Apple is continuing to lead the global tablet market, IDC analysts claim, but while the number of iPad sales declined in the most recent quarterly results, it isn't as much of a reduction compared to the overall marketplace's 8.6 percent decline in the third quarter.

Apple reported selling 9.7 million iPads in Thursday's quarterly results. A dip from the 10.3 million units it shipped for the third quarter of 2017. Despite the slight drop of approximately 6 percent, the number is still considerably higher than the rest of the market.

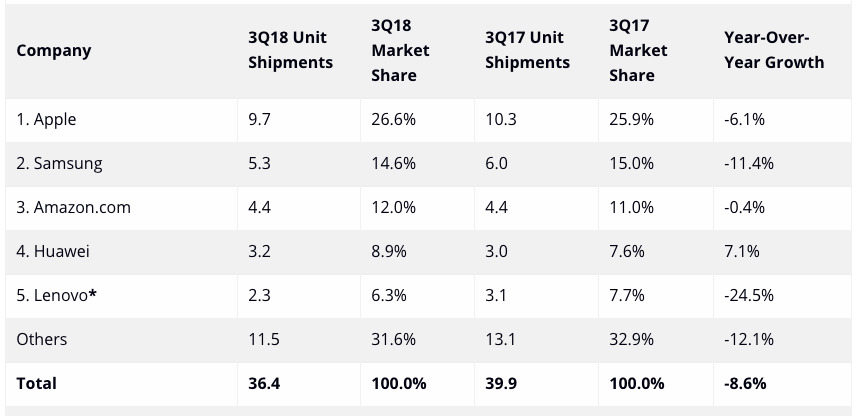

According to IDC, Apple has a market share of 26.6 percent, an improvement on the same period last year, where it made up 25.9 percent of the market. The increased market share is attributed to other declines in the market, with an estimated 36.4 million shipments 8.6 percent down from the previous year's 39.9 million in the quarter.

"The refreshed $329 iPad with Pencil support that launched in late March continued to drive volume, although it was unable to maintain the same momentum from the third quarter of 2017," writes IDC, as it was the first time in a while that Apple had released a lower-cost iPad. "iPad Pro saw year-on-year declines in anticipation of a refresh at the beginning of the fourth quarter," the firm suggests, "which bodes well for Apple through the end of the year."

Apple continues to have a considerable lead on the main rival Samsung in IDC's list, with the South Korean electronics giant achieving 5.3 million units for the third quarter of 2018 and a market share of 14.6 percent. These figures are down from the 6 million and 15 percent share for the same period last year, with Samsung seeing negative growth of minus 11.4 percent.

Samsung is considered to be seeing growth in its detachable device portfolio, but that is outweighed by continued slate category declines. The company is apparently facing pressure in low and mid-market segments, with competitors seen to be providing better value products.

"The tablet market is more like the traditional PC market than ever before," advised senior research analyst Jitesh Ubrani. "Not only do these markets move in sync with each other, but the decreasing margins and overall decline, particularly in slate tablets, has led to the top five companies capturing a larger share" over smaller vendors.

"Even among the top five, it is essentially Apple and to a lesser extent Samsung that continue to invest heavily in product innovation and marketing," suggests Ubrani. "This has helped the two companies to set themselves apart from the rest."

The rest of the top five is made up of Amazon in third, maintaining its 4.4 million shipments, Huawei seeing growth from 3 million to 3.2 million year-on-year, and Lenovo dropping from 3.1 million to 2.3 million, equating to year-on-year growth of minus 24.5 percent.

Malcolm Owen

Malcolm Owen

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee

Amber Neely

Amber Neely

Wesley Hilliard

Wesley Hilliard

William Gallagher

William Gallagher

16 Comments

Every other garbage tablet maker would kill to have Apple’s current iPad sales.

iPads just last so long. I got third generation new, and sold to mother-in-law for 100 bucks in March 2016 when I got Air 2. Although I still use 2009 MBP and 2006 iMac, so I'm not exactly riding the crest of the tech wave (save in mobile).

It’s very revealing of priorities.

there is the old joke about HP selling products at a loss and making it up on volume, but that isn’t what we are talking here. Apple’s margins are the largest in the business. It has a tonne of room to make its frustrated fans happy.

The risk of going with option A ( lets call it the Burberry Strategy), as Apple is clearly doing, is that for a product like iPads, where Apple is dominant in the category, it slowly kills interests in the category completely. These iPad pro prices exceed most laptops. People will go for better price and flexibility and stick with laptops. They won’t be buying one of each. Unless you are a filthy rich corporate executive of course.

This will change as more and more people stop thinking of iPads as media consumption devices and realize they really can be laptop replacements. I’m running some really powerful apps on my 1st gen iPad Pro and I’ll never go back to a laptop. Ii think Apple is trying to achieve this too.