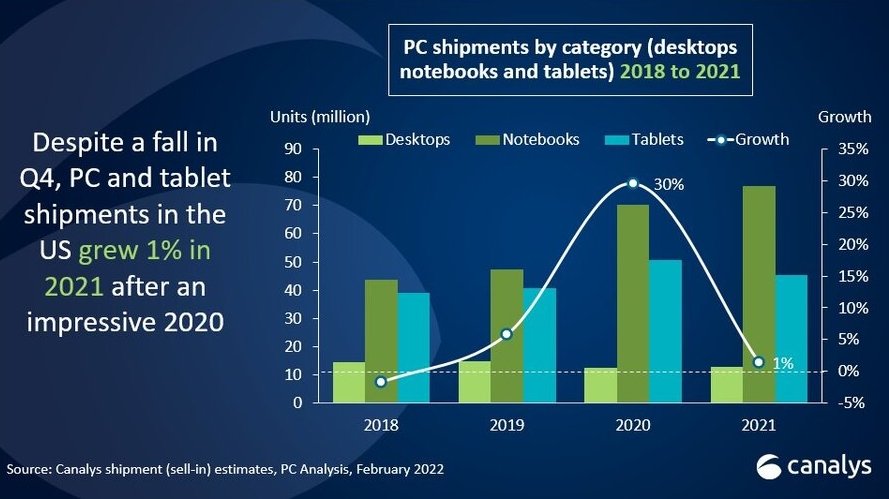

New research claims that Apple sold almost double the number of tablets of its nearest rival, but iPad growth comes as overall market shrank in the US.

Apple CEO Tim Cook has said that iPad sales were constrained by shortages, but new figures say US sales were still up on previous years.

According to research firm Canalys, Apple ended 2021 with 19.1 million iPads shipped. Amazon came in second place with almost half that number at 10.9 million, while Samsung sold 7.9 million tablets.

However, Apple's sales represented a 17% drop compared to 2020. Comparing Q4 2021 the same period the year before, tablet sales dropped by 31% to 12.7 million.

Cook has previously said that Apple had managed a "very strong performance" despite "larger than expected supply constraints."

"The supply constraints were driven by the industry wide chip shortages that have been talked about a lot, and COVID-related manufacturing disruptions in Southeast Asia," he said.

Canalys, however, attributes the dramatic fall in tablet sales to the reduced demand after customers bought more during the coronavirus pandemic. Chromebook fared worse than tablets for this reason, with a 74% drop in the year since WQ4 2020.

Overall, the PC industry, including Apple, reportedly grew by 1% during 2021. Canalys says HP came top with 25.9 million PCs sold, where Apple came in fourth with 10 million Macs.

That represents an annual growth for Apple of 12%. However, across Q4, Apple's Mac sales declined 3.1% compared to the previous quarter.

None of this data is confirmed by Apple. The company does not reveal detailed sales breakdowns, so comparative information depends on being gathered from multiple third-party sources.

Canalys nonetheless predicts that, based on its data, device sales will continue at a higher rate than before COVID.

"The US PC industry's overall growth in 2021 highlights the long-term potential of the demand initially created by the pandemic," said Brian Lynch. "While Q4 2021 showed less impressive performance than the year overall, the market is well positioned to continue providing significant opportunities, especially from a revenue perspective, for the coming year amid strong business demand."

William Gallagher

William Gallagher

-m.jpg)

Thomas Sibilly

Thomas Sibilly

Wesley Hilliard

Wesley Hilliard

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

8 Comments

Heh, desktop unit sales continued to decline through the pandemic. 12m units per year is not a big pie for Lenovo, Dell, HP, Apple, and lower tier OEMs to split. If the unit share ratios stay about the same, with Apple taking about 8%, Apple is selling about 1m iMac, Mac mini, and Mac Pro units a year. With an ASP of $1300, that's about $1.3b per year revenue. Wonder what it will level off at?

That's a pretty optimistic opinion. It seems were are in the tail end of the pandemic buying wave. People are headed back into the office. The market is saturated. There's a good chance unit sales will head back to 2019 unit sales numbers in a year.

In the past month me and two other immediate connections have gotten a new Mac. I’ll probably be getting another later this year as well as at least one iPad.