If Apple were to heed the advice of investor Carl Icahn and increase its share buyback program, it could have a quick and significant effect on the company's stock, a new analysis has found.

Analyst Chris Whitmore of Deutsche Bank analyzed a possible financial outcome if Apple were to increase its existing share buyback plan. In his scenario, another $50 billion worth of shares purchased at an average price of $500 would add about $4.25 in earnings per share in the company's fiscal year 2014.

In Whitmore's estimation, that would be an increase of about 10.5 percent over the year. He believes Apple's current $140 per share of net cash would be enough for the company to undertake such a strategy.

In addition, a $50 billion buyback at $500 per share could be self funding, the analyst believes. He noted that interest expenses on debt needed for the buyback would be about $1 billion — an amount that would be offset by dividend payments reduced by $1.2 billion, thanks to retiring dividend-bearing common stock.

For those reasons, Whitmore agrees with Icahn, who revealed he spoke with Apple Chief Executive Tim Cook last week, and advised him to buy back more stock. Icahn didn't publicly disclose just how much stock he believes Apple should buy back, but the company's current plan calls for it to repurchase $60 billion worth of shares through 2015.

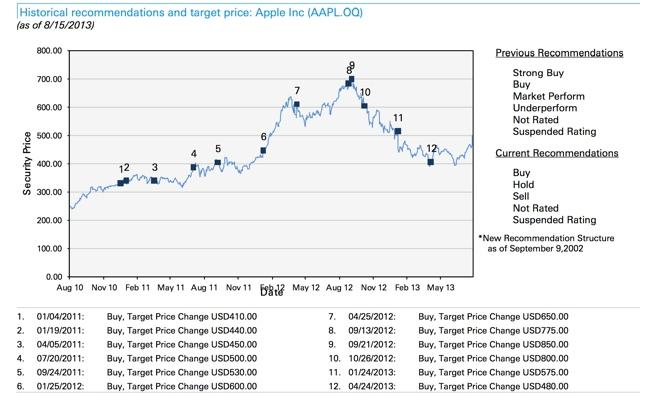

Icahn also said he is bullish on AAPL stock, and has invested $1.5 billion into the company. The support from Icahn, as well as growing hype over an anticipated iPhone event on Sept. 10, helped push shares of AAPL north of $500 last week.

Whitmore's projections published on Monday are somewhat similar to those of Amit Daryanani of RBC Capital Markets, who said last week he believes Apple could nearly double its current $60 billion share buyback program. Daryanani's estimates see that strategy adding about $4 to Apple's fiscal year 2014 earnings per share, representing an increase of about 10 percent.

Neil Hughes

Neil Hughes

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

25 Comments

I trust the current Apple board of directors more than I trust Icahn.

Do any of these investors or analysts actually care about Apple as a company or do they only care about AAPL and its potential for income? I wonder how many of them actually own anything from Apple. Of course, that's not a requirement for owning the stock but it says a lot about the person if they're willing to use the product they're investing in.

disclaimer: I finally own some AAPL but definitely care more about Apple's longevity than I do about making any money on AAPL.

'Whitmore agrees with Icahn, who revealed he spoke with Apple Chief Executive Tim Cook last week, and advised him to buy back more stock." Apple taking advise from outside investors? Oh please NO!

Icahn's vocal involvement has me more concerned than any fake b.s. worries about Apple expressed over the 2 years.

He's the epitome of 'short term thinking', and poison for every company he touches.

I'm more decided than ever to bail at $600, at least to the tune of 50%.

Why should Apple artificially support the stock at a time when it is rising anyhow? As long as the "import" of foreign funds and their taxation are unknown, there is no need to feed speculators. A few bad news (legit or not) can destroy all gains from such a buyback (and subsequently all the non-virtual money used for it). And as we have seen how influential people like Icahn are, just him tweeting he's selling AAPL now could destroy $50b in no time.