chassis no thicker than a traditional credit card.

As AppleInsider reported when Coin was announced in 2013, the device replaces multiple swipe-based cards by storing account information and outputting card data to point of sale terminals via a dynamically programmable magstripe. Current models don't support chip-and-pin security and lack the necessary NFC modules for contactless payments, but with near universal acceptance of swipe-to-pay POS systems, Coin's form factor is currently more flexible. That is if it works as advertised.

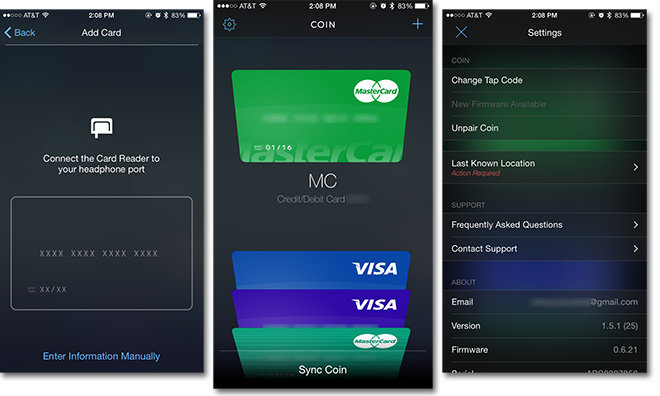

Setup is fairly straightforward, though we did run into some problems swiping in new cards. Pairing is completed by first registering through Coin's website, downloading and logging in through Coin's app, then authenticating and linking your unique card to an iPhone on first sync. Coin itself is personalized to each user and comes with your name etched on the back and an area for signature entry.

Using Coin's iOS app and the provided magstripe reader dongle, we were able to load up our most-used cards with relative ease. Coin's dongle hardware is similar to Square's product in that it uses iPhone's headphone jack as an interface. Like older Square models, Coin's reader stores its magnetic bits in one side of the housing, meaning cards must be facing a certain direction when swiped.

Some credit cards require authorization before being provisioned for use, a simple process of tapping in the CVV number located on the card's back, which is then cross-checked against data on a given provider's network. Our debit cards also needed to be authenticated by providing a correct PIN. We did have trouble with one pesky credit card that refused to cooperate with Coin's reader even after multiple swipes at different speeds. In that case, we resorted to punching in our details manually.

Tapping "Sync Coin" in the iOS app brings up a list of stored cards available for transfer (up to eight), as well as options for "Lock and Find" and changing your tap code, a unique six-tap Morse code-like sequence entered upon initial setup. "Lock and Find" is Coin's security option that uses an iPhone's Bluetooth and GPS capabilities to keep tabs of where and when Coin was last seen. The feature also uses BLE proximity features to alert users when they leave a card behind. Total card information and device settings transfer time clocked in at around ten seconds.

As long as a host iPhone is within Bluetooth range, Coin automatically unlocks when its lone button is depressed. Alternatively, the device can be unlocked using your tap code, though we found this method unreliable. A tactile click should be felt each time the button is pressed, though the mechanic was inconsistent and at times "mushy" on our unit. Luckily, a small green LED located just to the left of the button offers a secondary indication that inputs are being recognized.

Once unlocked, users are able to cycle through stored cards, identified by their abbreviated name (MC for Mastercard, VISA for Visa) and the last four digits and expiration date. Coin can be used at practically any magnetic card reading terminal, including ATMs. After use, the card automatically locks and powers down, monitoring for Bluetooth wake signals from a host iPhone.

We have yet to test Coin in the wild, but are anxious to do so since a majority of retailers in our small town do not accept Apple Pay. Touchless NFC payments are starting to see wider adoption thanks in large part to efforts from tech companies like Apple and Google, but swipeable cards are for now the de facto form of credit and debit payments. Here, at least, traditional cards are unquestionably the most accepted option.

In the U.S., EMV chip-and-pin systems will roll out in October, making current Coin models useless. However, POS terminals must be upgraded before that happens, so Coin has some time before becoming completely obsolete.

Those interested can preorder Coin through the company's website for $100.

Mikey Campbell

Mikey Campbell

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

36 Comments

Coin is deader than dead. The only thing they have left is their fancy twitter username.

I initially ordered one of these at the pre-order price of $50. At that time, the delay before it was to ship was a year, which is pretty long to trust someone with your money when they are just selling (at the time), vaporware. Then, as that time-frame was was closing, we suddenly got emails out of the blue stating sorry, but it will be another year. However, we were offered the "opportunity" to beta-test the product at OUR expense. There was immediate pushback from the community, and the beta-test was significantly narrowed in scope to a few thousand people, but became free as a result of the outrage of their customers. Once actual users (beta-testers) had cards in their hands, trying them in the real-world, it became apparent that there were numerous unrelated problems with the technology. Only about 85% of attempted transactions worked. Progress in correcting these issues moved very slowly, mostly being blamed on old readers that were somehow incompatible with the Coin. Meanwhile, it was announced that the U.S. would switch to chip & pin technology, like in Europe and other areas of the world. This is where I bailed. At least, they gave me a refund a year and a half after I essentially gave them an interest-free loan. No questions asked. That was nice. My reasoning was this: why invest in technology that is obsolete before it ships? Sure, it's kinda neat, but I KNOW it won't last. It can't! But it would probably be good for a few years, you might think, because it will take a long time for merchants to switch terminal technology, and you would be right - at least at the terminals that already support it. But there is a reason for the switch: security. This card claims to be "secure" (in that it's hard to hack), but it still hands over the info to a terminal just like any other magnetic card. Another is battery life. When the battery dies, the solution is buying a new card. This works out to significant annual credit-card-associated fees with no net gain. Obsolescence prior to shipping and the 10-15% of terminals that refused transactions from this card were the primary reasons I bailed. What is the point of having this card if I still have to carry the plastic to make sure I can pay for dinner? Sure, Coin gets me some nerd points (as if I needed them), but it ADDS a card to what I carry, which entirely defeats the point of it existing. And those merchants with out-of-date terminals that do not support Coin... If those merchants upgrade, it's only because they are forced to, and that will be to Chip + PIN technology. I know that Coin will still initially work with these, but once it reaches critical mass, and there is some high profile data theft, merchants will start to disable support for the old plastic (and Coin). This company had a great idea, but several years too late to make it really work. It's unfortunate, but I see the front door to the company as a coffin-lid. Obviously, this is just my opinion; I can see how other people might feel differently. But I can say now that I still feel that I made a good decision in getting my money back.

Um... no Amex?

While I think Apple Pay (and somewhat similar systems like Google's when ignoring their disrespect for privacy) are the better solution, it remains to be seen how many hurdles and nonsense banks and payment providers will put up in each country. Pretty much every decent payment idea in Germany has been virtually destroyed by only ever covering a small fraction of the market, while competitors and their alliances provided systems that are nothing but copies (or worse) with the goal of avoiding wide acceptance for anything. The crap with the artificial 20 Pound limit in the UK is IMHO exactly the same thing. Yeah, you can have a little, but we prefer to keep the meaty transactions ourselves...

Coin (if it does work) could still be a good solution for all these markets, as they have one advantage. They don't take business away from anybody and parties with different interests can't easily stop it. And as long as my iPhone or Apple Watch does not allow me to leave my original credit card at home, Coin does provide more security.

Just for giggles, I clicked the link to their website.. Not much change from a year ago, including... Why do they still say they are taking "pre-orders" if this has been shipping mainstream for a month?