Shares of Apple stock recently hit a 52-week low, but analysts at Goldman Sachs are still very optimistic about the company's fortunes, with one analyst saying AAPL is the most undervalued stock the firm covers.

via Business Insider

Goldman Sachs analyst Bill Shope on Tuesday said he still rates AAPL as a "Buy." Despite the cautious outlook of other analysts, Shope sticks with a $660 price target on the stock.

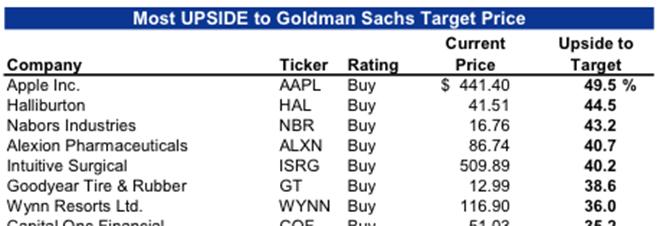

Another Goldman analyst, David Kostin, recently published a list of the Goldman-covered stocks with the most upside opportunity. Apple is at the top of that list, with 49.5 percent potential upside, ahead of Halliburton, Goodyear, Wynn Resorts, and more.

Goldman aren't the only ones with a positive outlook on Apple. Berkshire Hathaway chief and respected investor Warren Buffet said on Monday that Apple should use its cash pile to buy back more stock. Doing so, Buffet said, would be like buying dollar bills for 80 cents.

Kevin Bostic

Kevin Bostic

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

39 Comments

It's a damn joke how much AAPL is undervalued at the moment.

I'd like to see the list covering the most overvalued stocks. I have a pretty good guess as to what would be on top of that list.

unhuh.. Not buying it I'm afraid. Seems to be an abnormally high amount of quasay posative news this morning and today without much meat on any of these stories. I wonder if it has anything to do with the stock hitting a new low yesterday. People wouldn't be trying to make money now would they?

be careful about what GS says. it usually is the exact opposite of what they are doing and thinking.

These are the guys that helped AAPL crash and burn. And then they come out with a statement like that? They add a new dimension to the term 'slimey analysts'.

^ Add citigroup to that. Maybe the SEC should look into these "news releases". I don't imagine they would find anything they like.