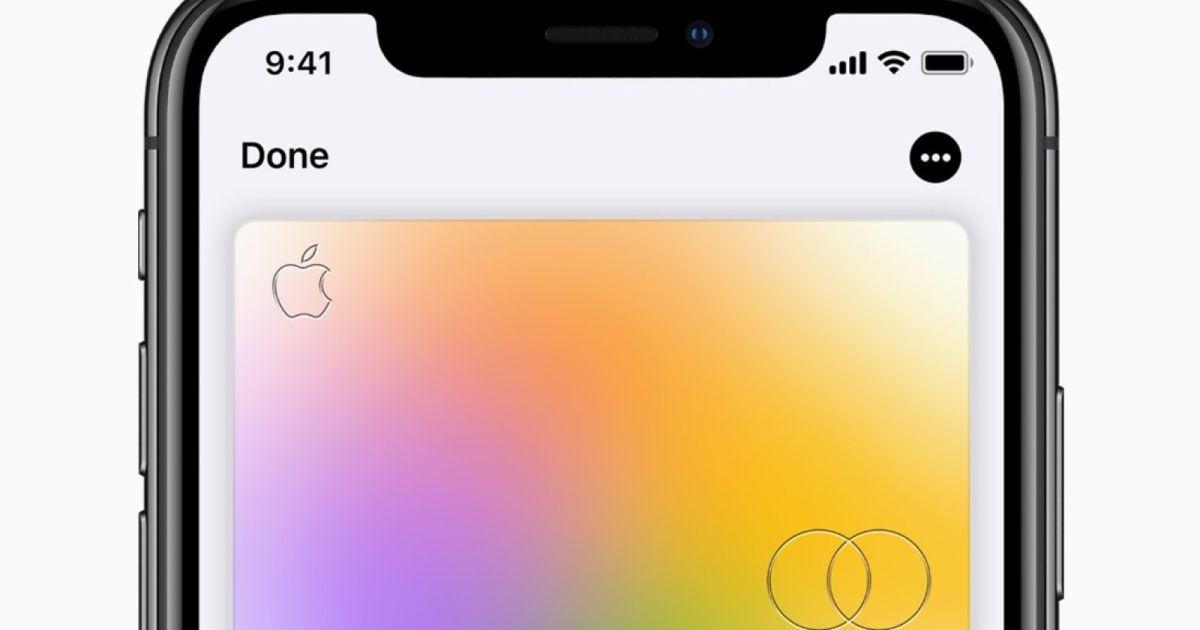

With a launch just weeks or even days away, Goldman Sachs has published the customer agreement for Apple Card, sharing APRs, usage restrictions and other details.

The publication is the first result that pops up on Goldman's website when conducting a search for "Apple Card."

On first opening an account, cardholders will be charged 13.24% to 24.24% annually on purchases depending on their credit, the document says. To avoid interest, people need only pay by their monthly due date.

As announced, there are no annual, transaction or penalty fees. Some other known details include the likes of the Daily Cash program, which returns money to a person's Apple Pay Cash account. The highest return rate, 3%, applies only to purchases directly from Apple and does not cover payments to third parties, including Authorized Resellers.

One point of interest is that to both qualify for and keep the card, holders must "have an Apple ID associated with an iCloud account that is in good standing with Apple," and turn on two-factor authentication for that ID. That's presumably to avoid intrusion or fraud, since iCloud accounts are already sometimes hacked to make purchases on the App Store or elsewhere.

A "Required Device" with a digital card is not strictly necessary after signing up, but Goldman warns that it may close accounts without one. The company is also threatening to cut off access for people with jailbroken devices and restricts cryptocurrency purchases.

Apple CEO Tim Cook confirmed that the Apple Card will launch sometime this month during a recent quarterly results call. Rumors have hinted at the first half of the month.

Roger Fingas

Roger Fingas

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Wesley Hilliard

Wesley Hilliard

Christine McKee

Christine McKee

-m.jpg)

72 Comments

"The company is also threatening to cut off access for people with jailbroken devices."

Presumably they're worried about malware?

"

That could be seen as yet another anti-competitive policy and may come back to bite them.

How can that be anticompetitive? Most airline affiliated cards give more miles or points for charges for their own services. So do many store affiliated cards.

This is interesting:

It seems this is the exclusive way to pay, i.e. you cannot opt to receive a paper statement in the mail, and drop a check back to them; or go to a web site to pay via ACH. It also seems to imply that an ACH fund transfer option is coming to Apple Wallet (in addition to the debit card option already there.) I am guessing that Apple Wallet will allow scanning of a blank check.

[edit] it might actually be easier than that. I have bank amount information in Apple Wallet now so as to be able to transfer FROM Apple Pay Cash to the bank; perhaps they will simply alter this at rollout to allow transfer TO Apple Pay cash via that same ACH information.

The fact my wife and I can’t use the same card account lowers its appeal to us. We will still get it because Apple but it sucks we will have two separate bills and our spending won’t be merged in the analytics.

The latter is the bigger problem, in my view. We had talked about only having this one card. We could do it — we only have two now. But the main reason to do it would be to consolidate all of the good Apple analytics in one place. I trust Apple to do a good job with that, and to protect my data. Without that simplicity factor, though, we will opt to keep one of our existing cards (think air travel), at least until Apple gives us a way to link the two accounts.