Across decades, Apple has developed its reputation for selling luxurious electronics with both a premium price and elevated expectations. But Apple's attention to detail means it's not often a trailblazer. Could the profits that are currently driving Apple at some point shift to instead support vendors like Samsung and Huawei who offer cheaper access to new tech faster, in a sloppier but "good enough" beta technology form?

In reply to the article "Why Is Samsung's Galaxy Fold graded on a curve?" which looked at how differently the problems at Samsung are discussed in the tech media versus issues related to Apple, a reader called "Mr. Lizard" laid out the logic for holding Samsung's Galaxy Fold to a different standard than products from Apple.

Samsung's style of speed

Mr. Lizard had a lot to say about Samsung.

Many Samsung customers view these sorts of products and features as 'cutting edge,' and don't care anywhere near as much as a typical Apple customer would about execution. Consider that many of Samsung's product ranges bear no common design language, and feature tasteless decisions such as non-aligned ports. Their target market just doesn't care about this sort of thing, and that's ok.Samsung's culture is such that it desires to be seen to be first, and has no qualms with failing publicly. They're not pretending to be perfect, and so the media and their customers don't treat them as trying to be perfect.

Apple on the other hand publicly holds itself to incredibly high standards, and repeatedly and emphatically portrays its design as superior and world class. Therefore, the media and their customers take Apple's assertions at face value, and when Apple screws up with badly designed keyboards you can count on them being hauled up for it.

If Samsung stated their objective as being perfectionists and obsessive over quality in the same way as Apple does, then they might get treated the same by the press. But they don't claim to be these things, so the press understandably doesn't hold them to the same level of account.

Of course, the reality is that Samsung certainly does have "qualms with failing publicly," does pretend to be perfect in its marketing — even frequently mocking Apple's designs before copying them — and it clearly wants to present itself as being at least on Apple's level, if not better and more advanced in both style and fashion.

Samsung took pride in being first to releasing a phablet with a stylus, a smartwatch, netbooks, water resistance, Qi charging, and of course being the first mainstream source of OLED phones— a display technology which Samsung pioneered as the leading manufacturer of advanced mobile screens.

A couple years ago, a strident media narrative portrayed Apple as falling behind Samsung. It's still far ahead in any figures that matter.

A couple years ago, a strident media narrative portrayed Apple as falling behind Samsung. It's still far ahead in any figures that matter.Samsung has stridently worked over the last several years to portray itself as superior to Apple in both raw technologies and in trendy style. But as Mr. Lizard described, Samsung has taken shortcuts and played down software usability and hardware precision to ship its "fresh trendy new" technology first, warts and all.

Samsung's strategy of "good enough, fast style" has not made it nearly as profitable as Apple. And its efforts to cut corners are increasingly apparent even to sympathetic reviewers seeking to present Galaxy as an equal peer to iPhones.

Its efforts to rush new tech to market have also repeatedly flopped in a spectacular fashion. That includes not just the Note 7's sloppily designed batteries and the Galaxy Fold that began breaking on day two, but also the wildly underwhelming launches of Gear watches, the albatross of VR headgear, fake security authentication, its largely ignored 360 degree camera, the unpopular Bixby, and a number of other fast-fashion flops.

If not Samsung, Android?

Android advocates have long expressed the idea that Samsung and its brand don't need to be that impressive or even commercially successful. If Samsung can't displace Apple, another Android licensee like Motorola, Xiaomi or Huawei eventually will. It's a numbers game. Android has been "winning" for so many years now that you'd expect it to eventually come out ahead.

It may appear that there are just too many other "good enough, fast style" options pushing prices lower— and subsidized by Chinese state intelligence that Apple will eventually run out of innovations, technical or platform advantages or simply sheer luck and Google's Android will overwhelmingly rule the same way Microsoft did in the 90s.

Lots of Android proponents believe the platform has "already won" simply by shipping the most devices. It certainly does seem counterintuitive that Apple can continue to sell virtually all of the profitable devices in phones, tablets, notebooks, and wearables, in a world where there is a major price disparity between iOS and Android, and between Macs and iPads and commodity PCs or netbooks.

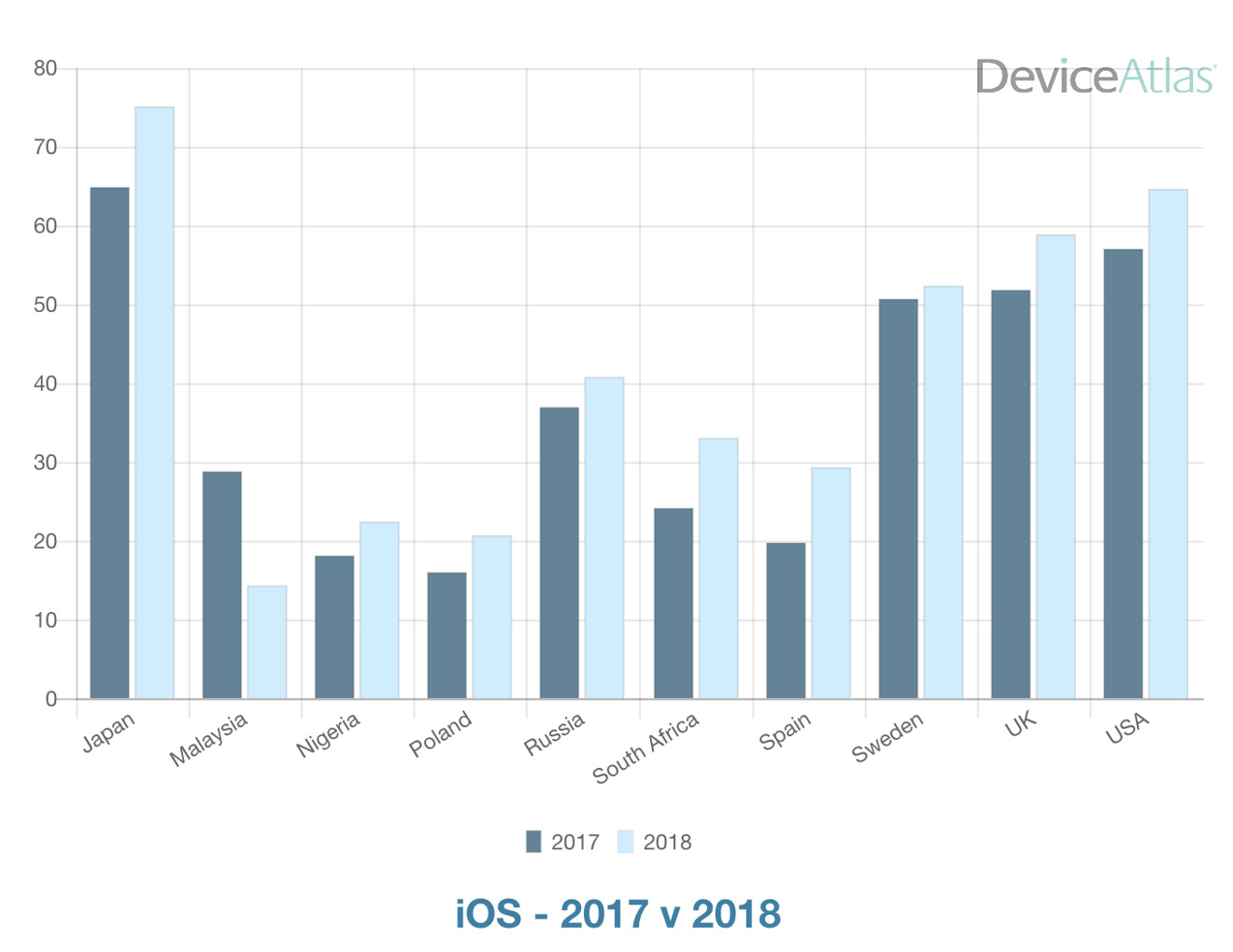

Yet Apple has maintained its lock on collecting nearly all of the available profits in consumer electronics for well over a decade now. And rather than just retreating into a premium tier niche that is profitable but not particularly popular, Apple's iOS now accounts for the majority of actual activity across the installed base of users in the U.S., in many affluent E.U. countries, in Japan, and even maintains a very strong installed base in China— tied with the leading Huawei brand, and well ahead others — even in place where cheap phones are everywhere, IP counterfeiting is rampant and competition for sales is intense.

In affluent nations, the percentage of mobile activity occuring on iOS is higher than Android. Source: Device Atlas

In affluent nations, the percentage of mobile activity occuring on iOS is higher than Android. Source: Device Atlas Is it possible, however, that global tastes in hardware may shift to the point where cheaper phones become so popular that industry profits begin fueling faster advancement outside of Apple than within its Walled Garden?

Paradise Lost, Regained

Anyone who lived through the 1990s already knows that a much younger Apple once lost its once premium position with well-built Macintosh hardware and thoughtfully designed software to an era dominated by Microsoft.

In the 1990s, Windows PCs began offering more choices, faster chips, and in many cases much lower prices— along with shoddy hardware, flimsy cases, poorly designed software rushed to market with bugs, and an overall level of slapdash sloppiness that everyone just passively accepted. Nobody cared that PC-era tech was crap, because it was cheap.

The allure of a lack of attention to detail— as long as the price was right— was also seen in the devolution of printers, which changed from well-built machines into flimsy garbage designed only to last long enough to sell a few cycles of consumable inks. At the same time, the rapid collapse of prices in memory, storage, and processing— driven by price-centric consumption— opened up entirely new ways to use technology.

By the end of the 90s decade utterly dominated by cheap PCs, Steve Jobs had returned to Apple and was seeking to rebuild the company as a more-cost competitive, consumer company. The 1998 iMac and the next year's candy-colored "toilet seat" iBook were radically cheaper products (compared to its Power branded line) that aggressively pushed higher-end tech into cheaper, consumer-friendly packages that introduced fresh and new enabling technologies into the mainstream, including USB and WiFi.

Apple's era of affordable luxury

After finally regaining a solid footing, Apple appeared to shift aggressively toward premium in the 2000s. It introduced a high-end Titanium notebook, the glassy G4 Cube, and a $400 digital music player. iMac turned from a blue CRT bubble into a sharp-looking but significantly more expensive flat panel machine, and the iBook turned into a more conventional but also more expensive box before becoming the MacBook— which has evolved into a skinny line of ultra-premium notebooks.

In 2007, when Apple showed off its new iPhone, it prompted howls of laughter from Microsoft's chief executive Steve Ballmer, who found Apple's pricing hysterical: "There's no chance that the iPhone is going to get any significant market share," he said at the time. "No chance. It's a $500 subsidized item!"

Yet Apple's $500 iPhone trounced the $150 Windows Mobile Motorola Q that Ballmer was touting. The idea that Android would take over as the "new Windows," in pushing Apple's platform into a minority niche while becoming the mainstream choice of most users and companies, is based entirely upon the history of Windows in the 1990s. But that logic often fails to acknowledge that Microsoft itself failed to repeat its Windows playbook against iOS over the last decade.

Premium sales are driving the future of technology

Since the debut of iPhone, Apple's ability to popularize higher priced, premium products has fueled its profits and paid for expensive developments including a decade of advanced custom Application Processors that have outpaced the development of rival processor chips; Apple's tightly optimized operating systems; custom development of proprietary technology including Touch ID, Metal and the Apple GPU, TrueDepth cameras supporting Face ID, and mainstream Augmented Reality; as well as paying for the refinement of multiple development platforms that each lead their categories in driving custom app, games, and custom enterprise software development for iPad, Apple Watch and iPhones.

The economies of scale Apple enjoys, combined with the exclusive technology it has built using the sustainable profits of its hardware sales, has kept the company ahead of rivals that are trying to knock off what it did a year or two ago. Will that cycle of reinvestment get derailed by something happening in the world of Android?

Rather than losing steam, Apple's cash machine keeps going, creating new expansions of its ecosystem into health, personal audio, automotive, original content programming and new exclusive arcade games, and custom enterprise apps built in partnerships with Accenture, Cisco, Deloitte, IBM, Salesforce, and SAP. Those are all areas that neither Samsung nor any of its Android peers are doing well in, despite public efforts and intentions.

Is there any real likelihood that Apple's high-end luxury-class engineering will hit a wall where the company is no longer able to out-innovate the collective "good enough" efforts of every other phone competitor, either in association with Google or on their own with Android Open Source Project forks— including Amazon and phone makers in China?

The historical answer is wrapped up the complex frenemy relationship between Apple and Android's largest licensee, Samsung. And it appears that other Android licensees will follow the same general trend. So consider how these two massive competitors have ruthlessly fought and closely cooperated with each other over the history of smartphones, as the next article in this series will detail.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Christine McKee

Christine McKee

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Amber Neely

Amber Neely

Sponsored Content

Sponsored Content

Wesley Hilliard

Wesley Hilliard

147 Comments

Diminishing returns is here. Apple’s planned obsolescence as well. Who will prevail? The customer who has no sense will.

If good-enough will prevail than Apple will transform itself with enough differentiator to prevail. As Apple expanding it's services business which also draws customers to Apple hardware and it's eco-system.

In the beginning Android was crap. It’s good enough now, to give Android devices a look. I remain concerned about the security of the Google Play Store, but I’m not a kid that downloads a bunch of junk. So, it’s less important...

The iPhone and IPad don’t have me in an “ecosystem lock” but if I owned an Apple Watch the convenience factor would be compelling. I don’t like watches...

I’m watching what Microsoft does with Android/Linux. If they get better integration than what’s offered on Apple, that might move the needle...

Good article. “Good enough” will always be popular with the budget crowd, which uses price as the primary purchase consideration. Affordable luxury brands like Apple will continue to do fine with those who do not select based on price alone, and consider the value derived from better built systems and devices.

This is fine. There will always be both, likely in any product category from smartphones to hammers. Tho only in this product category will we see the price people creating accounts and posts to spin the narrative of decreasing sales to somehow imply their knockoff brands are “winning”.