When Google decided to stop rebranding its partners' Androids as Nexus models and launched its own Pixel phones three years ago, it targeted the camera as its best hope for standing out in a crowded, competitive smartphone market. That strategy failed in 2016, 2017, and in 2018. This year, Pixel 3 sales actually fell. Now, Google is back with a Nexus-priced phone in a market being devastated by even cheaper commodity.

Charting out the failure of Pixel

Google has avoided reporting unit sales or revenues of its Pixel phones. After many years of Nexus-rebranded phones failing to find many buyers, nobody expected Google to tear out of the gate with tens of millions of sales to rival Samsung's Galaxy S series, or hundreds of millions of sales to rival Apple's iPhone.

However, the notorious tech journal DigiTimes was quick to speculate that Google's Pixel smartphone might "reach 3-4M shipments in the second half of 2016," a figure that could establish Google as a fledgling new entrant.

As it turned out, Google didn't even reach sales of two million Pixel phones in 2016. Citing data from IDC, Cheng Ting-Fang and Lauly Li reported for Nikkei that "Google has only a small presence in the global smartphone market. Pixel shipments in 2018 were around 4.68 million units, or around 0.33% of the total market, research company IDC data showed. This compared with 3.45 million units, or 0.2% of the market in 2017."

We've previously offered criticism of data from IDC and reporting by Nikkei. There's problems here, too.

In fact, while IDC analyst Francisco Jeronimo a year ago echoed the same sentiment that Google Pixel shipments "represent a tiny portion of the smartphone market" in a public Tweet, he provided materially different "embarrassing" numbers for his company. At the time he stated that 2017 Pixel shipments had "doubled" to 3.9 million in an annual market of 1.5 billion smartphones.

IDC numbers are at odds with IDC numbers, and definitions of words like "growth"#GooglePixel shipments continue to grow, but they still represent a tiny portion of the smartphone market pic.twitter.com/W6FVZlYOlC

— Francisco Jeronimo (@fjeronimo) February 12, 2018

That's a 13% difference between what IDC tweeted and what it reported. Further, 0.2% of 1.5 billion is 3 million. So there are a lot of puzzle pieces here that don't fit together. Jeronimo also spun Pixel shipments as 'continued growth,' stating in the tweet stream that in its launch year, the original Pixel has only shipped 1.95 million units— half of what DigiTimes had suggested they might.

Assuming IDC numbers are based on real data, that means Google shipped 1.95 million of the original Pixel and Pixel XL models in the final three months of 2016, after launching in October. It then reached 3.45 million units of both Pixel and Pixel 2 models over the next year. But that's not "continued growth." It's a pretty spectacular drop from 65,000 units per month in 2016 to just 28,750 units per month in 2017. Jeronimo characterized this as "doubling" shipments in his February 2018 tweet. One could be forgiven for misstating such a thing if they weren't the source of the data.

Across 2018, sales of Pixels, which began to include the new 3 series, did grow over the previous year, but they certainly didn't double. Based on IDC's reports, they grew by 1.23 million, reaching average monthly sales last year of 39,000. Or if you go by the previous number IDC cited to suggest Pixel was "doubling," you get an increase of just 780,000 additional Pixel sales last year. Still solidly in "massive flop land" no matter what estimates you look at.

Google's comments to analysts are as terrible as IDC's estimates

In Google's quarterly earnings calls, the company's executives have been repeatedly asked, albeit meekly, about the status of its Pixel efforts. A year ago in Q1 2018, UBS analyst Eric Sheridan asked for an update, noting, "you've now been through two years of sort of Pixel devices. You've made the acquihire of the HTC engineers. Can you give us a sense of what you've learned so far from your Hardware efforts and how that might evolve product innovation or go-to-market strategies long-term?

Google's chief executive Sundar Pichai replied with a rambling nothing-burger.

"On Hardware, you know, the exciting part for us is, you know, now, I think we have all the end-to-end capabilities of a world-class, you know, hardware organization along with the quality of the software organizations we've always had. And in this area, it truly takes long-term planning," Pichai said "And so, for example, if you think about silicon, et cetera, the longer you can do it, the more advantages you have.And so, you know, I definitely feel we are taking the steps towards being able to do this well for the long-term. Part of that, obviously, involves scaling up our go-to-market strategies, both in the US and internationally, so that we can drive— drive adoption.

You know, I said earlier, our Net Promoter Scores show that we are right up there with the best in class devices, and across all the products we have. Not just our Pixel, across our Nest family and everything we do. So the opportunity is clearly there. We're going to lean into it. And, you know, it takes 2 to 3 years to really get to the scale where we want to see it, but we're committed to getting there."

Effectively, it sounds as if Pichai was saying that the problem was "scaling up" marketing and leveraging Pixel's huge investments made in silicon, to reach the "you know" scale needed in 2-3 years. That was the only mention of Pixel in the Q1 call.

However, in this year's Q1, at Google's third year of Pixel sales, the company's chief financial officer Ruth Porat volunteered some new data on Pixel. She stated, "Other revenues for Google were $5.4 billion, up 25% year-over-year, fueled by Cloud and Play and partially offset by Hardware. [] Hardware results reflect lower year-on-year sales of Pixel, reflecting in part heavy promotional activity industry-wide given some of the recent pressures in the premium smartphone market."

So rather than just scaling up slowly, Pixel unit sales are now shrinking and offsetting the growth seen in Other revenues. Pichai subsequently offered some additional comments, stating that "the breadth and depth of our product lines across Pixel, Nest and Home is amazing," and adding that "we're still early in the hardware journey, and when I look ahead at the portfolio that we've created across Pixel, Home and Nest, I feel really good about the range of products that we have."

Google's spectacular failure in its Pixel "journey"

Note that Pichai said that after Google canceled its Chromebook Pixel notebooks and discontinued the Pixel C Android tablet last month, both of which were once described as strategic and important products to feel good about.

After Google spent $1.1 billion to acquire most of HTC's phone engineers, and dumped incredible hundreds of millions into custom silicon design, its results are limited to "feel good" awards for actual products that are not selling well at all.

Google didn't say its Pixel sales were seasonally down from the holiday quarter. They were down over the year-ago quarter, meaning Pixel 3 sales collapsed after a launch blip even worse than Pixel 2's had. There's no way to spin that as anything other than a total, embarrassing failure.

After three years of sales, Apple Watch ramped up as a hit in a totally new product category. iPad did the same in tablets. Google has failed in both its Android Wear OS and in tablets, but here it is demonstrating that even in smartphones, after three years of "ramping" it's still not making any forward progress. It's sliding backward.

That's despite massive global advertising by Google that has sought to leverage even its own search page, and constant flogging by Bloomberg and the Verge— which seeks to weave native ads for Pixel phones into virtually every article it prints.

Google is not some neophyte to the smartphone game. It's been trying to sell Nexus phones in partnership with Android licensees since 2010. It hasn't been a humble decade. Google rather arrogantly threw out a series of Nexus flops, then outlined Pixel as its plan to beat Apple in the premium space. Pichai's most recent stab at Apple, in his public statement "Privacy Should Not Be a Luxury Good", rings hollow when you note that Pixel phones have been priced as high or higher than the year-ago iPhones they are aiming to compete against.

Google's unfocused camera angle for Pixel

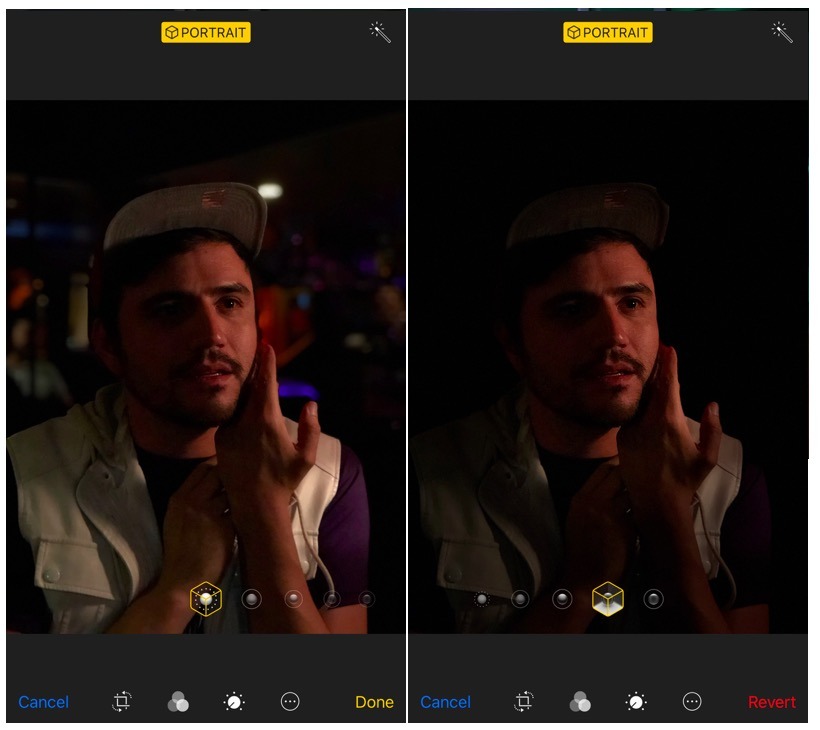

Google has shamelessly copied Apple's designs while portraying its single-camera Portrait mode as being better. In some cases, the Pixel camera is better. It can create a Portrait effect without needing to be a specific distance away, and it can uniquely synthesize low light images in near darkness. But critics hailing the Pixel's camera features have neglected to mention that Apple's dual cameras since iPhone 7 Plus actually capture real depth data that can be used for effects other than Portrait mode, including those created by third-party developers.

Additionally, the separate 2x zoom camera is useful for a variety of other things from capturing closer, less distorted panoramas to zooming in on wildlife in a slow-motion shot. Pixel is also lacking features like long exposure, adjustable aperture settings for Portrait shots, and has a lower quality display.

And despite having a huge, ugly notch, Pixel 3 still lacks anything like Apple's TrueDepth imaging system that supports Face ID, Portrait Lighting selfies, Animojis and other front-facing AR effects from a variety of third-party apps.

Apple's iPhone is also recognized for capturing exceptional video, something Pixel falls short in. And Pixel has consistently lagged behind other Androids in both real world and benchmarking performance due to its limited RAM.

With its cheaper new Pixel 3a, Google is digging back even further to achieve the performance of a 2013 iPhone 6. It is also carrying 4GB of RAM, the least of any Android flagship. On Android, that's not nearly enough because the OS is far worse at managing memory, and apps and games routinely demand four times as much RAM as comparable titles on IOS, according to GameBench.

Will a cheaper looking, slower Android with some unique camera abilities, but missing many unique iPhone camera features and can't match Apple's privacy and security, can't run ad-free iOS games, and can't keep up with blue bubble chats turn around Pixel's sorry trajectory? Judging from Samsung's troubled middle-ground offerings, it probably can't in a world where middling budget phones are already overserved by China.

Note that Google already tried slashing the price of Pixel 3 in half. A cheaper Pixel 3a model might cannibalize sales of other cheap midrange Androids, but is probably not enough to keep Pixel itself able to pay for very expensive silicon development as well as the salaries of two thousand members of HTC's former design team.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Christine McKee

Christine McKee

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Amber Neely

Amber Neely

Sponsored Content

Sponsored Content

Wesley Hilliard

Wesley Hilliard

72 Comments

OMG! It's about time, Google is plainly doomed now.

Desperation has set in, so much so that they're now deciding to offer smartphones at multiple price points with minor differences in capabilities and build and a mid-cycle release. What's wrong with just a couple of flagships, same time every year? Who does this, offering cheaper devices alongside "expensive", unless they're failing? Is anyone else's YOY flagship handset sales "falling backward"? Well there's the proof.

The Pixel 3a is an abject failure and blaming it on Verizon exclusivity doesn’t change anything. It’s right up there with the Samsung Fold.

How does one become CEO of Google, you know, when you speak, you know, like that? You know?