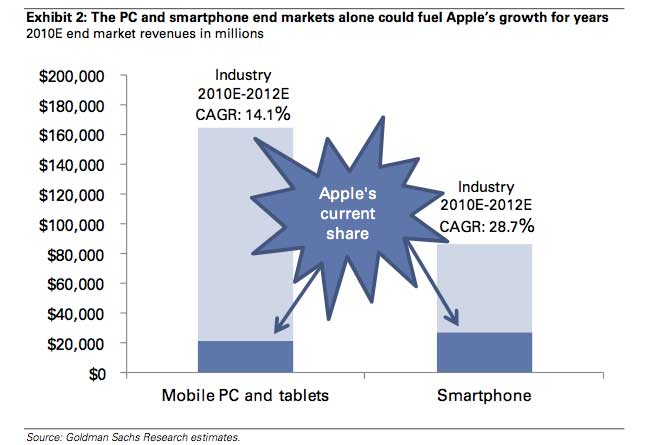

The 59-page report sent to investors on Monday calls the platform-centric business model of Apple the company's "secret sauce." It's that approach, analyst Bill Shope with Goldman Sachs argued, that has enabled Apple to quickly gain market share in the phone and tablet markets with the iPhone and iPad, respectively.

"We believe significant growth and profit opportunities for this platform still lie ahead," Shope wrote. "As a result, we expect revenue and earnings expectations to continue to trend upward, and we view the shares as attractive at current levels."

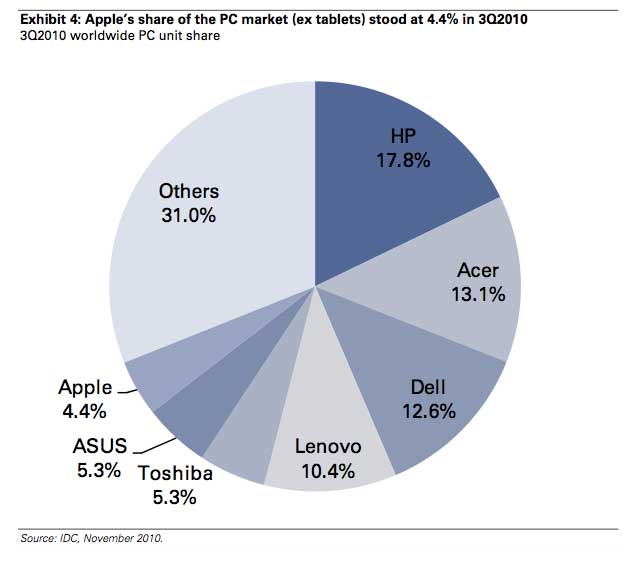

Shope has forecast that Apple will ship 37.2 million iPads in calendar year 2011. Combining the iPad with Mac sales would already make Apple among the largest PC vendors in the world, and Shope said he believes Apple's share of the total market will only continue to grow next year.

"By leveraging the iTunes and App Store components of the platform, Apple's unique tablet design has been able to potentially produce the most disruptive force to Wintel computing in the history of the PC industry," he said. "Tablet competitors are looming, so Apple can't rest on its laurels."

He also noted that he expects the company's gross margins to improve, which would quell recent concerns over slipping margins following the launch of the iPad and iPhone 4. Shope's analysis of Apple's platform history suggests the eroding margins are "normal," and that the company has "probably already seen the worst of it."

"Indeed, we believe Apple's margins have already bottomed, and we expect the company to resume its leverage-driven upside in coming quarters," Shope wrote.

Neil Hughes

Neil Hughes

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

11 Comments

"Indeed, we believe Appel's margins have already bottomed, and we expect the company to resume its leverage-driven upside in coming quarters," Shope wrote.

Did AI leave out a (sic) here, or did AI misspell Apple by accident?

Anyways, it is always great to hear from these analysts when they have good things to say about "Appel's (sic) margins". Goldman Sachs is among the best of the best, aren't they? Or are they one of the bad ones?

"Prominent" or not these firms are all bullshit artists at their core. They probably have a chimp throwing darts at a dart board to make their predictions. I mean just take a gander at Kramer for starters.

They (analysts in general) are considerably better in recent years. I remember when 80% were so far off the mark it was almost amusing. Always made for great quarterly results though, as for some dumb reason the fact that AAPL rocked the discotheque came to most as a surprise.

Apple's business model simply did not compute in their technically challenged accountants brains.

Is there a good website that compares the analysts predictions with what actually happened? (for Apple and/or other companies)

.

Sheez, what a bunch of pinheads

"Resumes" ?

Why they get away from Apple in first place ?

.

With "analysts" of this caliber

No wonder Wall Street got butt f'ked 2 years ago

Idiots

.