On Tuesday, long-time Apple-focused mobile device and enterprise hardware management software company Jamf filed for an initial public offering, worth $100 million.

In a confidential filing with the U.S. Securities and Exchange Commission Tuesday, Minneapolis-based company listed an offer size of $100 million. That offer size is a placeholder amount and is likely to change. The company was aiming to be valued at $3 billion in the listing.

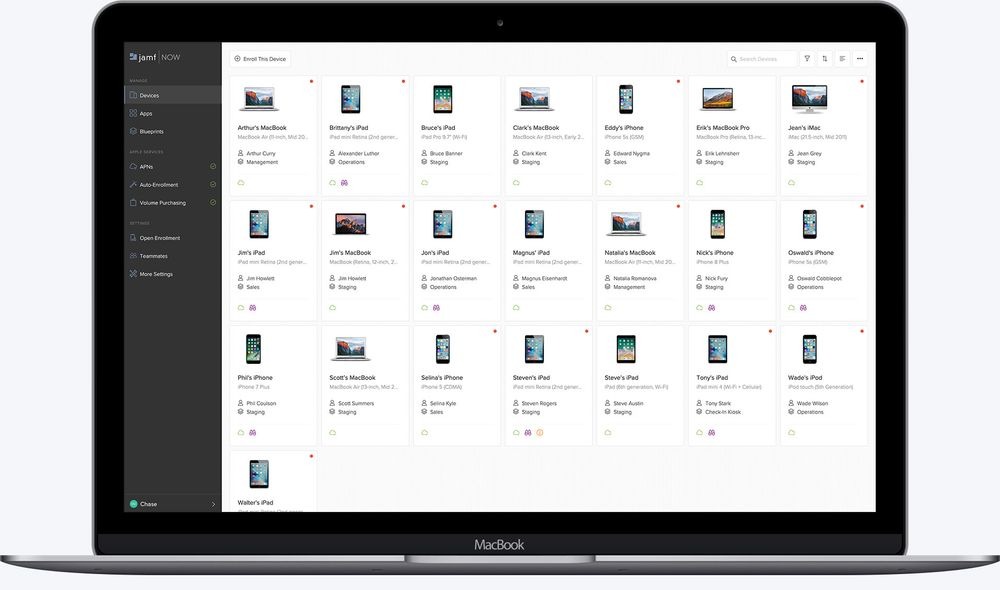

Jamf, founded in 2002, makes MDM platforms that lets enterprise users manage fleets of Apple devices — including iPhones, Macs and iPads. Apple itself has a client of Jamf since 2010, through it comprised less than 1% of the company's total revenue in 2019.

The MDM solutions company is well-known for its reports indicating that businesses and enterprise users prefer Apple devices. At its 2019 user conference, Jamf also announced new features and updates focused on security, deployments and education.

Jamf's IPO filing on Tuesday, spotted by Bloomberg indicated an $8.3 million net loss on $60 million in sales in the first quarter of 2020. The same period in 2019, Jamf reported $9 million in losses on $40 million in revenue.

Apple has long relied on third-party MDM platforms to offer fleet capabilities to enterprise customers. Earlier in June, however, Apple acquired Fleetsmith — an MDM solutions firm and Jamf competitor.

Mike Peterson

Mike Peterson

Christine McKee

Christine McKee

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Amber Neely

Amber Neely

Sponsored Content

Sponsored Content

Wesley Hilliard

Wesley Hilliard

2 Comments

Yup, grab the cash quick before Apple sherlocks you with the Fleetsmith acquisition.