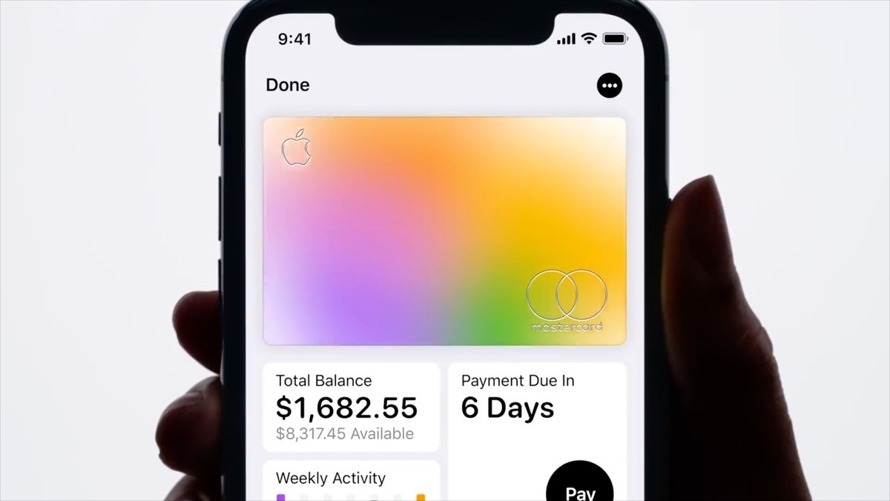

Owners of Apple Card are reporting Apple is finally expanding the number of credit reference agencies it will report to, with claims the Apple-branded credit card is starting to appear on credit reports generated by Experian.

So far, Apple has limited its reporting of consumer balances to one credit bureau, TransUnion, while no reporting was being made to either Experian or Equifax. While this has been the case for months, it now seems that the reporting is being made to more agencies.

An email from an AppleInsider reader who uses an Apple Card reveals they have spotted a change made to their Experian credit report, appearing when they checked their report on July 19. Searches on Reddit indicates it is affecting a number of users, with posts on the r/AppleCard subreddit indicating other users of the site as having seen the details in their report since July 18.

Discussion about the credit reporting practices of Apple Card intensified in October, when a report claimed Apple was rolling out reporting to other agencies. However, a source within Apple corporate not authorized to speak on behalf of the company advised to AppleInsider that the story was "not accurate," and that the reporting mechanism was effectively done. The source added that reporting was being done for some customers, but "everything will be reported" once it was fully deployed.

While credit card companies do typically provide reports to credit reference organizations, there is no requirement to do so, except to provide data to a system that credit card companies rely on. In December, Apple Card partner Goldman Sachs confirmed it reports back to TransUnion, a credit bureau named within Apple's support documents relating to the card, but without seemingly referencing other major agencies.

The claims of Apple Card appearing on Experian reports suggests Apple is finally rolling out the facility to other bureaus, but it is unclear if the same reporting is being performed with Equifax at this time.

The reporting may make an impact on the customer's credit score, as it will effectively be an extra creditor added to a list the customer may already have. The customer's history with Apple Card, such as payments and how much is used as well as the age of the account, is likely to force Experian to make changes to the user's score, though depending on the circumstances, it may be either a positive or a negative effect.

Malcolm Owen

Malcolm Owen

-m.jpg)

William Gallagher

William Gallagher

Wesley Hilliard

Wesley Hilliard

Christine McKee

Christine McKee

-m.jpg)

12 Comments

If there was any justice in this world, Equifax should’ve been leveled by the sheer volume of lawsuits against them stemming from their idiotic data breach.

Equif*x

Kinda like what they did.

U get it*

This is weird: One would think that credit card companies like GS/Apple, who are on the hook for fraud, would want to protect themselves by protecting their customers. But apparently not.... A few years back I opened a Discover credit card and, even though I have credit monitoring, I have yet to be notified that that account was opened!