Less than a month after it first went on sale, Apple's refreshed, moderately enhanced iPhone 5c has been targeted as possibly being a failure in scores of reports across a wide variety of major news outlets, even drawing comparisons to Microsoft's Surface flop. Can the company survive another 48 hours?

Prophecies of iPhone 5c failure span the globe

Less than a week after iPhone 5c went on sale, Adam Turner of the Australian Sydney Morning Herald asked "Is the iPhone 5c Apple's Surface RT flop?"

If hastily drawing such a connection seemed a bit premature, Rick Munarriz, writing for Fool.com (I'm not making that up) had jumped to the same "Is the iPhone 5C the New Surface RT?" conclusion two weeks earlier, before preorders had even started.

How could pundits separated by oceans have possibly known weeks in advance that that the rest of the tech media, as well as journalists who don't even have any tech expertise, would also be writing the same dire news about Apple's mid-level iPhone 5c model long before anyone even knew how well it was actually selling?

Looking beneath the Surface

Three months ago I profiled Microsoft's Surface, looking for clues as to why and how the company's beleaguered iPad contender could have failed so miserably, and how its failure could have come as such a surprise to certain members of the tech media and anyone who might be reading their coverage.

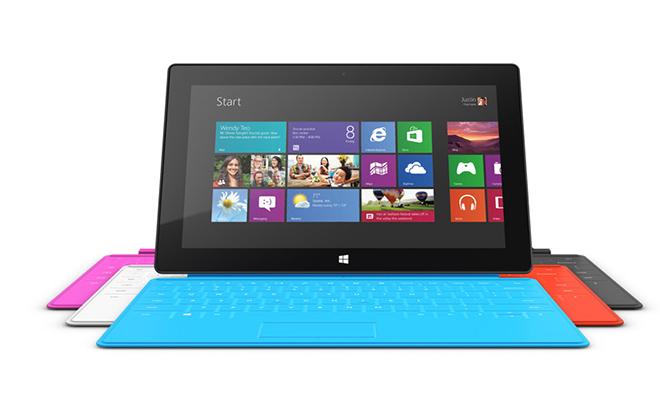

Like the iPhone 5c, Microsoft's Surface is a technology product that features bright colors. Unlike the Surface, Apple's iPhone 5c leverages a proven platform and app ecosystem, and comes from a company with a remarkable chain of successes in designing, marketing, selling and supporting mobile products.

The iPhone 5c is essentially a repackaging of what has been the world's top selling smartphone, outfitted with a better battery, support for more LTE bands and a $100 price cut. The Surface was an entirely new tablet based on a platform that had never managed to sell tablets before, equipped with battery performance inferior to the market leader and offering no discount on pricing.

After first unveiling its new Surface in June 2012, Microsoft disclosed the price in mid October, opening preorders that continued until its late October general launch, which was synchronized to occur alongside Windows 8.

A pre-launch report in the Wall Street Journal by Lorraine Luk cited checks with "component suppliers in Asia" as indicating that Microsoft had "placed orders to produce 3 million to 5 million of these tablets in the fourth quarter."

Confident optimism for Surface

The Verge was on scene at the Surface's splashy Times Square launch party, noting that "Microsoft created what can only be descried [sic] as an expensive spectacle."

Alexandra Chang, writing for Wired, announced that Microsoft had sold out of one Surface RT model "on day one," and while noting Microsoft had "no numbers to share," explained that "the sold out model is a good sign for Microsoft," adding, "it's too soon to know if it's a hit, but at the very least it isn't a dud." "It's too soon to know if it's a hit, but at the very least it isn't a dud" -Wired

IHS iSuppli reported in November that the Surface RT was "more profitable than iPad," detailing estimates that indicated lower costs and more profit padding than an iPad even before considering the $18 Touch Cover that Microsoft planned to sell for $80.

The firm identified Samsung Electronics as "the biggest design winner in the Surface," with Nvidia being "another major winner" as the maker of its Tegra 3 processor.

The media then patiently waited for more than another three months before The Verge recommended caution against jumping to premature conclusions, noting that "Microsoft will reveal sales figures eventually" after IDC had estimated holiday quarter Surface shipments to be less than 900,000 units.

Days later, Microsoft launched its Surface Pro version, and again it was widely reported that the company had "sold out" of at least some models of the higher end product. Paul Thurrott wrote that "critics will be disappointed to discover that Surface Pro is in fact flying off the shelves," and reported "Apple-like" lines queuing up for the product.

Some good news finally came months later in April, when Strategy Analytics counted 3 million tablets shipping with Windows in calendar Q1. There were still no official numbers from Microsoft, however.

Another three months later, one had to decipher Microsoft's Surface sales from the fact that the company reported total Surface revenues of $853 million, less than the $900 million charge it had written off on unsold Surface inventory. That meant the company could have only sold at most 1.7 million units across three quarters, compared to Apple's sales of 57 million iPads. It was also sitting on tons of inventory, more than it had sold at any price.

iPhone 5c vs. Surface

The first bad news to hit iPhone 5c was that, unlike the Surface, it had failed to "sell out" of inventory on its first day (although there were stock outs of specific models). As the Surface had proven (twice!) selling out of inventory is a critically important measurement of sales success, and/or inadequate inventory management and operational expertise. It means you either know what you're doing, or don't, or something in between.

By not selling out on day one, it was unclear if Apple had insufficient iPhone 5c demand or had too much experience in managing global logistics over the past decade of launching hit new consumer electronic devices. Like Microsoft's Surface, Apple had not announced preorder numbers for the iPhone 5c. That wasn't important for the Surface, but was reported as really bad news for the iPhone 5c, sending Apple shares tumbling.

Unlike Microsoft's Surface, Apple did announce combined launch weekend numbers for the iPhone 5c and 5s. They came in far above industry consensus. In fact, the numbers were so high that Gene Munster explained that Apple had really only announced sales that were his low estimate plus some extra nonsense that made his numbers look incorrect.

Rather than taking Apple's sales figures literally, much of the tech media picked up Munster's contortion of fallacy and began reporting that the iPhone 5c was actually not selling but simply filling channel inventory. The idea that iPhone 5c was actually selling ran counter to what the media had predicted: that "last year's phone" couldn't possibly continue to sell the way the iPhone 5 had been right up to the iPhone 5c launch, even with a $100 price cut.

Looking for facts to support a belief

The same news sources that patiently waited nine months for Microsoft's Surface numbers to be reported, and who passed that time by floating a series of optimistic assumptions that Microsoft's new Surface would not be a commercial failure like the Xbox, the Zune, the original Surface, Windows Mobile, KIN and Windows Phone, found it difficult to believe the data that Apple provided after three days of sales, because that data didn't support their predictions.

If you're thinking the Xbox doesn't belong in Microsoft's list of commercial failures, keep in mind that it consumed over $8 billion in capital subsidizing its sales before selling near break-even, and it cost the company another $1.2 billion in unanticipated warranty costs related to its 54.2% hardware failure rate. The Surface has actually been a much less expensive experiment.

Even by the most conservative estimates, iPhone 5c sold twice as many units across three days as Microsoft sold of Surface in a year. Additionally, Apple cleared more in gross profits across three days of 5c sales (not even including any preorders) than Microsoft brought in as revenue after nine months. That makes any efforts to badge the iPhone 5c a Surface-like flop patently ridiculous.

iPhone 5c is not low margin

Some analysts and members of the media wanted iPhone 5c to sell because they believed its profit margins were much lower than the higher end iPhone 5s, allowing them to voice concerns about Apple's crumbling profitability. But the facts don't support that belief either.

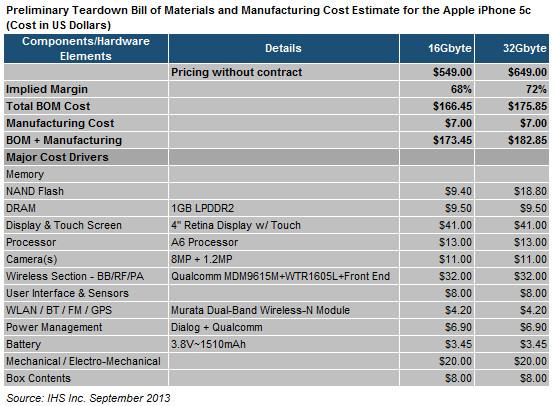

iSuppli calculated that the $549 5c costs $173 to manufacture (a 68.5 percent gross margin), compared to the $199 that it guessed the $649 5s cost to build (69.3 percent).

In comparison, iSuppli's cost estimate for the U.S. Samsung Galaxy S4 is $244, which at $649 has a 62.4 percent gross margin. Rather than being "low margin," Apple's iPhone 5c has significantly higher margins (according to iSuppli) than Microsoft's Surface (52.6 percent) and Samsung's Galaxy S4 flagship phone.

If Apple were selling a larger proportion of 5c phones relative to the 5s, it would be earning a little less, but it would not suffer from the plunging margins that analysts who recommended a much lower 5c price predicted that lower price to cause.

What about comparing iPhone 5c to actual, competing phones?

There's something else that the negative reports badgering Apple's iPhone 5c have neglected to mention. While many have listed perceived flaws of the iPhone 5c (it's not Apple's top of the line and it's not that much cheaper than the 5s), few seem to have acknowledged (quite bizarrely) that Apple didn't create the 5c to compete with its own 5s.

That bears repeating: Apple has not failed to price the iPhone 5c to be competitive with its own iPhone 5s.

Apple's iPhone 5c is designed to take sales away from competing models, such as Google's Droid MAXX and Moto X, the Nokia Lumia 1020, the HTC One, Sony Xperia Z and Samsung's Note 3 and Galaxy S4. How is the iPhone 5c "flop" doing in that regard?

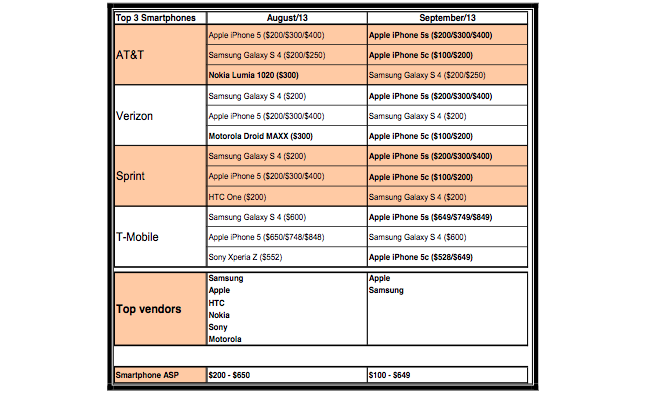

According to report on U.S. carriers by Canaccord Genuity, sales of all of those phones were topping the charts at AT&T, Verizon, Sprint and T-Mobile in August.

Apple's iPhone 5 was in the top three across all four carriers in August, but was in second place behind Samsung's Galaxy S4 everywhere but AT&T, where it remained the leading model. The launch of iPhone 5s changed that, taking the top spot across all four carriers.

However, the "flop" iPhone 5c sold well enough to bump all of the Google/Motorola, Nokia, HTC and Sony competitors out of the top three. It also outsold the Galaxy S4 on AT&T and Sprint, where it performed better than last month's iPhone 5 had, despite being only marginally different.

Brian Fung of the Washington Post called the iPhone 5c "officially a flop" because its "price has been slashed in retail stores worldwide — from Target to Best Buy to Wal-Mart and even in China — setting off speculation that the 5C just isn't selling like its more expensive sibling, the 5S."

Is there something remarkable about any of those retailers, or China, offering products at a discount below MSRP? Are other smartphones discounted? And if that's the definition of "flop," why is Android considered a "success"?

iPhone 5c is better than higher end competitors

Apple's primary competition in the market for profitable smartphones are those with a price and specifications similar to the iPhone 5c. Apple also sells the substantially less attractive iPhone 4S, offering an even lower price point to compete with cheaper phones. However, that price point represents the tail end of iPhone sales volumes, and contributes an even smaller share of profits.

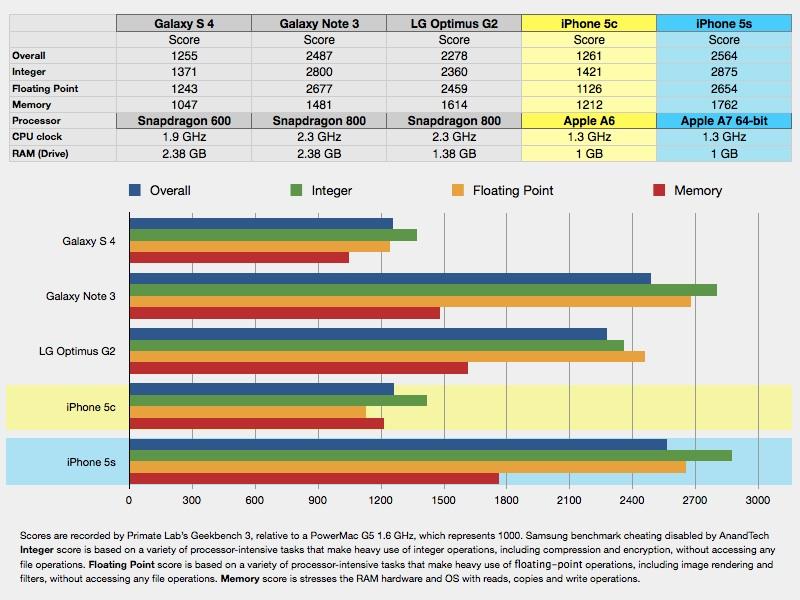

Samsung's Galaxy S4 delivers similar performance benchmarks to iPhone 5c, despite being clocked higher and having more RAM. And unlike various higher-end Android or Windows Phone models, Apple's 5c runs all of the apps and games designed for iOS, including the free Pages, Numbers, Keynote, iPhoto and iMovie that Apple now throws in for free.

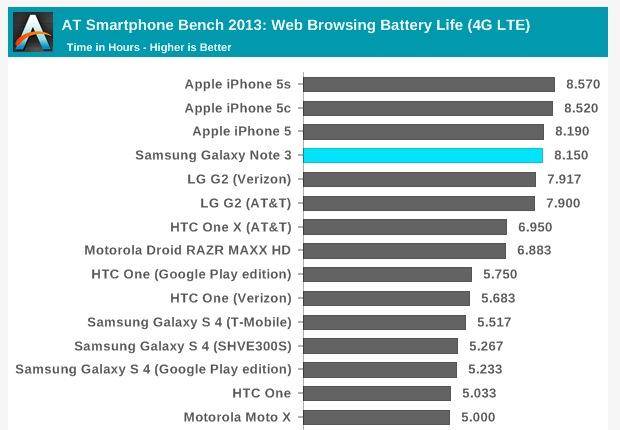

The 5c also delivers better battery life than Samsung's S4 or even its Note 3 outfitted with a huge battery. It also beats the battery performance of other Android phones in its class by an even wider margin.

Apple quite obviously designed the iPhone 5c to compete more effectively against other phones on the market than iPhone 5 had been, and that's what the data shows it is doing. Apple did not design the 5c to destroy its own profitability, or to make the 5s look really expensive in comparison. That would have been really stupid.

There is one more thing iPhone 5c is designed to do: make iOS 7 an even more attractive platform. Samsung, Google/Motorola and Microsoft/Nokia are introducing new products that make their platforms less attractive: low end devices that are slow and feel unfinished, products that are intended entirely to increase market share at the expense of users' satisfaction.

That race to the bottom didn't work for PCs, didn't work for netbooks, didn't work in music players and isn't working for Motorola, or HTC, or Nokia, or Blackberry in mobile phones. That makes it mysterious why analysts recommended such a strategy of failure for iPhone 5c, and why the media has largely joined them in protesting the success of the iPhone 5c for not doing what has been proven not to work.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee

Amber Neely

Amber Neely

Wesley Hilliard

Wesley Hilliard

William Gallagher

William Gallagher

215 Comments

Wait until after the Christmas/New Year sales numbers before you make a judgement on the success or "failure" (i.e. lack of support) of the 5c. My teenage son has a 5c and he loves it.

The 5c is only a failure in relation to the 5s. I don't know if Apple considered that $100 bucks is not enough of a savings for people to forgo the latest and greatest.

I just bought my daughter a 5c for her birthday. It's a great phone and I was happy to have saved $100 over the similar 5S model. I am mystified by people who think $100 less is somehow "not much cheaper." I don't know anyone who doesn't think $100 is not a significant savings. Anecdotally I saw that three people where I work have bought 5C phones in the last few weeks. Admittedly they are all women but last I heard women make up a substantial portion of our population.

It is equally possible that someone could have written an article about how the 5s sold so many more units than anticipated, as customers decided to purchase the more expensive model. E.G. The Surprising Success of the 5s.

And in absence of actual numbers indicating total sales, isn't this speculation and negativity just a journalist looking for an angle?

After the two models have been on sale for six months, in all worldwide markets, and Apple has provided a full accounting of units sold with a breakdown per model (and maybe even color), then, and only then, can anyone offer a valid opinion.

Stories of production cutbacks don't tell you if this was anticipated or if the cutbacks came much later than originally anticipated.

The editorial misses the most compelling argument against the negative 5C press: Apple hasn't even fully released it to the international market that was considered the "sweet spot" for the 5C.

No one in their right mind expected 5C to outsell 5S in the US or western countries.