Apple co-founder Steve Wozniak feels the recent public scrutiny of the iPhone maker's tax strategies is entirely justified, saying that the corporate tax rules in America are "really not fair."

Wozniak spoke at a conference in Northern Ireland on Thursday, saying that the tax system needs to be reworked to put corporations on the same level as people, according to The Telegraph. Criticism of Apple's tax practices, the Apple co-founder said, is warranted because corporations have more leeway than ordinary people when it comes to taxes.

"Apple itself," Wozniak said, "you'd think, would say, 'My gosh, there's systems. We have to go for it the way we can maximize our profits."

That goal of profit maximization, he said, could lead corporations to do things that might be considered unethical if an individual did so.

"For a corporation," Wozniak opined, "there's no such thing as personal ethics. It's like you will do anything, any scheme you can, to maximize your profits."

The solution, Wozniak said, is to equalize taxation between people and corporations. People are taxed on income, while corporations are taxed on their profits.

"That is why the rich get richer and the poor get poorer," Wozniak said, "and I am always for the individual being much more important than their training; same reason I created Apple computer at the start, it was to empower the little guy."

Legislatures should, according to Wozniak, remake the laws so that both groups are taxed by the same metric.

"Why do businessmen get to write off lunches and cars? If normal people did they would have more savings.

"That is really not fair, that businesses are not treated the same as people.

"A person would say, 'my life is my business and I have to pay for my home, pay for my clothes, my food and what is left over if I make a little money some year and put it in savings, that is my profit', but people are not taxed on profit, they are taxed on income."

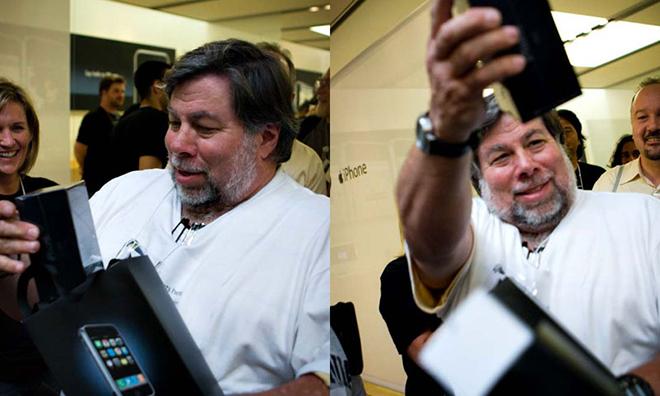

Wozniak, who has not worked at Apple in decades, remains a faithful Apple fan and general booster of technology. He is also well known for his frequent, colorful remarks on the affairs of the company he helped create.

His comments, at their core, may be similar to what Apple CEO Tim Cook prescribed when he defended Apple's policies before a Senate panel. Both men call for a simplification of the tax code, but Cook's main point before the Senate was that the code should be simplified downward, in the form of lower corporate taxes.

Apple, Cook said, pays every dollar it owes in taxes. Overseas revenues, though, the company routes through an Ireland-based subsidiary, so as to avoid the United States' 35 percent corporate tax rate.

For domestic earnings, Cook called for the U.S. corporate tax rate to drop to roughly 25 percent. For international earnings, Cook was less specific, though he said that the rate "would have to be a single-digit number."

Wozniak's talk covered a range of other topics, including both education and wearable technology, according to Alan in Belfast. Apple CEO Tim Cook may not have much faith in Glass, but Wozniak was quite interested in the technology.

"I am getting so jealous," Wozniak said. "I don't know if the marketing plan was ripe to hit someone like myself or not... I haven't had time to be a full explorer with that, so I didn't get the Google Glasses yet, but boy that's starting to seem like an interesting thing that I sure want to try."

The Apple co-founder also opined on the viability of an Apple smartwatch, which is thought to be in development.

"I also don't mind the idea of a watch, as long as the watch is my smartphone that I can basically do all my smartphone stuff on including asking Siri questions. Wouldn't mind a watch, but if all it's going to be is pretty much music and measuring how many steps I walk per day, nah, that wouldn't be enough."

AppleInsider Staff

AppleInsider Staff

-m.jpg)

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

16 Comments

Yawn. The more I hear about governments and people complaining about large company's not paying tax the more I think why don't politicians get off there arse and change the laws to force tax. Not that its simple. Americans are probably of the opinion that tax should be paid on profits made overseas while overseas country's are complaining about the low level of tax paid in there country's.

Is it possible for Apple to have him banned from saying anything relating to Apple!? Not that I want to get in trouble with the free-speach movement. I'm a poor-sole with not much, I do however have a roof over my head & can feed myself but is not Mr Wozniak a multimillionaire? Not to stop any rich person from taking up the right of the poor & downtrodden but this is in no way related to such.

Woz, you fool. Why didn't you just come out and say that you've always hated Steve and hated how he marketed your Apple I design and hated how he made a company out of your products and gave you the money to live a life that no human being has ever—and possibly will ever—have again?

Is it possible for Apple to have him banned from saying anything relating to Apple!?

They'd probably have to stop paying him first, but yes, Apple can bar him from speaking about the company.

actually Woz is wrong. People are taxed on profit only, at least to a degree. Because they get deductions etc. And if he has an issue with the tax code, fine. But to imply that Apple is doing anything wrong is just being an ass. As for the tax code, I say if the revenue came from outside of the US then it should be taxed by the area it came from, not the US. It's only fair to the other countries that are providing the same police, roads, utilities etc for the offices and stores in their area.

I've only read AI's article but isn't he defending Apple by saying corporations are there to maximise profit. If you create a tax system that allows a way around paying tax then there going to do it and it's nothing to do with ethics as ethics don't apply to a business.

But speaking on the side of the common person, corporations making billions should be required to be pay tax in the same way as regular people.

Not sure if he actually said it or not, but the other aspect is that if your rich you can shift your income into a business. Just think how much money you would save if the money you paid on your mortgage was tax deductible. If your rich it's not hard to do, if your poor it is hard. To illustrate further if you take £1000 of earning in the UK, you loose 40% leaving you with £600 to pay for your house with, make it tax deductible and you have £1000 to pay for your house with!

Hence rich get richer, poor get poorer. Just because he's a millionaire, doesn't mean he can't support poor people.