On May 14, Apple will pay shareholders of record a quarterly dividend of $0.52 per share, but investors must have settled ownership of the company's stock by Monday, May 11, in order to qualify.

Apple has been paying its shareholders a dividend about a month and a half after the end of each fiscal quarter ever since it declared its modern dividend plan in the summer of 2012.

The May dividend will be the fourth to occur since the company issued a 7-for-1 stock split. That split also converted the dividend from $3.29 per share to 47 cents per share.

Apple just announced plans to increase its May dividend from 47 cents to 52 cents per share during its Q2 earnings conference call.

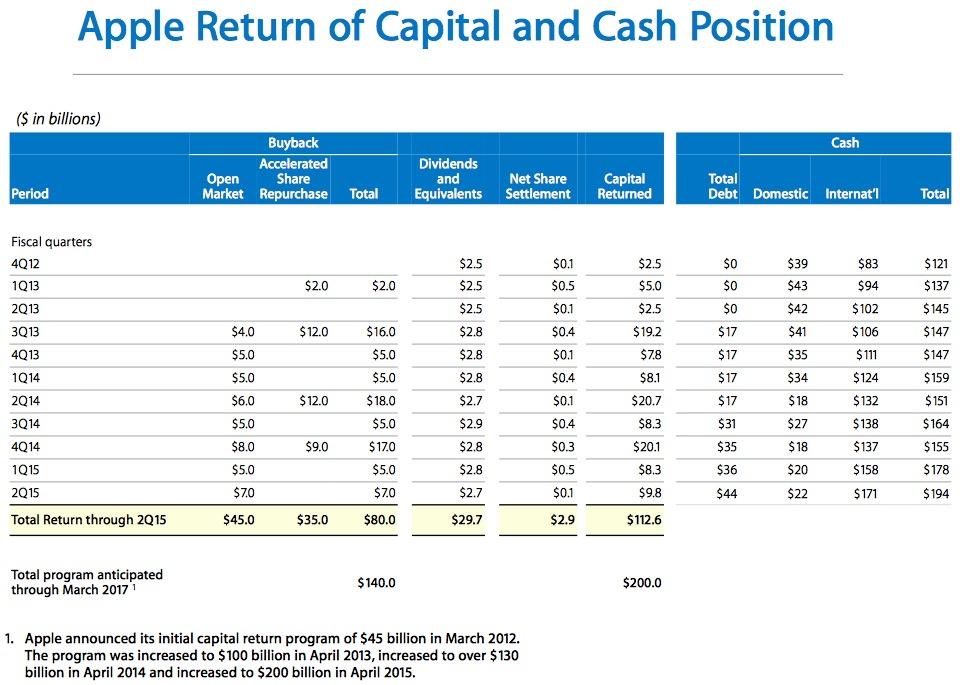

Since the stock split, Apple repurchased a surprising $17 billion of its own stock in the September quarter; $5 billion of stock in open market purchases during its December quarter (Apple's Fiscal Q1 2015); and another $7 billion of stock in open market purchases during its March quarter (Apple's Fiscal Q2 2015).

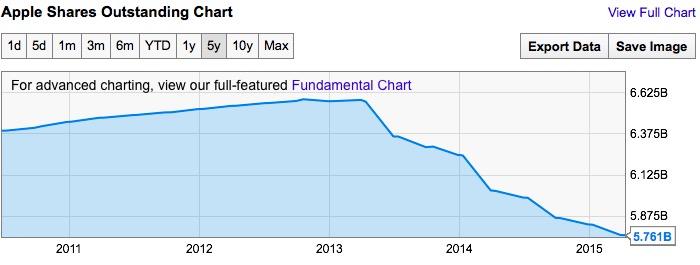

The company now has 5.761 billion shares outstanding.

Since the beginning of 2014, Apple shares are up 59.2 percent, compared to Microsoft's 27.98 percent gain or Google's 3.43 percent decline in nonvoting GOOG C class shares and 1.61 percent loss in standard GOOGL A class shares.

Since the start of 2015, Apple shares are up 16.51 percent, compared to Microsoft's 2.06 percent gain or Google's 2.79 percent gain in nonvoting GOOG C class shares and 4 percent gain in standard GOOGL A class shares. Google split its shares into the two classes and awarded investors one of each, effectively stripping investors of half their voting rights through the "dividend" dilution.

AAPL Dividends & Buybacks

Dividends are a minority portion of Apple's shareholder capital return program, the majority of which has been earmarked for buying back outstanding shares.

Buybacks increase the scarcity, and therefore value, of Apple's stock by taking shares off the market and retiring them. Removing shares from circulation also enhances the company's closely-watched earnings per share metrics. Over the last four quarters, Apple has repurchased $34 billion worth of its stock off the market or via accelerated repurchase programs.

"The Company also plans to increase its dividend on an annual basis, subject to declaration by the Board of Directors," Apple states in its 10-K filing, a comment reiterated by the company in its most recent earnings conference call.

Over the past four quarters, Apple has paid out over $11 billion in dividends to its shareholders, distributing about $2.8 billion every quarter, although that number is decreasingly slightly in tandem with the company's stock buybacks.

Apple's volume of stock buybacks have reached the 5 percent threshold to qualify for inclusion in the "NASDAQ BuyBack Achievers Index," as well as the PowerShares Buyback Achievers Portfolio, as noted in a report by ETFtrends.

In total, Apple has spent $80 billion on stock buybacks since initiating its capital return program, including an opportunistic $14 billion share grab initiated after the stock plunged more than 8 percent last January following the company's holiday Q1 release which detailed its highest ever quarterly revenues and operating profits— results that the tech media depicted as "disappointing."

Combined with dividend payments and net share settlements, Apple has spent $112.6 billion on capital return since mid 2012, and it plans to return a total of $200 billion over the next two years.

Apple is currently using much of its domestic U.S. cash flow to finance stock buybacks and dividend payments, and is also issuing bonds at extremely low interest rates to help pay for its capital return programs.

It currently holds $171 billion of its total $194 billion cash reserves overseas; spending those funds domestically would incur a substantial tax penalty unless the U.S. Congress approves a tax break to enable and incentivize American firms to invest their foreign earnings in America.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

49 Comments

Ex-dividend has come and past already. That was yesterday.

Can't believe Apple Insider gets this wrong every single quarter.

You needed to own the shares at the end of Wed to get the dividend next week.

And all of these news come with the price: AAPL dropped to below $124. This is fcking buying time right before ex-dividend day tomorrow. I just grab another 100 shares and set limit sale all my AAPL at $135...(by WWDC hopefully). Move to long term investment on ETF instead, guys. Damn stock so volatile because of the manipulative idiots in Wall Street and that pissed me off.

Ex-dividend has come and past already. That was yesterday.

Can't believe Apple Insider gets this wrong every single quarter.

You needed to own the shares at the end of Wed to get the dividend next week.

Technically Apple Insider has it correct. But who, ever, talks about the share settlement date? Ex-dividend date is the critical date for anyone buying shares in the normal manner. And yes, Thursday at the open the stock went ex-dividend, meaning that a person would need to have purchased before the end of Wednesday's after-market session (8pm) in order for newly purchased shares to deliver to that person this quarter's dividend.

The article isn't wrong. It also isn't offering buying advice on securities. It is detailing Apple's dividend payments. "May 14, Apple will pay shareholders of record a quarterly dividend of $0.52 per share, but investors must have settled ownership of the company's stock by Monday, May 11, in order to qualify." To have settled ownership by Monday, you'd need to have purchased the shares Thursday May 7.

The article isn't wrong. It also isn't offering buying advice on securities. It is detailing Apple's dividend payments.

"May 14, Apple will pay shareholders of record a quarterly dividend of $0.52 per share, but investors must have settled ownership of the company's stock by Monday, May 11, in order to qualify."

To have settled ownership by Monday, you'd need to have purchased the shares Thursday May 7.

Investors don't actively "settle ownership", and putting it in those terms is obscure and confusing, requring some arithmetic that accounts for closed days, which further means consulting a calendar The ex-dividend term is much more straightforward; if you don't own the stock prior to it going ex-dividend, i.e. before its ex-dividend date, you're excluded from the dividend.

ETA: And sog is correct. The ex-dividend date has come and gone on May 7, and you would need to have purchased on May 6 or earlier.

Technically Apple Insider has it correct. But who, ever, talks about the share settlement date? Ex-dividend date is the critical date for anyone buying shares in the normal manner. And yes, Thursday at the open the stock went ex-dividend, meaning that a person would need to have purchased before the end of Wednesday's after-market session (8pm) in order for newly purchased shares to deliver to that person this quarter's dividend.

"Investors" means "stock brokers" in this case, not individuals who own AAPL. Yes, Investors need to settle or "record" stock by the end of May 11. However, the title says "approach Ex-dividend" is misleading. Suppose to be "approach record day". Ex-dividend day is 2 business days before the "record day" which was on May 7 and public needs to own AAPL before Ex-date to qualify for dividend, so May 6 was the cut off date.