The U.S. plans to enact new retaliatory tariffs on nations that tax digital goods from American internet companies, including those that tax App Store purchases.

The Office of the United States Trade Representative (USTR) has proposed tariffs that are approximately equal to taxes that various countries are requiring of international tech companies. Bloomberg estimates that the total annual value of the duties reaches $880 million.

The USTR's retaliatory tariffs would tax imports as much as 25% annually from a list of countries that includes the U.K, India, Spain, Italy, Turkey, and Austria.

The countries currently charge anywhere from a 2% to 5% tariff on digital-services revenue for various online activities. Details vary by country but apply to income from online areas like digital marketplaces, advertising, software-as-a-service, social media, and search engines.

Among the countries imposing digital taxes on U.S. firms, the USTR estimates that the U.K. takes in the most, at $325 million annually.

The retaliatory tariffs would apply to physical imports. They would cover an eclectic range of products, including caviar, fairground amusements, telescopes, and shrimp.

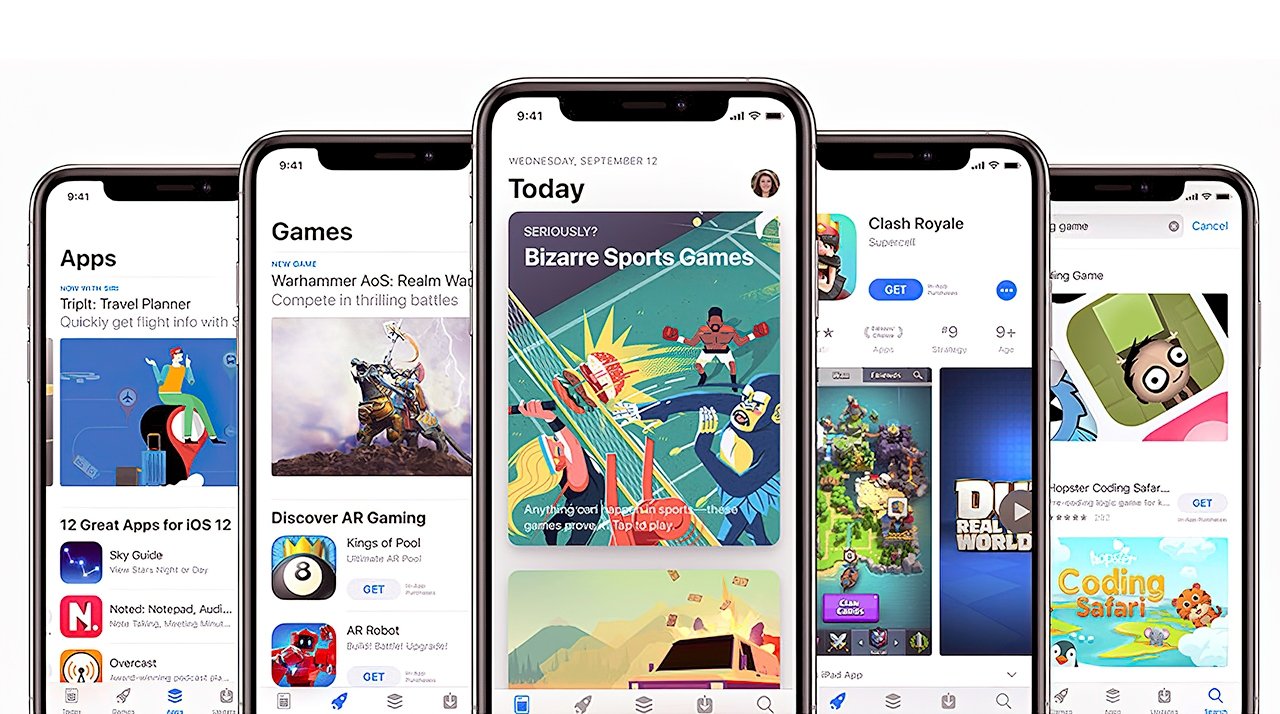

In 2020, Apple warned developers in the Apple Developer Program that it would begin recalculating for changes in global tariffs, potentially impacting developer revenue. At the time, Italy and the U.K had recently added their 3% and 2% digital services taxes on top of their existing value-added tax (VAT). Both countries are included in the USTR's new proposal.

The Internet Association — an American lobbying group that includes Amazon, Facebook, and Google — approved of the United States' proposed tariffs. The group released a statement applauding the USTR's action as "an important affirmation in pushing back on these discriminatory trade barriers as the U.S. continues to work to find a viable solution at the OECD."

Apple is not a member of the Internet Association.

The USTR has asked for public comments on its plans. Public hearings for the new tariffs begin on May 4 with the U.K. They continue through the following week, wrapping up with Austria on May 11.

Will Shanklin

Will Shanklin

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

Andrew Orr

Andrew Orr

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Bon Adamson

Bon Adamson

-m.jpg)

27 Comments

Government is such fun. On one hand Washington investigates, threatens, and cajoles the tech giants. On the other it goes to bat for them against other countries trying to tax them. It makes sense in that different arms of government are responsible for different actions and accountable to different laws and treaties, but it's still an odd look.

In the same way that non-US sovereign nations are free to tax anyone how they see fit within treaty frameworks, the US is also free to do the same, be it 'retaliatory' or not.

How it will be seen outside the US on a political level is something the US will have factored in and accepted, so no issues there either.

Digital stores should be taxed like any retail store... but that can only be feasible if stores don’t divert their profits to some other country, and the problem is stores divert profits to another country... So I think it is quite understandable that there are countries that feel that these companies are not paying enough taxes...