Goldman Sachs on Wednesday gave a ringing endorsement for Apple stock, telling investors that the iPhone Upgrade Program, Apple Music, and anticipated streaming television product will change how the market views the company.

For analyst Simona Jankowski, a live TV streaming service would be a "key enabler" for Apple, helping transition the company's business model into what she called "Apple-as-a-Service." The praise for Apple was detailed in a note to investors, which was summarized by Bloomberg.

"Theoretically, Apple could transition other products into installment plans as well, and charge customers a monthly bill that also includes its other services such as Apple TV and Music," Jankowski said.

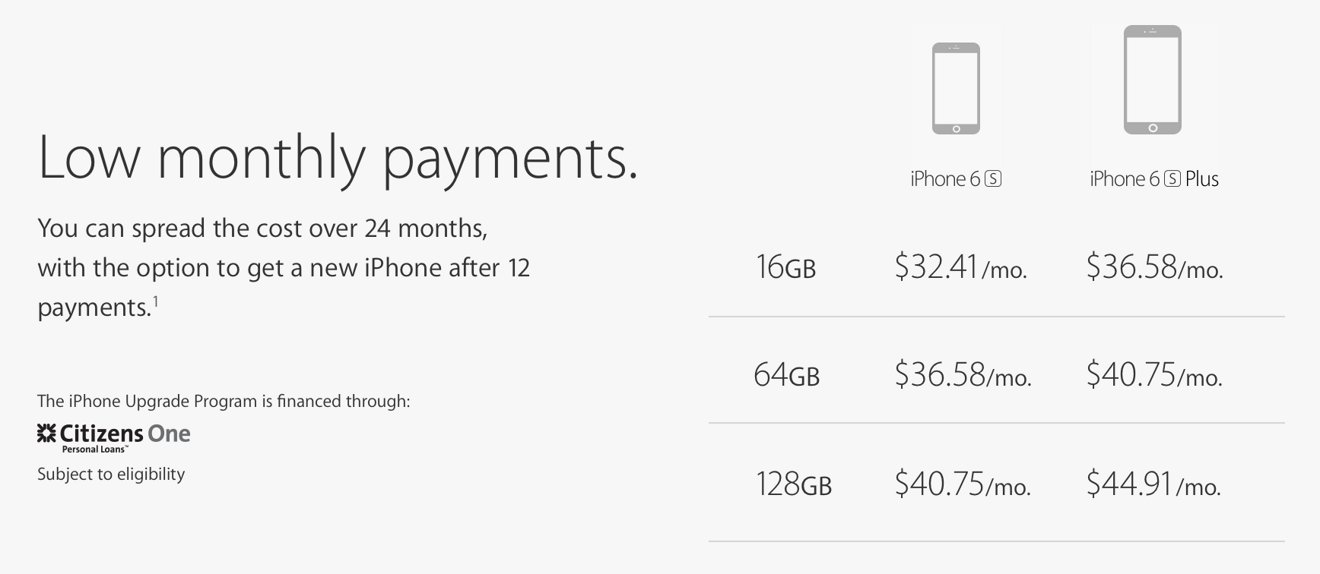

Apple has even introduced a recurring revenue method for its best selling and most profitable product, in the form of the new iPhone Upgrade Program that launched in September. The service is an interest-free way for customers to pay off their new iPhone and AppleCare+ warranty over a two-year period, with the added option to upgrade their iPhone to the latest model every 12 months.

With Wednesday's upgrade, Goldman Sachs has added Apple to their "conviction buy" list. The firm has also set a 12-month price target of $163 for shares of AAPL.

The key factor for continued growth in the stock, according to Jankowski, is for investors to stop viewing — Â and trading — Â Apple as if it's a hardware company. Instead, if traders were to view Apple as a services company along the lines of rivals Google or Facebook, its stock would trade at a much higher price-to-earnings ratio.

As of Wednesday, shares of AAPL hovered above $115 in early morning trading. The company has a price-to-earnings ratio of just 12.33 trailing 12 months, compared to 30.57 for Google, and 105.55 for Facebook.

Neil Hughes

Neil Hughes

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Amber Neely

Amber Neely

Malcolm Owen

Malcolm Owen

37 Comments

Similarly, I do not think that Apple will sell automobiles directly to consumers. I think they will sell transportation as a service. Basically, a more trustworthy, consistent, and higher-quality Uber.

[quote name="Blastdoor" url="/t/190246/goldman-sachs-sees-apples-transition-into-services-company-driving-stock-to-163#post_2808112"]Similarly, I do not think that Apple will sell automobiles directly to consumers. I think they will sell transportation as a service. Basically, a more trustworthy, consistent, and higher-quality Uber.[/quote] There's also likely a huge opportunity in autonomous delivery vehicles and other types of fleet vehicles. Uber (single trip) fleets is one area, but rental fleets would also be huge. Imagine a person on business, having their rental car meet them at the curb, take them to their hotel and to their business meetings, all pre-organized from a read of the traveler's schedule. Then dropping them back at the airport, and then pick up the next scheduled renter. Convenience, efficiency, greater utilization of the resource. Too compelling to not have the future unfold in this manner. And in answer to Sog, it would not be Apple who would own the vehicles; it would be the taxi and rental agencies who would own the fleets. Perhaps leased from Apple, or purchased on credit from Apple. Either way, Apple generates a recurring revenue stream that refreshes with the aging out of individual vehicles within these fleets.

The report makes sense and taken on its face is a positive catalyst for the stock.

Stock up in a big way right off the open!! Fingers crossed that the market can't find its other shoe.

Geeez and this they found out NOW, I'm impressed - NOT! Of course hardware is just a piece of the equation you'll have to be blind not to see that. It could even turn out to be a small piece. And they call them themselves analysts, pathetic...