Estimates from market analysis firm IDC released on Wednesday show the overall PC market declined 13.9 percent year over year in the first quarter of 2013, the worst single-quarter slip on record.

Update: This article now includes numbers from Gartner, which were also published today. Interestingly, the firm's estimates conflict with IDC's preliminaries, especially regarding Apple's shipments, which Gartner found to have grown during the first quarter.

According to data from IDC's Worldwide Quarterly PC Tracker, the nearly 14 percent fall is almost twice what was expected for the sector. This is the fourth consecutive quarter of declines.

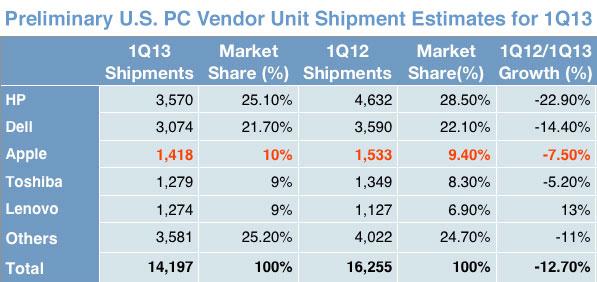

The U.S. saw 14.2 million combined shipments as the PC market continued to free-fall in quarter one, declining 12.7 percent year-to-year on . The contraction represents a 18.3 percent sequential drop compared to the fourth quarter of 2012. Total shipments reached 2006 levels, making the first three months of 2013 the tenth straight quarter of year-on-year declines, not counting a brief reprieve in the third quarter of 2011 that saw less than 2 percent growth.

Preliminary estimates had Apple at 1.4 million units shipped, netting the company 10 percent of the U.S. market in the first quarter, a 7.5 percent drop from the same period in 2012. The performance allowed Apple to hold on to third place behind HP and Dell. While the Cupertino company performed slightly better than other OEMs in the U.S., the company was a victim of steep competition from its own iPad, IDC said.

The two front runners were hit hardest with massive U.S. shipment contractions of 22.9 percent for HP and 14.4 percent for Dell. Number one HP managed to keep its position on over 3.5 million units shipped, but Dell closed the gap with just over 3 million shipments. Worldwide, HP suffered 23.7 percent negative growth year over year due to internal restructuring.

Following the top three were Toshiba and Lenovo, the latter being the only manufacturer to post positive growth in the U.S. during the three-month period, saw decent gains of 13 percent. Asia/Pacific shipments for the company declined, however, leveling out the firm's overall growth. HP and Lenovo were neck and neck for worldwide shipments, separated by less than 300,000 units.

Interestingly, the launch of Microsoft's Windows 8 didn't help shipments, and according to IDC, actually kneecapped the segment.

"At this point, unfortunately, it seems clear that the Windows 8 launch not only failed to provide a positive boost to the PC market, but appears to have slowed the market," said Bob O'Donnell, IDC Program Vice President, Clients and Displays. "While some consumers appreciate the new form factors and touch capabilities of Windows 8, the radical changes to the UI, removal of the familiar Start button, and the costs associated with touch have made PCs a less attractive alternative to dedicated tablets and other competitive devices. Microsoft will have to make some very tough decisions moving forward if it wants to help reinvigorate the PC market."

O'Donnell referenced the poor adoption rate of the newest Windows operating system, which contributed to significant shipment drops across all regions compared to the same quarter in 2012. The lackluster reception of Windows 8 was not fully to blame for the decline, however, as traditional barriers of price and supply held back manufacturer attempts to revitalize the sector with "Ultrabooks" and other innovations. The efforts appear to be largely unsuccessful, with consumers finding the upgrades too clunky or too costly to warrant a purchase.

Gartner Estimates

Gartner has also issued their own PC shipment estimates for the first quarter of 2013, and while the numbers are mostly in line with IDC, the firm has grossly different data for Apple

While IDC estimated Apple's growth to have atrophied 7.5 percent year to year, Gartner noted in its report that the company actually saw positive U.S. growth of 7.4 percent. By comparison, Gartner estimated that Apple shipped over 1.65 million Macs for the quarter, a 230,000 unit disparity from IDC's findings.

U.S. shipments in thousands of units. | Source: GartnerInterestingly, the firm's estimates relating to the other top-five vendors are similar to IDC's, including the overall rankings for the companies. The exact numbers, however, were somewhat different. For example, as noted above, HP and Lenovo were in almost tied for the top position worldwide, but Gartner had the U.S. company outperforming by about 20,000 units compared to IDC's nearly 300,000 units.

Mikey Campbell

Mikey Campbell

-m.jpg)

William Gallagher

William Gallagher

Andrew Orr

Andrew Orr

Christine McKee

Christine McKee

Andrew O'Hara

Andrew O'Hara

Malcolm Owen

Malcolm Owen

49 Comments

Perhaps Moore's law of speed doubling has finally surpassed people's need for faster computers. Even a five year old computer is plenty fast enough for many consumers. Plus, there is no compelling reason for upgrading to anything beyond XP on Windows and even many Mac users are content with SL. Then of course there is the iPad factor.

Economic conditions aren't helping either.

Assuming these estimates are accurate it's hard to argue that we're not in a Post-PC era. Another takeaway is that it shows Apple increasing its marketshare to double digits. Perhaps not significant by itself but when you consider that around 5% Apple had over 90% of the $1000 and up market and was taking 1/3rd of the market's profits. Those ratios are likely higher now.

It's a good thing Apple releases their internal information to the IDC so we know we can trust their figures.

It's a good thing Apple releases their internal information to the IDC so we know we can trust their figures.

He he! :)

Ok I'm confused. iMac is selling well but Apple's Mac sales are down. Teens love iPhone and its selling well, but Apple's suppliers are making way less money because no one is buying iPhones. iPhone 5 is a hit but it's a flop. Which is it please? Is Apple doing well or crashing?