Apple was one of the only companies to grow its wearables business in China in 2022, with the Apple Watch Ultra helping to create a new segment for professional smartwatches.

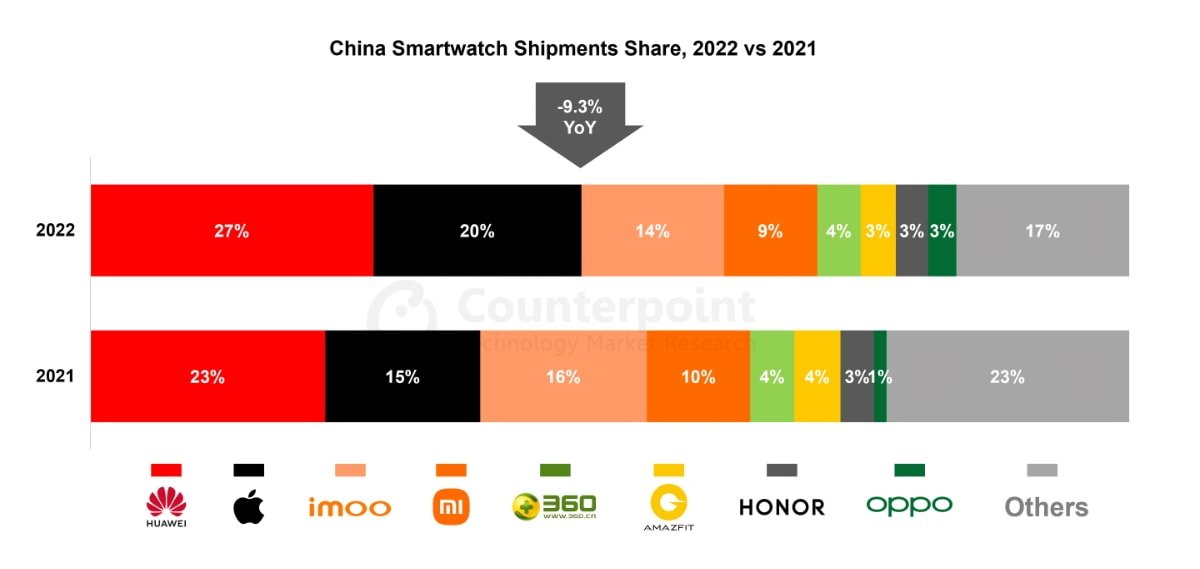

China's smartwatch shipments decreased by 9.3% year-over-year in 2022, primarily due to the impact of the COVID-zero policy. As a result, the market shrank to pre-COVID levels, with only quarter one of 2022 registering a quarterly year-over-year shipment growth.

During the same timeframe, worldwide smartwatch shipments grew 12% year-over-year.

Research from Counterpoint shows that Huawei and Apple dominated China's smartwatch industry in 2022, with a combined share rising to nearly 50%. Apple, OPPO, and Huawei were the only top brands to grow year-over-year at 22%, 105%, and 9%, respectively.

Strong sales of Apple's Watch Series 7 models and the newly announced Watch Series 8 and Ultra models helped Apple post shipment growth in China. Ongoing innovation in health monitoring features and an ideal data and interaction experience fueled Apple's success.

The Apple Watch Ultra, which created a new segment for professional smartwatches, helped Apple dominate the premium markets.

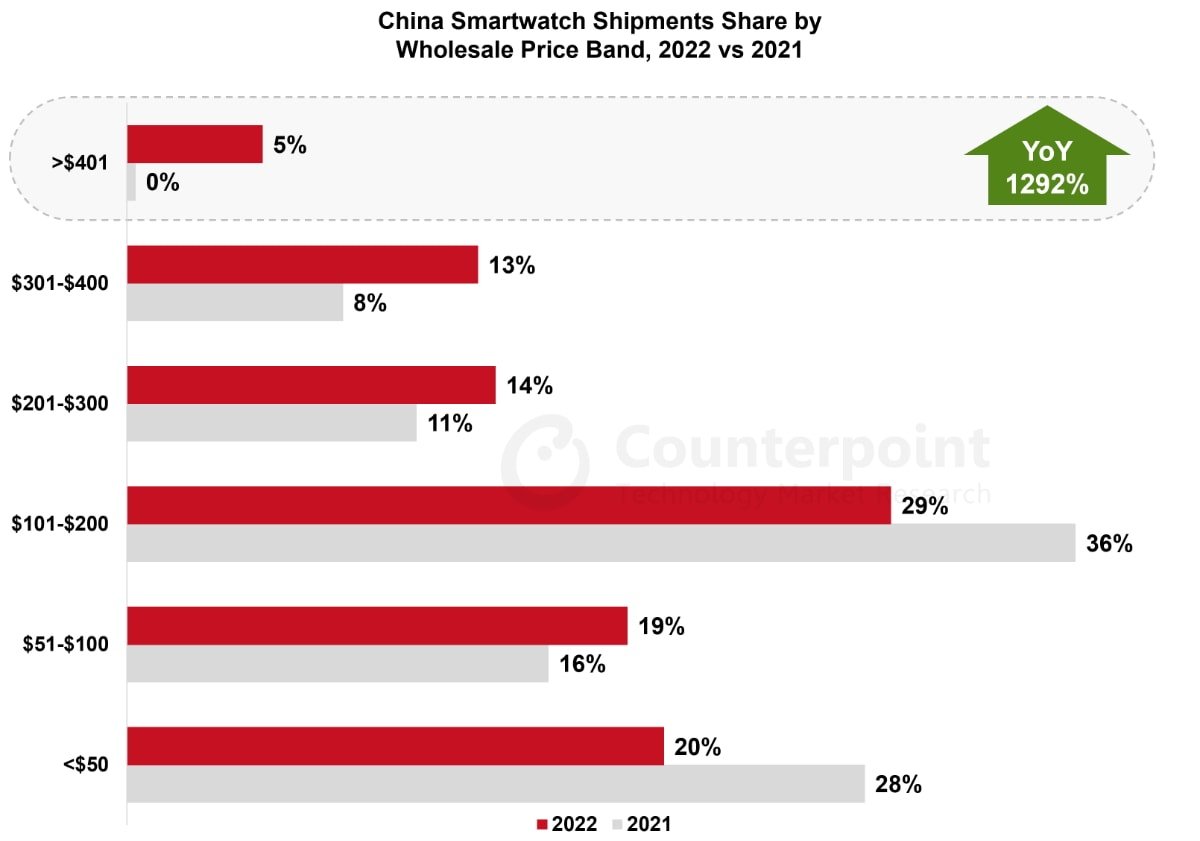

The most significant aspect of the year was the share rise of the high-to-premium segment for smartwatches greater than $200. Shipments in the $301 to $400 segment grew 46% year-over-year, while shipments in the $401 and over market grew a 1,292% year-over-year.

"This shift to the high-end segment is similar to the shift witnessed in the smartphone market in 2022," said senior analyst Ivan Lam. "In recent years, Apple and Huawei's marketing efforts have led high-end consumers to view their smartwatches as professional-grade devices with advanced sports and health monitoring capabilities."

Counterpoint expects China's smartwatch market to rebound due to active volume push by OEMs and post-COVID reopening measures in 2023. The market's average selling price may also rise due to the continued demand for more professional smartwatches.

Andrew Orr

Andrew Orr

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Amber Neely

Amber Neely

1 Comment