Apple Card is out now for a select few people, and it will be available for the rest of us later this month. Even before you get yours, though, we've got the important details of how to apply for it — and how you should or should not use it.

Editor's note: This story has been updated on August 6, with more information since original publication, and a video detailing the Apple Card.

Going by how much debt we're all carrying, we're at least familiar with how to spend on credit cards. Apple already says that it's going to be better at helping us manage that debt with the Apple Card and related software. But for all that Apple is about making things simpler, credit is complicated.

Apple has done a remarkable job of finding new or at least clearer ways to deal with the issues, but the fact remains that you'll have a lot to learn. The Titanium Apple Card may be the smallest metal device the company has ever made, but it still needs a manual — or a guide to how to use it.

The basics

Apple Card is only out now for a select few people — we don't know how many, but Apple has told is it's very few — so we can't really assess how long it takes to sign up. Yet from the few examples we know, it's consistently been fast.

You expect Apple to make signing up be quick, and it does use your existing Apple ID information to fill out the application form for you. What's less clear, and less within Apple's control, is how long the credit approval process takes.

There are certain mandatory requirements before you even apply, though. You have to be aged 18 or over, for instance, and be a US citizen or lawful resident in the States. Then you must have an iPhone running iOS 12.4 or higher, and you've got to have two-factor authentication switched on.

With all that in place, the issue over being accepted or not is down to your personal credit score. Apple Card appears to be using the TransUnion credit check service, at least for this initial US launch, so you could check out how that firm rates you.

Be aware that, as ever, any check on credit can affect your score.

Based on the little information we have so far, it appears that the credit check will take no more than a minute or so.

What we then know is that for everyone who is approved, the Apple Card can be available to use immediately. You have to accept the card, which means reading certain terms including, most importantly, your APR. This will vary depending on your credit status, ranging from 12.99 to 23.9 percent.

If you accept this, you tap and that's it, your new Apple Card is added to your Wallet app on your iPhone. In reality, it's been added to your Apple ID, so actually it appears immediately on your Watch as well. It's also available to you via Safari for online payments on your Mac.

Before you buy anything

Your new Apple Card will be in your Wallet app — and it will be the default payment, unless you change that.

It's possibly fine to leave Apple Card as the default since anything you buy with it, from anyone, will get you some daily cash reward, but you may well want to change this. Say you currently have one debit card set up that gets used by Family Sharing in the App Store. You'll have to check whether that persists or has been swapped to Apple Card, and then change it back if needed.

If this will be the first time that you've had more than one card on your Watch or iPhone, you need to know how to switch between them to find the one you want to pay with now.

On either iPhone or Apple Watch, double-press the side button to launch Apple Pay. You'll see an image of one card, probably Apple Card, but you can swipe to the right to get any other one.

Whichever card is being shown on the screen is the one that the next purchase will be charged to.

The Titanium Apple Card

There are really four ways to pay for anything with an Apple Card, starting with how out in the real world, you're best off waving your iPhone or Apple Watch wherever possible. That pays with Apple Card via Apple Pay. If you are somewhere that doesn't accept Apple Pay, though, you're going to need your titanium Apple Card.

This works like any other credit or debit card, except that it isn't NFC or what's known outside the US as contactless. If you want the convenience and the speed of just waving something over a reader, you should do it with your iPhone or Watch.

The Titanium Apple Card, which you get within a few days of being accepted, is for when you're somewhere that can't take Apple Pay. There are decreasingly few of these, but they still exist and they're the excuse you need to get out this ridiculously gorgeous metal card.

Before you can do that, though, you have to activate the card. While the procedure is slightly different depending on which iPhone you have, it's mostly very similar to setting up a HomePod.

You hold your iPhone near to the card and then tap through the setup screens that appear. Apple has published details of how you can do this with the current iPhone XS, iPhone XS Max and iPhone XR, plus the older iPhone X. It's not clear yet how you do it with older iPhones, however.

One important thing to note about the physical card, though, is that you could at least in theory use it to withdraw cash from an ATM — but you mustn't.

Some cards charge you a fee for this, and Apple has explicitly stated that it does not charge fees for anything. However, what we won't know for certain until more of us see the card in action, and see those statements, is whether using an ATM will cost you in other ways.

All cards vary, but there are some which will increase your interest rate if you do this. They not only charge more for that transaction, but they keep the rate up for everything else you buy in this billing month.

So don't do that. And speaking of interest rates, this is the one area where Apple's hyperbole isn't matched or exceeded by the reality. The company repeatedly says that it offers low rates, but it doesn't.

Instead, the quoted rates are pretty much in line with other credit card firms so it's fair to assume that a bad idea on one of those will be a bad idea on Apple Card too.

Paying online

Apple has promised that when you need to give a merchant your credit card number, Apple Card will generate a new one just for them. In practice so far, though, we've yet to see that in action. However, it's been made much clearer just how you can give someone your actual card number, given that there isn't one printed on your actual card.

In the Wallet app, you can press the ellipses button at top right — it's a plus sign until you sign up for Apple Card — and then tap for card information. Again, Face ID confirms its you, but then you are shown the details.

You can also tap to copy the number and then paste it into a merchant's website.

That's most use when you're setting up an account on a service that you intend to use often, such as Amazon.

For one-off purchases, you may very well be offered the choice to pay with Apple Pay. This isn't offered everywhere, but it is increasingly common to get Apple Pay listed alongside options such as PayPal.

If that's the case, you just right ahead and use Apple Pay. You'll have to authenticate that it's you making the purchase so if you're on a new MacBook with the T2 security chip, you'll be able to touch your thumb or finger against the reader. If you're not, if your Mac doesn't support this Touch ID, you'll have to enter your Apple ID and password.

Similarly, if you're buying online via your iPhone, you'll be prompted to press the side button twice in quick succession, and then Face ID will confirm that it's you.

When you've bought

One of the Apple Card features that the company is championing, is what happens when you actually buy something. As is the case with many other credit cards, you get some money back.

That money comes out of the fee that the credit card company charges the vendor. And Apple is using it to incentivize you to buy everything via Apple Pay.

Should you ignore that and just buy something using your physical card, Apple will pay you back 1 percent of the purchase price. If you instead buy anything on the card via Apple Pay, then you'll get 2 percent. And if that purchase is of any Apple product or service, you'll get 3 percent.

It's till not certain yet what happens if you, say, buy an LG UltraFine 5K Display from an Apple Store. It's not an Apple product, but it is being sold to you by Apple, so we're expecting that it will count to your 3 percent.

What is clear is that Apple's money back rate is nothing special, compared to other cards. However, the way you get it definitely is.

In every other credit card that we can find, which offers any form of cash back, you get it at the end of the current monthly billing cycle. With Apple Card, you get it back daily.

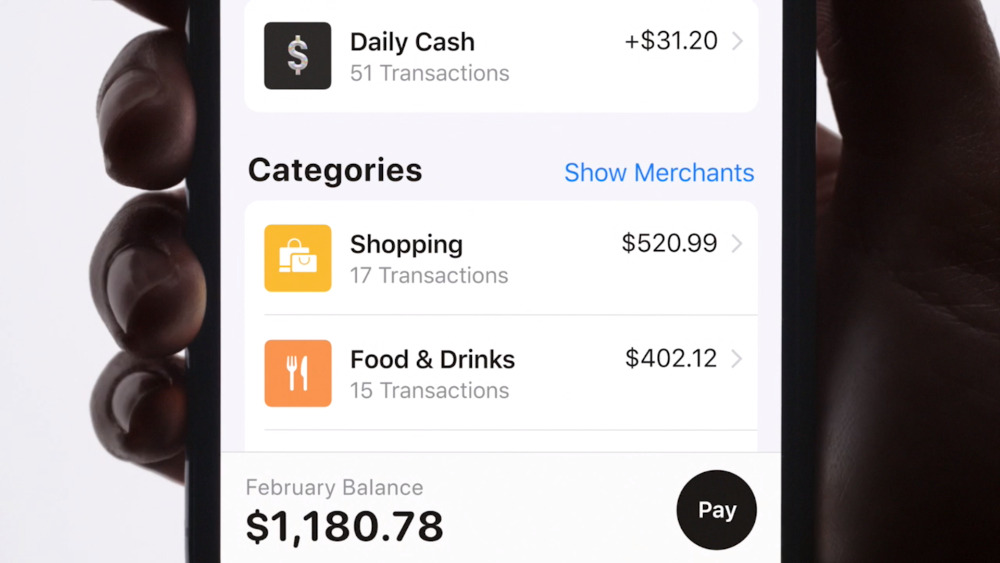

Consequently, Apple calls it Daily Cash. And, again unlike some cards, it imposes no maximum limit on how much you can get each day.

Significantly, that Daily Cash does not get paid onto your Apple Card. If you buy something, then you have a balance on the card that you owe and the Daily Cash amount does not reduce that.

Instead, you'll have what amounts to a second card in your Wallet. Apple Pay Cash has been available to customers for a while now, and the Daily Cash is paid into that. If you choose, you can then use that amount to pay off your Apple Pay card, but it's up to you.

Speaking of paying off

Apple makes a big deal out of how it wants to train people to carry less debt. As it currently stands, Apple will make most of its money out of Apple Card via its interest rates. It does have some income via your use of Apple Pay, but primarily the business is the same as with any other credit card.

Apple's rates are fairly consistent with the credit card industry, so it's as much in your best interests to quickly clear any outstanding balance on Apple Card as it is with any other card.

That's somewhere that Apple Card does help, though, and it does so through several ways. The simplest is just that your iPhone will remind you ahead of any payment due date so that you don't miss it.

Then at any point, you can tap on the card in your iPhone's Wallet app and see details of your spending. There are overview summaries, color-coded into types of different spending, or there is as much detail as you want, right down to specific items.

As Apple said at the March 25 presentation when it announced Apple Card, we have all had entries on our credit card bills where we simply could not identify the vendor. You understand that it's because vendors use different payment processing firms or are simply owned by larger companies you haven't heard of. Whatever the reason, though, if you aren't sure what a payment is for, you can now tap to learn more.

If the greater detail doesn't clarify it, then there's one more step that will. You can tap on a payment to call up a map showing where you were when you made it.

Nice touches

It's the little details like that map of where you made the purchase that make this typical of Apple. They have indeed taken something we all use and found ways to make it more useful.

Apple has also designed the software very well, so far as we can tell until the card is launched and we can all use it extensively.

So it's easy to use, which will mean we use it more both to monitor our financial state and just to buy more things with it. Apple Card is well-thought out and fits particularly neatly into all our Apple Pay options. Plus the lack of typical fees is definitely a bonus, as is the titanium card.

Then there's the amount of cash you get back. It's excellent that we're paid daily, but American Express, for instance, pays back 5 percent — although only during your first three months of use.

As Apple Card takes its first steps out into the wide world, there is an awful lot to like about it.

Keep up with AppleInsider by downloading the AppleInsider app for iOS, and follow us on YouTube, Twitter @appleinsider and Facebook for live, late-breaking coverage. You can also check out our official Instagram account for exclusive photos.

William Gallagher

William Gallagher

-xl.jpg)

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee

Amber Neely

Amber Neely

Sponsored Content

Sponsored Content

Wesley Hilliard

Wesley Hilliard

58 Comments

Definitely will consider it when it becomes available.

I don't really the point of this credit card, it is extremely expensive if you don't pay your full balance every month. (Which I do but I guess this is different in Germany). Also like any other credit card I have to essentially guess which purchase belongs to which invoice or receipt. I wish this information would be a bit more verbose on the statement. Maybe even the entire invoice. So, I'm not really sure if this credit card has any advantages over the one i have from my bank.

A couple things:

What kind of credit score will be needed to get this card?