Researchers at Piper Jaffray expect that Apple will reveal during its quarterly conference call next week that it sold some 50 million iPhones for the quarter ending in December, five million more units than the firm previously estimated, while Topeka Capital Markets sees positive indicators for AAPL and set a price target of $1,111 for the stock.

In a quarterly preview, analyst Gene Munster of Piper Jaffray predicts that Apple will surpass the firm's earlier December quarter estimates by five million units based in part on "commentary from AT&T suggesting iPhone sales expanded slightly [year-over-year] and [from] Verizon that iPhone helped it reach record activations in December." Munster estimates roughly 15 million iPhones could have been sold in the U.S., with a possible global sales range of 41 to 54 million units.

Munster also reduces the estimate for iPhones sales for the upcoming March 2013 quarter by five million to 38 million units. The firm expects that Apple's forthcoming guidance will shed light on recent reports of component order cuts.

Piper also expects Apple to announce 25 million iPad sales for the December quarter, with 20 million full-size iPads sold alongside five million iPad minis. Mac sales will likely see a drop of seven percent year-over-year, with Apple selling 4.8 million Macs over the last three months of 2012.

Topeka Capital: Apple risk-reward "extremely attractive"

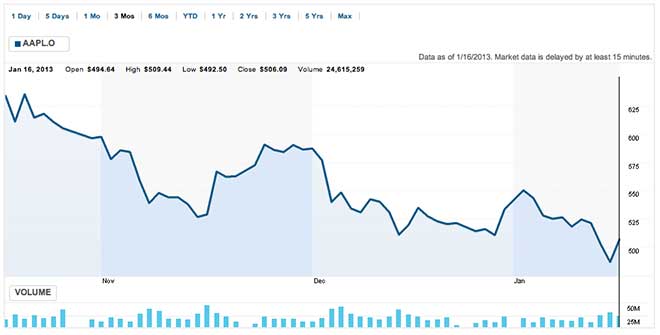

Analysts at Topeka Capital Markets remain upbeat on AAPL despite negative sentiment surrounding the stock. In a report released Wednesday — titled "Apple's Brightest and Most Innovative Days are Ahead of It" — analyst Brian White said the firm believes Apple's product portfolio "has never been stronger," rated the stock a "buy," and set a 12-month price target of $1,111.

White pointed toward three factors in his positive assessment of Apple's future. First was the continuing growth of the smartphone and tablet sectors, two areas where Apple holds an enviable position as a market leader. Second were positive indications out of China, where Apple is working on a deal with the world's largest carrier China Mobile and is now moving to position its iPhone to be more price-competitive.

Finally, White pointed to the television market, which he believes is still ripe for an Apple disruption. The report views Apple's "reinvention" of the TV experience as an eventuality, and White was unimpressed with the smart TV offerings Samsung, LG, and others had on display at last week's Consumer Electronics Show. A strongly disruptive Apple television product, White says, could create an entirely new $100 billion to $400 billion market opportunity.

Kevin Bostic

Kevin Bostic

-m.jpg)

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

74 Comments

$1,111?! That has to be a typo. They must mean $1.11¡

I'd be willing to accept $1,111 a share if someone twists my arm.

Time for manipulative pigs to come back to the trough.

$1,111?! That has to be a typo. They must mean $1.11¡

Pfffftttt...

My Morgan Stanley financial advisor (I recently retired) thinks AAPL is poised for take off. It's in my IRA portfolio.

I think $1,100 is a little on the lofty side, UNLESS they sign China Mobile and come out with a kick butt HDTV line along with some major iPhone, iPad etc. releases. I think that $750 to $800 during the next 12 months is POSSIBLE. But I feel $700 to $750 is a little more realistic. But I think there is a good chance they'll sign China Mobile, but it's a matter of what deal they strike, but China Mobile wants too much.