In a U.S. Securities and Exchange Commission filing on Thursday, Apple announced a new two-billion euro debt offering (about $2.26 billion) as it continues to take advantage of historically low interest rates.

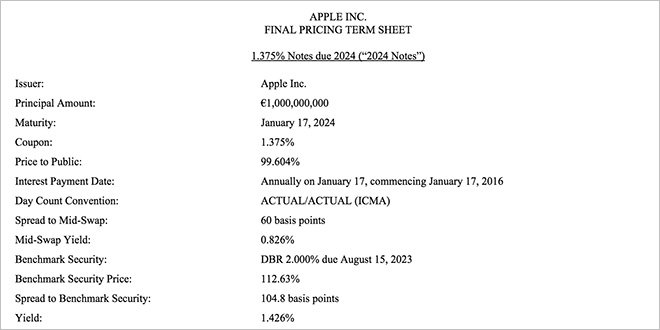

Apple is offering two bonds set at 1 billion euros each that are slated to mature on Jan. 17, 2024 and Sept. 17, 2027. Yields on the euro-denominated bonds are expected to hit 1.426 percent for the 9-year notes and 2.040 percent for the 12-year notes, with annual interest payments due to start next year on Jan. 17 and Sept. 17, respectively.

Underwriting Apple's latest bond issuance are Goldman, Sachs & Co., Deutsche Bank, J.P. Morgan Securities and Merrill Lynch International, while Citigroup Global Markets Limited and Credit Suisse Securities (Europe) Limited are acting as co-managers.

The debt offering is dated for Sept. 10, 2015 and holds a settlement date of Sept. 17 with denominations set at 100,000 euros. Buys in excess of 100,000 euros will be completed at integral multiples of 1,000 euros.

Apple is turning to debt markets to raise funds to buy back stock and issue dividends as part of its capital returns program. The company has more than $190 billion in offshore assets, but is averse to repatriating the cash due to high U.S. tax rates.

Apple has raised billions of dollars from bond sales, denominated in U.S. dollars, Japanese yen, Swiss francs, euros and British pounds.

Apple plans to return $200 billion to shareholders through dividends and stock buybacks by the end of March 2017.

Mikey Campbell

Mikey Campbell

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

14 Comments

I don't understand why anyone would tie up money for 9 years at 1.426%. The dividend yield on the common stock is 1.85%, the company has a history of raising the dividend every year (10% raise this year alone), and there is the strong possibility of appreciation over a 9-year period.

[quote name="msuberly" url="/t/188171/apple-issues-new-euro-bond-worth-more-than-2-25b#post_2774497"]I don't understand why anyone would tie up money for 9 years at 1.426%. The dividend yield on the common stock is 1.85%, the company has a history of raising the dividend every year (10% raise this year alone), and there is the strong possibility of appreciation over a 9-year period. [/quote] Asset allocation and diversification. Plus, if you're the holder of the bond in the Eurozone, you're getting paid the coupons in Euros, unlike Apple dividends which are paid in U.S. Dollars and have to be converted into Euros -- so you're also avoiding any currency risk. Add: One additional point. Note that the 'mid-swap yield' (essentially, equivalent to a risk premium) is 0.826%. In other words, a holder of the bond is getting a 138% higher yield from holding Apple, compared to the paltry 0.6% they can get for a bond of equivalent maturity risk free bond in the Eurozone! Crazy yields, I know, but makes perfect sense for the bond holder given how low returns are over there.

I am not very knowledgeable in such matter. Can someone please explain me how does APPL benefits with all such debt creation in other countries, especially they have pile of monies there. Yes, I do understand the part that they are trying to get more cash there because it is dirt cheap right now and they can certain use up the cash they have there to pay up the debts when needed, which might still be cheaper than repatriate back to US, unless US government has one time repatriate holiday. What is Apple going to do with this new money?

As msuberly noted, the dividend yield is about 1.85%, so paying 1.426% on the bonds, and earning 1.85% on the stock they buy with the money is almost riskless profit, and paying 2.04% on the other bond will probably yield a profit, given the historical trend of rising stock price and dividend.

I am not very knowledgeable in such matter. Can someone please explain me how does APPL benefits with all such debt creation in other countries, especially they have pile of monies there. Yes, I do understand the part that they are trying to get more cash there because it is dirt cheap right now and they can certain use up the cash they have there to pay up the debts when needed, which might still be cheaper than repatriate back to US, unless US government has one time repatriate holiday.

What is Apple going to do with this new money?

The proceeds from the bond sale are US funds, so they can be used to pay dividends or buy back AAPL stock. Settlement of the debt is done with foreign funds, so that money doesn't need to be repatriated to the US.