American Technology Research analyst Shaw Wu put out a call to clients on Friday, saying they should be prepared for a slight letdown at Apple's event next Tuesday unless chief executive Steve Jobs pulls a rabbit from his black turtleneck.

More specifically, Wu said his check into the company's supply chain have turned up no evidence to suggest a major hardware revelation will take place at the event, which "may be viewed as disappointing" given that some investors previously had high hopes for major Mac-related announcements.

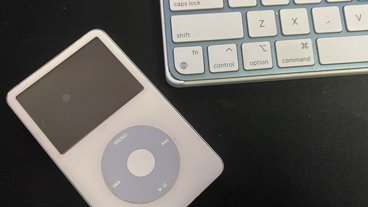

Instead, he sees a "modestly redesigned 4th generation iPod nano and slimmer 2nd generation iPod touch with lower price points and higher storage capacities," but isn't expecting radical changes to the iPod portfolio given the great success and extensive refinement the media players have already undergone.

The analyst maintains that the company's MacBook Pro and MacBook are due for refreshes with more radical redesigns, but aren't likely to be unveiled at Tuesday's event as the focus appears to be on its non-Mac businesses.

"In addition, we are picking up that MacBook Air could see a minor refresh and potential price cut to increase its value proposition as build plans have slowed from earlier robust levels as customers have opted for MacBook or MacBook Pro instead," he wrote.

Some potential "wild card" announcements that could boost sentiment surrounding the event could include "an advanced AppleTV with DVR and TV tuner capabilities" or "new touch form factors (iPod-Mac hybrid) with larger screens," he added.

The AmTech analyst maintained his Buy rating and $220 price target on shares of the Cupertino-based electronics maker, vouching his belief that the company remains the best play in the digital home market and that penetration levels of its Mac and iPhone business segments remain opportunistically low.

"The disturbance in the macroeconomic environment is within lower-income demographics and financial institutions with exposure and impact to overall liquidity," he wrote. "This could certainly spread, but we believe Apple's business will remain strong in the near- to medium-term. Enough high-end consumers are still buying tech, though commodities inflation could pressure future margins."

Sam Oliver

Sam Oliver

-m.jpg)

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

95 Comments

It is down over $15 from a few days ago-and this on news that they may have sold 7(!) million iPhone 3Gs already-it looks to be another record MAC quarter-and the Christmas shopping season is right around the corner.

Whatever, APPL investors buy on rumors and sell on facts-even good ones?!?

Does anyone listen to Shaw Wu? He is about as bad as Prince McClean.

Does anyone listen to Shaw Wu? He is about as bad as Prince McClean.

Who is Prince McClean?

Ironically, any expectations that were assumed were manufactured by these same analysts

It is down over $15 from a few days ago-and this on news that they may have sold 7(!) million iPhone 3Gs already-it looks to be another record MAC quarter-and the Christmas shopping season is right around the corner.

Whatever, APPL investors buy on rumors and sell on facts-even good ones?!?

I think if you're really paying attention to anyone saying they may have already sold 7 million iPhone 3Gs....... you're making a mistake.

If that's the rumor you're looking at, then you'll be willing to buy on the rumor and want to sell when you get the facts.

The phone is going great, but 7 million is crazy.