Following initial notice of a pending bond sale, Apple on Wednesday launched a $5 billion U.S. dollar-denominated debt offering to fund its capital return program, outstanding debt, acquisitions and other operational expenses.

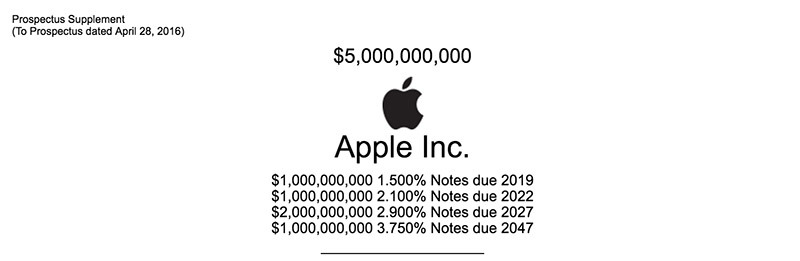

Detailed in a filing with the Securities and Exchange Commission, Apple's latest bond sale is comprised of three $1 billion note offerings set to mature in 2019, 2022 and 2047, as well as a $2 billion note due to mature in 2027.

Apple expects to net $4.98 billion after deducting underwriting discounts and other expenses associated with the sale. That money will go toward an ongoing capital return program expected to return $300 billion to shareholders by 2019.

By yield, Apple is offering $1 billion in 1.5 percent notes due in 2019, $1 billion in 2.1 percent notes due in 2022, $2 billion in 2.9 percent notes due in 2027 and $1 billion in 3.75 percent notes due in 2047. The company is set to pay interest on a semi-annual basis on March 12 and Sept. 12 of each year, beginning in 2018.

As noted in a prospectus filed yesterday, Goldman Sachs, Bank of America, Deutsche Bank, J.P. Morgan and Morgan Stanley are listed as joint book-running managers for the transaction.

Apple has turned to favorable debt markets instead of repatriating its gigantic offshore cash hoard to help finance its $300 billion capital return program, which by some estimates is nearly three-quarters complete. The company holds $261.5 billion in overseas cash, a figure that would be subject to America's high tax rate if repatriated.

AppleInsider Staff

AppleInsider Staff

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Wesley Hilliard

Wesley Hilliard

There are no Comments Here, Yet

Be "First!" to Reply on Our Forums ->