While Apple's detractors see a bleak future for the world's richest tech company, the reality is that it will be much easier for Apple sell iPhones, iPads, Apple Watch and Macs in 2016 given that its competitors are now weaker than they were in 2015.

Following upon the first segment of this editorial published yesterday, this segment specifically looks at Apple's business outside of iPhones.

Pity the iPad maker

Next to iPhones, a secondary concern for Jay Yarow of Business Insider heading into 2016 was that Apple has been reporting fewer unit sales numbers of mobile computing devices it brands as iPads.

However, once you realize that Apple isn't losing iPad sales to tablet competitors, or to PCs, but is instead simply selling more tablets in a smaller form factor equipped with an LTE mobile chip under the iPhone brand rather than as "iPads," and that Apple is making more money doing this, the logic behind iPad-fretting begins to look pretty uninformed.

Apple's trading unit sales of low-ASP iPad mini sales for higher-ASP, more profitable iPhone Plus nano-tablet sales is not just evidence of conservative operational competence. It also offers evidence of bold operational risk taking, that Apple is willing to cannibalize its own products to create new growth.

Additionally, it shows successful operational implementation, as Apple didn't just sacrifice its own iPad mini sales; the real loser in the rise of iPhone 6/6 Plus sales was Samsung's premium fablets. Apple has not only checked Samsung's ability to meaningfully erode iPad sales, but "meaningfully" crushed Samsung's high end, even as its rival struggled to implement a defense through price slashing.

Worrying that Apple's iPad unit sales are down while its iPhone 6 Plus sales are exploding would be like worrying that Microsoft wasn't selling as many Windows Home licenses after it found a way to sell users a more expensive Windows Pro license instead. Or fretting that GM's sales of basic cars were declining after it began upselling buyers to SUVs and minivans. Also, where's the concern that Apple is now selling fewer 4 inch iPhones?

The larger problem for iPad rivals is that Apple continues to sell all the tablets that make any sustainable profit, and that it continues to outsell every other vendor by volume. Nobody has proven to be better at designing or selling tablets: not Amazon, not Microsoft, not Google and not even Samsung, which sells nearly twice as many smartphones as Apple (albeit making a fifth as much money), but does not sell more tablet units than Apple.

Beyond fablets, there's another emerging product category that Apple has wrenched away from Samsung, even if nobody seems to have noticed. You might call them tablettvs.

Samsung sells massive numbers of TVs. Most Android tablet buyers are using their tablets as TVs (based on Internet stats). That means Apple's iPad not only disrupted and crushed the entire existing business of Windows Tablet PCs (which Samsung was leading with fat notebook-tablets like its UMPC Q1, below), but also created a new "mini flatscreen TV" product category and beat Samsung in that arena, too.

There's so much feebleminded clickbait portraying Samsung as an upstart underdog in tablets "taking on" Apple, but the reality is and has always been that Samsung was a tablet leader until Apple entered the market and stole away tablet PCs— and then tablet-sized portable televisions, which now span from iPad mini's 7.9 inches to iPad's 9.7 inches to iPad Pro's 12.9 inches. You could also include iPod touch for a 4 inch screen.

That happens to be the four sweet spots for handheld displays sold as tablets. Samsung has shotgunned out a huge range of tablet options, but none have stuck better than Apple's offerings, and none of Samsung's tablets really make any money.

Display-based tablets and mobile TVs are both product categories that Samsung should have had the experience to lead and to hold on to. Apple stripped the company of leadership in products that are built around the components Samsung specializes in producing. That looks pretty bad for Samsung, considering that it makes a wide variety of other products that Apple might similarly take away in the future, if it chooses to. Display-based tablets and mobile TVs are both product categories that Samsung should have had the experience to lead and to hold on to. Apple stripped the company of leadership in products that are built around the components Samsung specializes in producing.

Across the last 15 years, the four major product categories Apple has released each entered the market as an underdog among entrenched incumbents, then rose up and stole away all the available profits. First with iPod (humiliating Sony, Microsoft and every other music player) then with iPhone (devastating Nokia, Ericsson, Sony, HTC, Palm, Blackberry, Motorola and Samsung) then with iPad (trouncing Samsung, Motorola, Palm, HP, Dell) and now with Apple Watch (crushing Samsung, LG and Motorola).

Despite this record, there's no benefit of the doubt being given to Apple, but rather nothing but increased skepticism that the team that always wins can pull off another victory, despite the fact that it's now much larger and better capitalized, with greater vertical integration than ever.

Samsung isn't threatening iPads. iPad (along with iPod touch and iPhone 6 Plus) have trounced Samsung (along with Sony, LG, HP, Dell, and everyone else in the PC, handheld, slate and TV markets). This is indisputable.

But instead of asking what the crushed incumbents will do to rival iPad and win back their former sales, clickbait sites keep reminding us that Apple's iPad is being outsold, not by any other vendor, but by the combined production of all tablet makers on the globe, even if they have to cite the most biased and contrived market research data available to allege such a bizarrely construed, meaningless factoid.

Until Microsoft releases its data on Surface sales, we won't know how well that company is performing as a competitor to iPads and MacBooks as of the last quarter. However, Microsoft has been struggling to make Surface sustainable for three years now. Despite regularly depicting its sales as performing well (and regularly "selling out"), the truth keeps eventually leaking out that it has never sold very many Surface models of any kind.

Additionally, Microsoft is in the awkward position of competing against its PC hardware partners. That means even if Microsoft does manage to stumble upon a successful Surface launch, it will face intense competition from the same commodity producers that Apple supposedly faces, but in Microsoft's case, its competition will be able to run all the same software, making it much harder for Surface to stand out from commodity PC tablets than it has been for iPads.

Apple doesn't face the kind of "platform risk" that Microsoft does, along with Microsoft's individual licensees, who similarly could invent something novel and watch other Windows makers steal away their success with commodity copies. In fact, Microsoft's Surface is essentially a ripoff of the tablet hybrids other Windows makers have been producing. Apple's commodity-producing rivals face an even more intense risk of having all their innovations stolen away by other licensees using the same common platform

Google faces the same platform risk as Microsoft. Even if it were able to develop an incredible new Android tablet, phone, wearable or other new product category, it would face an even larger scale of commodity copycats capable of running all the same software, without even benefitting from any resulting OS licensing the way Microsoft does. And the same issue affects individual Android licensees.

So while Apple supposedly faces huge commodity risk (one that hasn't really affected its ability to sell iPods, iPhones, iPad or Apple Watch), its commodity-producing rivals face an even more intense risk of having all their innovations stolen away by other licensees using the same common platform. On top of that, Apple is now in a position to harvest their best ideas, too.

These are all issues that are never even considered by those worrying about the supposedly imperiled future of the world's largest and by far most profitable tablet producer.

Pity the Apple Watch maker

Predictably, as if cranked out by an "Apple is doomed" meme generator written in JavaScript, BI next complains that "The Apple Watch is not the blockbuster people thought it was going to be."

Yarow never identifies "the people" that thought Apple Watch was going to be a "blockbuster" nor defines what level of blockbuster the Apple Watch failed to achieve. He does however cite a notoriously contemptuous critic of Apple, Nilay Patel of The Verge, who at the end of 2015 announced that "The Apple Watch offers little more than notifications and fitness tracking, and there are other devices that do a much better (and much more discreet) job of fitness tracking."

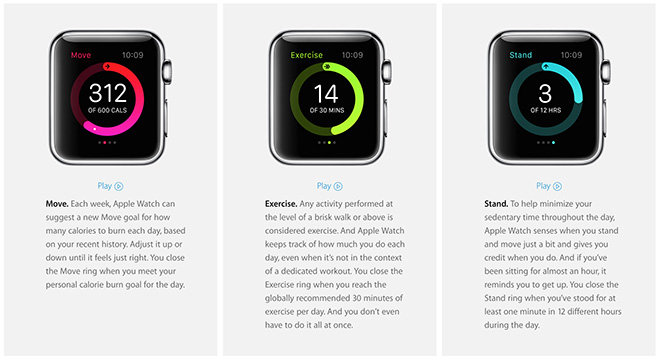

Apple Watch is not primarily a fitness tracker. Unlike Fitbit, Apple Watch is marketed as a watch, not a fitness band. However, if Apple Watch were instead a "discreet" fitness tracker selling at the price of a Fitbit, Apple's market opportunity would be closer to that of Fitbit, a company with a current market valuation of $4.5 billion.

If you think Apple missed out by shooting poorly at the wrong target, it helps to consider that Apple sold about $7 billion of Apple Watch units across three quarters in 2015, despite facing early production issues, constrained supplies and being an entirely new product category. Apple wasn't aiming at being a Fitbit.

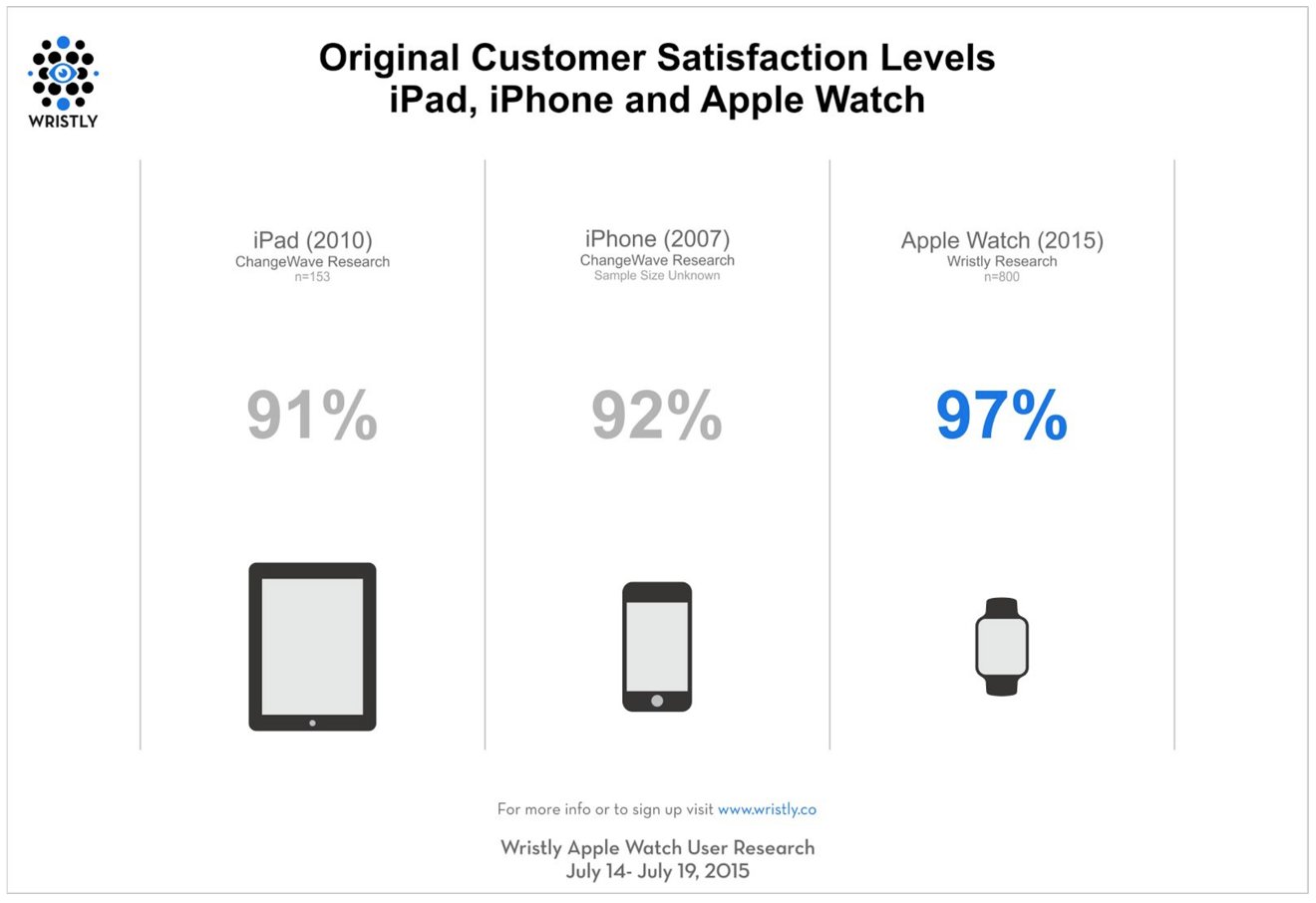

Patel has to compare Apple Watch to anything other than smartwatches, because of the overwhelming evidence that Apple Watch obliterated every other smartwatch vendor from day one. Fitbit has become the popular choice for comparing against Apple Watch because it is the only significant wearables vendor that survived the first year of Apple Watch.

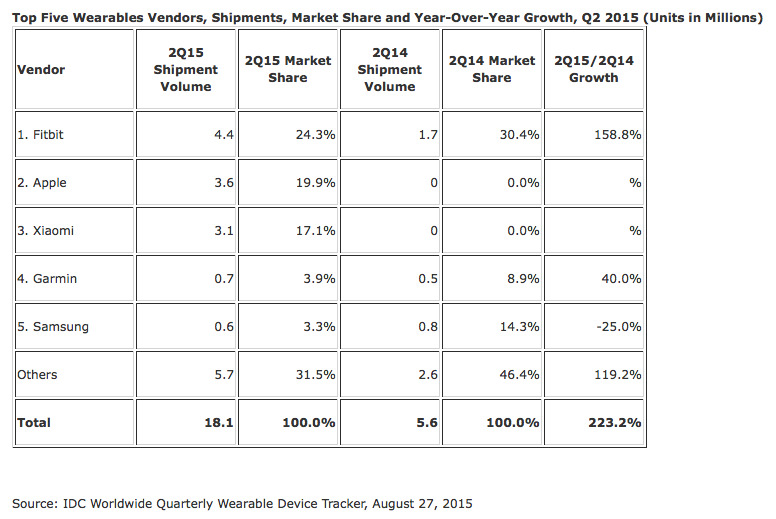

Notice that when IDC reported on the wearables market in August, it didn't heap doom upon Fitbit because a new rival had entered the market and taken away 20 percent market share.

If you're keeping track, that's what IDC reported when Samsung began selling an Android-based iPad rival (and misrepresented its having shipped two million tablets of its own). IDC gravely proclaimed that Apple had lost 20 percent of its market share, even though nothing of the sort had even occured.

In wearables, IDC decided to report that Fitbit remained the "market leader" and enjoyed "triple-digit year-over-year worldwide volume growth." Apple Watch didn't have sales from a year ago, so its growth (which IDC admitted was "within striking distance" of Fitbit) was infinite.

The only other wearable vendor to approach even 1 million shipments per quarter was Samsung; the quarter that Apple Watch appeared, Samsung's sales growth went negative and its market share plummeted from 14 percent to 3 percent. That's not good news for Samsung in other product categories where Apple might begin competing with it.

IDC also managed to keep Apple Watch "unit market share" in check by throwing in an equal number of Xiaomi Mi Bands, a "wearable" that sells for $25 ($13 when on sale). So according to IDC, the top three vendors in wearables as of Q2 were Fitbit, with 24.5 percent share (4.4 million units sold at an ASP of $88, worth $390 million) Apple, with 19.9 percent share (an estimated 3.2 million at an ASP of around $450, worth $1.44 billion) and Xiaomi with 17.1 percent share (3.1 million devices that sell for as much as $25, potentially $77 million, or perhaps half that).

IDC appears to be doubling down on its established practice of emphasizing worthless data while minimizing the most significant information in the press releases it generates for public consumption. Apple's $1.44 billion market entry was only "within striking distance of the market leader" bringing in $390 million? And about on par with a Chinese company that at most collected $77 million?

Comparing Apple Watch to an activity tracker is like comparing iPod to an MP3 dongle or comparing iPhone to a Nokia dumb phone; it only helps to muddy the waters and distract away from the fact that in smartwatches, Apple again entered a new market segment, one where Samsung, LG, Motorola and Google had all spent years trying create a beachhead, and completely destroyed the curiosity-scale sales of every rival within its first weekend of availability.

Now turn things around: Fitbit just signaled its intention to expand beyond simple activity trackers and head into Apple Watch territory. Despite another "breakthrough price," the new device was so poorly received that investors took a $1.5 billion off the valuation of the company, in recognition that Apple is actually a "difficult compare" as a competitor.

Again: the people with money backing Fitbit decided that direction was the wrong one for the company and scrambled to back out. Of course, investors could be wrong. But given the fact that established consumer electronics firms with years of experience in developing and selling mobile devices haven't been able to stand up to Apple's first quarter of sales suggests it's a bad business to be in, even if IDC works to obscure this.

That reality doesn't fit the narrative Patel's Verge regularly recites, maintaining that Apple isn't innovative, doesn't know what people want, charges too much, and can't match the combined contributions of a community of collaborating partners. It pretty clearly can.Nilay Patel's depiction of Apple Watch as being 'not the best fitness tracker' is reminiscent of iPhone once being described as 'not the best mobile for making analog cellular phone calls.'

As a product, Apple Watch isn't a fitness tracker and isn't a Rolex. However, that's like saying iPhone wasn't a camcorder and wasn't a PC. It actually ended up having a profound affect upon market demand for standalone camcorders and the demand for conventional PCs. Complaining that there may be a fitness tracker that is "more discreet" than Apple Watch is like saying in 2009 that there are standalone camcorders that record better video than an iPhone 3GS.

Patel's depiction of Apple Watch as being 'not the best fitness tracker' is reminiscent of iPhone once being described as 'not the best mobile for making analog cellular phone calls.'

I'm also old enough to remember people once scoffing that PC word processors were often a poor replacement for the typewriter. Similar short sighted vision today fails to even acknowledge the future potential of wearables, even as we see world-changing examples of wearables' potential in emerging technologies ranging from health and medical research with the ability to save— and improve— lives in new ways to gesture-based remote control devices that are the stuff of futurism.

BI, along with the Verge, have been heaping intense contempt upon Apple's products for years. One can't help by notice that the "other devices that do a much better job," which are relentlessly foisted upon their readers with a level of undeserved fawning praise that often reaches a fundamentally reverent, awe-struck tone, have largely all been losers that have been rejected by the market. Neither site has demonstrated any particular ability to identify good products, but instead regularly expresses a bias that consistently runs counter to what consumers actually want, the features they care about, and the issues that matter to them.

At this point, anyone who continues to derisively scoff at the monumental success of Apple Watch— particularly given the complete incompetence of any other vendor to offer any hint of capacity to deliver anything comparable in a form that customers are willing to actually pay for— is just insulting their own credibility. They do not need any further articulation of their ridiculousness.

What about concerns that Apple Watch isn't likely to match the scale of success seen from Apple's $155 billion per year iPhone business, or its $23 billion iPad business or $25 billion Mac enterprise? Well it's useful to consider that nobody saw the Mac as having a $25 billion annual opportunity. Or that iPads were derided as a big iPod touch, and that even the iPhone was scoffed at by non other than the chief executive of Microsoft as being unlikely to sell beyond commercially insignificant quantities.

It doesn't seem likely that Apple can convince everyone who has an iPhone to also buy an Apple Watch. However, if even a quarter of those who bought an iPhone last year do, that's another iPad-sized opportunity (in terms of units and dollars) achieved from Apple's existing user base, without even needing to sell any outside buyers on it.

And again, while IDC portrayed Apple's entry into wearables as good news for competitors (explained as "Anytime Apple enters a new market, not only does it draw attention to itself, but to the market as a whole," by Ramon Llamas), that also means that all the attention to wearables being generated by Fitbit and other activity tracker vendors creates another huge pool of opportunity for Apple's more advanced product to fish in.

Pity the Apple TV maker

It should come as no surprise that Yarow is also derisively dismissive of the new Apple TV 4. And why not? It's not like he works for a media outlet that has a reputation of credibility to uphold. It's "just OK" he says.

Apple has never before had an open TV platform for developing apps and channels. It has sold a closed TV appliance, in the former versions of Apple TV that Tim Cook once referred to a "hobby."

It's no longer considered a hobby. It became a billion dollar annual business some years ago. Apple TV now has its own platform name: "tvOS," which indicates that it will be a priority moving forward.

Apple is now a leading SoC developer, so unlike Sony and Microsoft, it can leverage $200+ billion in annual device sales to subsidize the development of ultra fast, proprietary silicon to power future generations.

Sony and Microsoft are just now beginning to sell a new generation of consoles patterned after the architecture of Intel PCs. Apple TV is built upon the architecture of iPads and iPhone, using the same development tools and frameworks. Neither Microsoft nor Sony sell significant numbers of PCs, while iOS devices are central to Apple's business.

That means all the money Apple invests in iOS broadly benefits everything it does, including Apple TV. Also unlike Sony and Microsoft, Apple doesn't lose money on hardware sales.

If you look at how fast Apple iterated new versions of iPhone and iPad, and then postulate what an Apple TV will look like in a couple years living off the back of A10 or A12 chips, an "it's okay" observation of Apple TV appears really myopic when given as analysis of the company's future trajectory, rather than as a pouting hardware review.

Currently, Apple TV 4 is also a pretty good product for its price. Apple's new tvOS has impressed the market enough to become the mentor-hero Samsung looks to when designing its own television products, and Samsung is somewhat of an established expert on the television market.

I mean, come the fuck ON. pic.twitter.com/abiZlF2hy6

— G. Keenan Schneider (@_GKeenan) January 5, 2016Apple TV is not an Xbox One or PS4, but Apple isn't initially intending to create a business in the high risk, low reward conventional game console segment. Apple TV is an iPad for the television, and a central hub for HomeKit, App Store and other elements of the ecosystem that keeps Apple's customers coming back for more. Saying it "should be better" or "should have come out last year" or alternatively that it "was rushed to market" is lazy, sophomoric weak-sauce analysis for a site that calls itself Business Insider.

The real problem however, is that rather than comparing Apple TV to an imagined best scenario of the most perfect device that could be dreamed up, it really only makes sense to compare the product to what else is on the market at a similar price. And so far, there's not really a lot that deserves mention. Once again, remember that eight generations of iPhone have outsold a wide range of peers each claiming better specs and unique features, from BlackBerry's keyboard to Nokia's nearly indestructible phone sets to Motorola's LTE phones and Samsung's big displays.

Also, remember that dismissing Apple TV as virtually irrelevant to Apple's overall revenue picture was a tactic previously used to suggest that iPad would never go anywhere and that even if it did, Android tablet makers (and Windows tablet makers) would beat it with commodity copycat products. That didn't turn out to be true at all; iPad now generates over $20 billion per year for Apple. And really, the same was earlier said of iPhones and iPods.

Pity the iTunes & App Store ecosystem

The same sort of commentary is also available for Apple Music, Maps, Health, Photos, which again BI grouses are all "just OK," as if there is a bear chasing Apple and the company is really close to being mauled, when in reality Apple has its laces tied and is running, and all of its competitors are sitting on the ground unsure whether they should think about putting on running shoes or just play dead instead.

Samsung's "Milk" version of Apple Music just collapsed. Microsoft gave up entirely upon its Zune ambitions. Google hasn't been able to duplicate the success of iTunes, and its own efforts to get hardware makers to develop Android-based iPod killers never took off. HP, an early PDA maker, wasn't able to capitalize upon its legacy to successfully build MP3 players or smartphones. These are all things that are not "just OK," if you want to calibrate the value of BI's success-o-meter.

Who else has a valuable Maps platform? Nokia once did. Google's has never made money in 7 years, and now its losing its relevance among the affluent demographic that uses iOS. Microsoft, the PC monopolist, hasn't been able to make its own Bing maps very popular or very profitable. I've already outlined how Apple's Maps could get better, and even pointed out that they have some seriously embarrassing flaws. But to suggest Apple isn't commercially winning in the area of maps is pretty asinine.

It's hard to talk about Health without looking at Apple Watch. Nobody else is doing anything of comparable competence. Google and Samsung have nothing more than me-too product demos that have failed to sell hardware. Fitbit showed up with a watch that might have achieved some success if it had been released more than a year ago. That's all not "just OK," it's another series of failures.

It's the same story with Photos and Apple's iCloud backend. There's free services like Flickr and Google Photos, but both have distinct drawbacks and neither is commercially successful in a way that suggests they will survive the decade. Apple's Photo App Extensions aren't just a clever idea, they're getting employed by third party developers to do cool new stuff. And hitched to the world's most popular camera, iOS Photos is a conduit for stoking consumer storage demand from Apple's iCloud. There are features of Photos and iCloud that need to be fixed or improved (as I noted in discussing Apple TV), but it's helping to generate new revenue for Apple, which few competing photo products can even claim at all.

Apple certainly has a lot to do in 2016, but characterizing this as an impossible climb displays an incredible ignorance of what we all just witnessed in 2015.

It looks like Apple's competitors have a tough year ahead.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Amber Neely

Amber Neely

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

-m.jpg)

82 Comments

I’m sure we’ll soon hear from the AI trolls (and that includes the so-called supporters) about the fantasy world DeD invents where Apple is a successful company going forward. They will remind us of just how Doomed™ Apple really is and that it’s all over if Apple doesn’t do exactly what they say it must do to survive in a world where competitors are beating its brains out. Yes, Apple is on its last leg and total collapse is imminent.

Daniel Eran Dilger verbose posts supported by numerous charts give Apple investors exactly what they want to hear - that Apple is doing fantastic job and the bright future is ahead. Keep listening to this old DED tune, while AAPL stock melts down. And it will keep melting down because Apple products start to suck.

One fundamental problem with Apple that Cook failed to fix and DED failed to address is Apple's perennially weak cloud. Without a strong cloud, iPhone becomes more a jewelry item than a useful device (I know, the comparison is extreme, iPhone is still a good phone but I want to drive the point). DED barely mentions cloud in his post saying it "need to be fixed or improved." Right.... Eddy Cue can fix the cloud, and you know what else... pigs can fly.

One question every Apple investor should ask is this. Are Apple products as useful and as easy to use relative to their competition as they used to be? If not, then they do not justify the premium price Apple demands for them; Apple's popularity will go down and so will its stock.

What is with the double standard against apple? Can you imagine if any one major product sucked as bad as Microsoft or Google's endless betas? Like if Apple had self-driving cars humming along Palo Alto for however many years with no actual product we would be seeing the stock delisted and trading at $1.25. Seriously doomed. Google gets what % of its revenue from advertising? Talk about a revenue concentration. Apple actually makes stuff, that works and works together, and it's never good enough. People, just look at the cash flow this machine generates. You can't dispute hard sales. All else is vapor.