Google's Chrome OS partners Acer, Asus, Dell, HP, Samsung and Lenovo collectively shipped 37 percent more low-priced netbooks than the number of premium laptops Apple sold during the quarter in the U.S., although most of those Chromebook sales were to K-12 schools.

Following a similar report by Gartner, IDC analyst Jay Chou delivered carefully couched statements to IDG's Gregg Keizer for Computerworld, noting that Chromebooks had out-shipped Macs in the U.S. for the first time during the quarter.

Keizer wrote that IDC's figures were based on "estimates generated using information from vendors and Asian component suppliers," because neither Google nor its licensees report actual shipments of ChromeOS devices.

The report cited former IDC analyst Bob O'Donnell as pointing out that "people buy Chromebooks because they're looking for the cheapest device." Now an independent analyst running Technalysis Research, O'Donnell referred to Chromebook's primary attraction as being cheap enough to attract "price sensitive" buyers.

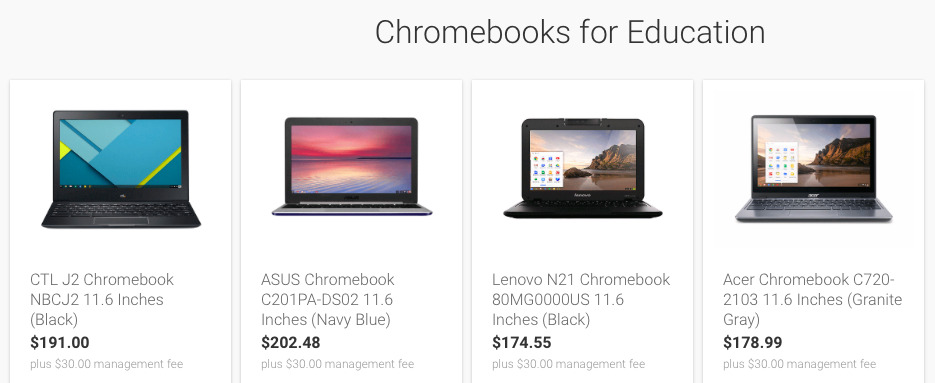

The average price of consumer Chromebook models listed by Google on its website is about $320, but Google's PC licensees provide even cheaper options to schools. Its Chromebook for Education site lists models that sell for less than $200, before adding a $30 management fee.

An earlier report by Tom Warren for The Verge cited IDC analyst Linn Huang as emphasizing that Chrome OS took the lead "in terms of shipments," making it clear she wasn't talking about revenue or sustainable profitability, or even strategic importance.

IDC data estimated that Apple sold 1.17 million Macs in the U.S. during the quarter, and estimated 1.6 million shipments of ChromeOS netbooks. That means ChromeOS collectively earned all its licensees revenues of somewhere between $320 and $400 million based on IDC's estimate, while Apple's quarterly sales of U.S. Macs amounted to about $1.4 billion, based on the IDC numbers and company's Mac average selling price of about $1,200.

Apple does not break out Mac sales by region, but its total U.S. revenues for the quarter were $19 billion, or 37 percent of its global revenues, and Macs made up $5.1 billion, or about a tenth, of its global sales.

Huang also carefully limited her comments to the U.S., adding that "Chromebooks are still largely a U.S. K-12 story." Gartner earlier stated that around 70 percent of Chromebooks globally were sold to schools.

The IDC figures cited did not make mention of iPads, which have become a large part of Apple's education sales for the same price-conscious reason as Chromebooks, nor did it mention Windows PC sales, which have historically led in education and in the overall market for computers.

Notably, neither IDC nor Keizer nor Warren noted that U.S. schools historically order most of their computing equipment during Q3, while Q1 has long been the education sector's slowest quarter, particularly for vendors like Apple that maintain long term contracts with K-12 districts.

Google desperately needs needs some good news for ChromeOS

Google has long been looking for some good news regarding its ChromeOS initiative, which the company first launched back in 2009. IDC has historically promoted carefully presented data to flatter Microsoft and its PC OEMs, so it's no surprise that the market research company would craft isolated data to provide some hope for Chromebook licensees, most of whom also produce Windows notebooks.

In 2011 Google floated an enterprise subscription plan for renting Chromebook devices to businesses for $28 per month, but that effort didn't gain traction. The next year, Google revamped its web-based ChromeOS to look more like a conventional Windows PC.

That didn't help. In 2014, IDC analyst Isabelle Durand noted that "So far, businesses have looked at Chromebooks, but not bought many." Two years later, ChromeOS still hasn't gained much traction outside of education, as noted by IDC's Huang.

Beating half of Apple's education sales at a time

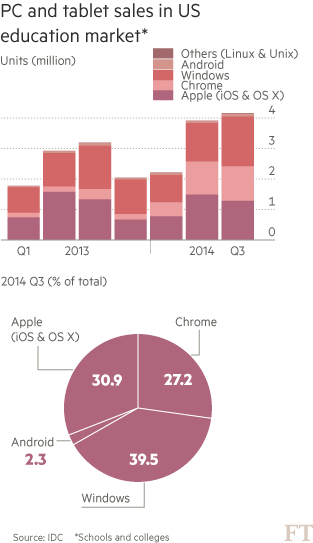

Back in December 2014, a Financial Times article written by Matthew Garrahan and Tim Bradshaw incorrectly claimed that Apple had "lost its longstanding lead over Google in U.S. schools," based on IDC data that estimated that ChromeOS netbooks had slightly out shipped iPads in the education market, ignoring Apple's Mac sales.

Now the reverse is true, with IDC creating headlines that ChromeOS had exceeded Macs in education, without any mention of iPads. IDC also made no mention of Android, which has failed to really make any progress in education, despite ostensibly powering most of the tablets shipped globally.

Based on IDC's most recent data, the U.S. education market hasn't grown much over the past three years. The research firm earlier reported data (above) showing that Apple sold less than a million iPads and Macs in Q1 2013 and 2014, and sold just under 1.5 million Macs and iPads in its Q3 peak education quarter in 2014.

Education was once one the few market segments where Apple had any serious market share. However, as K-12 purchases have shifted downward to take advantage of $200 Chromebooks, Apple has introduced a series of products clearly targeting other, more valuable markets. Its ultra thin Retina Display MacBook is priced starting at $1,299; MacBook Pros range from $1099 to more than $2000, and its cheapest Air notebook starts at $899.

The company's iPad line starts at $269, but it has recently focused its attention on new iPad Pro models with support for a Smart Keyboard cover and Apple Pencil. Those models start at $599 and range well above $1000. Apple provides some discounting for educational users, but its pricing overall shows that the company is not trying to gain new market share at any cost.

Apple has previously built low-end models designed specifically for education, such as the Newton eMate in the late 90s and a CRT-based eMac between 2002 and 2006 that was priced lower than its flat panel iMac for consumers. It currently does not have any low cost iPad or Mac models custom-built for the education market.

ChromeOS and Android

Google can't be too happy about the demand it's seeing for ChromeOS devices overall, because last year the company made a last minute shift to replace ChromeOS on its new Pixel C hybrid tablet/notebook with Android OS in order to appeal to a broader audience.

That didn't result in significant sales of Pixel C either. Most reviews criticized Android as not being well suited to a keyboard-based tablet and specifically identified the smartphone-oriented nature of Google Play's Android apps as being a poor fit for a notebook style form factor with a larger tablet sized screen.

At its recent Google I/O conference, the company unveiled a plan to host Android apps on ChromeOS devices in an effort to increase the number of titles available to the struggling web-based platform, which is essentially Linux hosting a Chrome browser, where "apps" are effectively a thin client web application hosted within Chrome.

ChromeOS installed base ~12 M vs ~100 M Macs

Apple reported sales of 4.03 million Macs globally, a year-over-year decrease of 12 percent. Apple blamed the quarter's Mac sales shortfall on unfavorable exchange rates, which drove up the price the company's products internationally, and the worsening overall economic climate affecting many of its sales regions, most notably Greater China. The company portrays this shortfall as a temporary setback.

In Apple's most recent earnings call, its chief executive Tim Cook noted, "Overall, the Mac continues to attract a large percentage of new customers. In our latest survey of major markets, over half of buyers were new to the Mac. And in some countries, the percentage is extremely high, like in China, where over 80% of customers were purchasing a Mac for the first time. We're confident in our Mac business and our ability to continue to innovate and gain share in that area."

Chief financial officer Luca Maestri added, "Despite the overall market slowdown, we generated double-digit Mac growth in a number of markets, including Russia, Korea, Singapore, Taiwan, and the UAE."

Based on IDC's data and the fact that new sales of ChromeOS devices are isolated in the niche market of education, and the fact that ChromeOS has only been shipping in noteworthy volumes (about 1 million, quarterly) in education since the middle of 2014, that means that the total number of ChromeOS devices sold since 2013 is no more than about 12 million, and many of those were likely replaced over the last three years.

Apple has a large installed base of Macs worldwide. At WWDC 2014, the company reported 80 million Macs in use, and since then it has sold more than 33 million new Macs. Despite long term growth in Mac sales that have bucked the collapsing trend among PCs overall, Apple has more recently focused attention on the total number of iOS devices and Macs in active use, a figure which is now above 1 billion.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Charles Martin

Charles Martin

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Sponsored Content

Sponsored Content

46 Comments

I think Chrome Books are doing well, but they aren't a sign of success for Chrome OS. Google has managed to become the only player in a pretty decent size market. People who want a laptop like device with minimal configuration and management by the user which is fairly cheap. Macs are way more expensive, and are far more finicky in terms of management and configuration. Windows has cheaper devices which can compete on price, but the management is ridiculously confusing. Microsoft's response was Windows RT, but that was a confusing mess. I don't think Apple has a competitor, or will ever release a competitor, for Chromebooks.

iPad Pro is Apple's answer for Chromebook for minimal configuration/management and apps based device. Nothing will change as far as MacBook goes, I wouldn't say never, but I don't see Apple release cheaper MacBook with iOS installed just to compete with Chromebook.

And in a related note... Samsung sold 37% more flip phones than Apple sold of the 6s.

Google really is headed for a crisis. They desperately need to move the user base to web based search. The iOS keyboard is essentially a Hail Mary pass.

They missed on their revenue numbers for the last quarter. Cost per click revenue is down and Facebook allows for far more precise targeting of digital ads. Amazon is moving its membership to their app, bypassing Google search all together.

Chromebooks going into schools aren't going to do anything to fix Google's long term problems.

Google is going in multiple directions, including some that involve very major capital investments like fiber. Other than digital search ads, they do not dominate the profits in any other segment. And Microsoft is beginning to take search marketshare with Bing. The company is unfocused and undisciplined.

The more I analyze Google, the more I realize that the company is headed for a crash.

Apple is going to take Qualcomm's modem business and give it to Intel. It means that QCOM's profits rapidly decline. Intel gets into the iPhone and has a guaranteed source of profits on the dominant mobile platform. Apple continues to invest in TSMC and in return TSMC produces state of the art CPUs that no one else can touch for mobile performance. Snapdragon performance won't keep up. Either for CPU performance or for modem performance.

Android gets relegated to second tier hardware with the Snapdragon and Exynos CPUs being built on a less capable process.

And if Apple gets exclusivity for Intel's 3D XPoint memory on mobile devices, all of the air will be sucked out of the Android market.