Rebuking overtures from Australia's big-three banks looking to break in on Apple Pay's success, Apple in a letter to the Australian Competition and Consumer Commission this week said requests for access to iPhone's digital wallet technology would fundamentally undermine the handset's security safeguards.

Apple went further in its three-page letter to the ACCC, likened the three banks — Commonwealth Bank of Australia, National Australia Bank and Westpac Banking Corp — to a cartel that wants to suppress new, potentially disruptive financial market innovations, reports The Australian Financial Review.

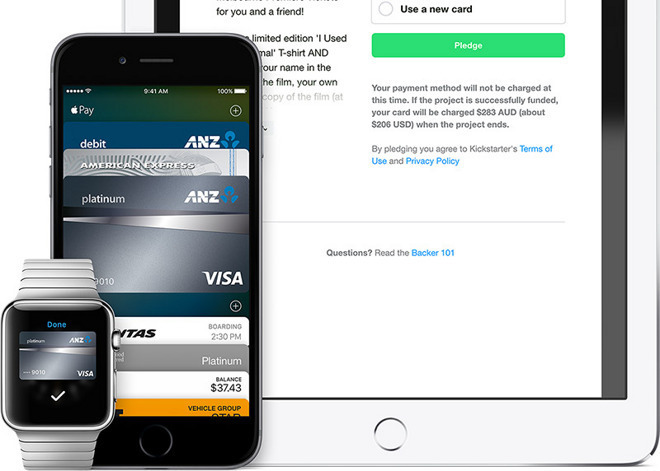

In July, Australia's three biggest lenders filed an ACCC application seeking approval to collectively negotiate the installation of third-party digital wallets on iPhones. Currently, Apple restricts touchless NFC payments to its in-house Apple Pay solution, a limitation the company says is meant to protect consumers.

"Apple upholds very high security standards for our customers when they use Apple devices to make payments," Apple said in its statement to the ACCC. "Providing simple access to the NFC antenna by banking applications would fundamentally diminish the high level of security Apple aims to have on our devices."

For their part, the banks claim compatibility with third-party digital wallet software will give consumers choice beyond Apple Pay, adding that Apple's single-source solution amounts to anticompetitive behavior.

Apple's letter asserts much the same, but in reverse.

"Unfortunately, and based on their limited understanding of the offering, the [banks] perceive Apple Pay as a competitive threat," Apple's statement reads. "These banks want to maintain complete control over their customers. The present application is only the latest tactic employed by these competing banks to blunt Apple's entry into the Australian market."

Interestingly, the document was signed by Marg Demmer, a former executive at ANZ Banking Group. In April, ANZ became the first major Australian bank to break rank and ink a deal to bring Apple Pay to its customers, a decision that drove a 20 percent increase in online credit card and deposit account applications.

Apple continues to negotiate with Australia's banks in light of the proposed Apple Pay boycott. Apple said it needs support from the big-three institutions in order to roll out Apple Pay on a "meaningful" basis, but the company appears to be facing an uphill battle.

Mikey Campbell

Mikey Campbell

-m.jpg)

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

61 Comments

So the three major banks would like to have Apple Pay for themselves while on the same time refusing Apple Pay to use their services. I understand that all business want profits, but if by "any methods necessary" means jeopardizing the consumer's security (and we're talking their money here) AND neglecting the consumer's choice to use ApplePay by forcing their own products (using Apple Chip while throwing out Apple Pay token tech), I think there is a big problem here - in which does not lie on Apple side.

After perusing the statements from both sides and much reflective, deliberate, and thoughtful consideration I have come to the following conclusion:

F*ck the f*cking banks.

Not a good day for any Australian Organisation to make the claim "Trust us" we are doing this you the Consumer/Citizen.

If you live in Australia, everyone knows that the Big 4 banks are just outrageous bastards. Stick it to em Apple. Up your, boys !