As movie downloads and rentals shift to streaming subscriptions, Apple has to maintain the relevance of its iOS, tvOS and macOS platforms in being able to play popular content. But why did it start from scratch in creating Apple TV+ rather than simply using its huge pile of cash to snatch up Netflix?

Why Apple isn't acquiring Netflix

There's lots of chatter about the potential of Apple buying Netflix. It comes from people who would benefit from such an enormous acquisition. That includes investors who are long on the idea of Netflix continuing to expand its base of subscribers while incrementally charging them more, and longer on the idea of some magic bag of gold dropping down and buying their shares of Netflix.

However, there's little reason for Apple to be interested in buying Netflix. First, Netflix already has an incredibly high valuation greater than $150 billion, meaning there's little potential for Apple to add any value and create any growth. And in an era of increasing scrutiny of massive media acquisitions, buying Netflix could end up very expensive for Apple in ways far beyond its current nosebleed valuation.

When asked about acquisitions, 1 Infinite Loop automatically replies, "Apple buys smaller companies from time to time, and we generally don't discuss our purpose or plans."

It's pretty clear Apple's strategy has been to pay around $300 million for a smart team and advanced technology it can use to sell the next year's 215 million iPhones for $160 billion, not to spend $160 billion and work backward at finding talent or stumbling on a technology.

When companies spend $15 billion to take over large, existing businesses the way Google did with Motorola and Nest, or the way Microsoft did with Nokia and aQuantive, it typically makes for a huge embarrassing mess. Apple buying Netflix would be ten times as bad.

Secondly, there's no reason to think that Netflix is doing something other companies can't. Apple already knows a lot about Netflix's business, because it has been servicing its subscriptions in the App Store. While Netflix discovered some key insights about the market for non-linear television content, it's not a complex mystery to duplicate what it's now doing.

The expensive, low profit nature of Netflix

Netflix offers very appealing television content that has attracted 149 million paying subscribers globally, but it has a pretty unattractive business. It has to spend incredible amounts of money— in ever larger amounts— developing new original content just to remain relevant, and it actually is not even that profitable.

The current business model of Netflix has only existed for a few years. While the company originally got started back in 1998 just as Steve Jobs began turning Apple around, for most of that time it was in the very different business of renting DVDs via mail.

In 2007 Netflix began streaming films over the Internet and rapidly shifted away from DVDs. The following year, it launched Red Envelope Entertainment to create its own original programming, but then shut down the project in 2008 to avoid any appearance of contention for the rights to film studio projects.

Netflix's House of Cards

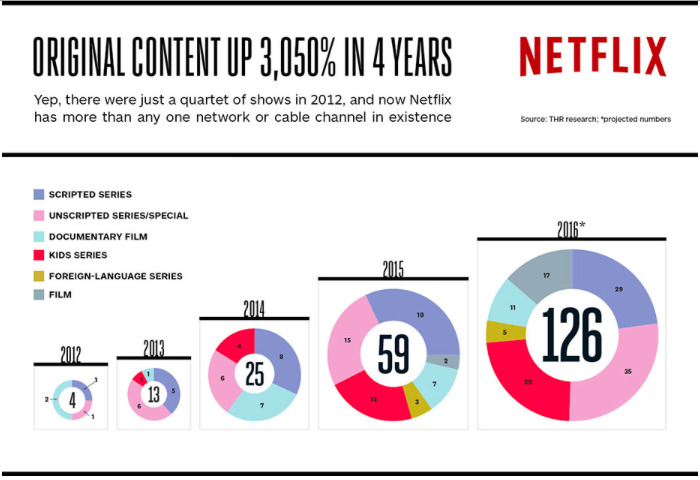

In 2012 Netflix returned to producing original content with the project House of Cards. It rapidly remade itself as a content production juggernaut paying top dollar for films and episodic series that would otherwise be purchased by TV networks and cable channels. Netflix's market valuation exploded after that: original content was Netflix's iPhone moment.

The difference between Netflix and Apple was that Apple's iPhone actually generated huge, immediate profits and has continued to do that for twelve years. Apple's valuation relative to its earnings has sat in the toilet as investors worried that it might run out of customers or that some competitor might walk in and take away Apple's business.

Netflix isn't generating cash, but investors have given it a spectacular valuation in the hopes that someday it will, in an imagined future where everyone pays for its service and there won't be any competition for original content television.

Apple's price to earnings is currently 15.6; Netflix is at 123.31. If Apple were valued like Netflix, it would have nearly an $8 trillion market cap. That alone explains why Apple is buying back its own shares rather than acquiring Netflix. Apple sees great potential for itself but not much for Netflix, while public investors see little hope for Apple and huge potential for Netflix. One of those two groups is probably wrong.

Netflix itself appears to be betting that it can corner the market on original television programming. By 2016 it was spending $6 billion annually to create 126 original series and specials noted Hollywood Reporter. It was generating more original content than any other network or cable channel. That year HBO was spending $2 billion.

Last year Netflix doubled its annual spending rate to $12 billion. Its valuation has skyrocketed, apparently, on the premise that Netflix has created a large membership of avid content subscribers without much direct competition, and that at this point it will be difficult for anyone else to catch up.

But in addition to Apple's upcoming TV+ offering, Netflix also faces new competition in streaming from Disney, NBCUniversal, and WarnerMedia, all of whom are moving away from licensing their content to Netflix and instead offering their programming directly to subscribers on their own. There's also Amazon Prime, Hulu, and a variety of other sources creating their own original programming.

The big spender

In the most recent March quarter, Netflix reported revenues of $4.5 billion and net income of $344 million. Netflix's gross margin is 36% and its net profit margin is just 7.5%, which has been its average net margin over the last year. How can the company afford to spend so much on new programming? It's not generating cash. Over the last quarter, Netflix free cash flow was -$460 million.

It's financing via debt. Netflix now carries $10 billion in long term debt, and just announced plans to issue another $2 billion in bonds. It also has $18.9 billion in content-spending obligations to pay back over the next five years, over half of which isn't on its balance sheets.

To pay for this, Netflix has been marketing to expand its subscriber base while incrementally changing its subscribers more. In the March quarter, the company announced 149 million paying subscribers globally. In the U.S., Netflix has 60m subscribers and it just raised their monthly rates again, with the most popular Standard plan shifting from $11 to $13.

Yet it can't keep raising subscriber fees without hurting subscriber growth. Further, its greatest growth potential is in other countries, where it can't charge nearly as much. In India, for example, its Standard plan only costs $9.20 and it just introduced an even cheaper mobile-only plan for $3.64 per month.

That makes Netflix a bit like Amazon: spending massively to create a business that doesn't generate huge profits, in the hope that someday it will, once it creates a monopoly and can charge whatever it wants. However, also like Amazon, Netflix is facing more new competition, not less.

Apple is nothing like Netflix

Apple has little in common with Netflix. It's not financing its future with massive debt. Apple has only incurred debt to delay having to pay U.S. taxes on foreign income until they were lowered, and the interest on its debt is much lower than Netflix's.

Apple is also a cash machine. Its net margins are consistently around 22%, about three times Netflix's. Apple generated $77 billion in cash flow from operating activities last year. Netflix lost $339 million over the same period. Yet Apple's market cap is only 5.7 times larger than Netflix. That means to acquire Netflix, Apple would be paying a sixth of its valuation to buy a lesser performing business, to put it mildly. And for what: to learn how to spend incredible amounts of money shopping for original productions?

Apple's primary hardware business is not really comparable to Netflix. But Apple's Services segment is: largely licensing and subscriptions. Rather than earning lower margins outside of hardware, Apple's rapidly growing Service gross margins are nearly twice that of Netflix. Apple just reported March quarter gross margins of 62.8% for its Services segment, compared to Apple's overall gross margin of 38%, and Netflix's gross margin of 36%.

Can Apple create its own Netflix?

Netflix funds original programming at a scale capable of keeping its subscribers paying. Apple can afford to do that without racking up debt, and its existing installed base of users have already enthusiastically adopted Apple Music and other subscriptions.

The primary insights Netflix has discovered over the last decade of moving to mostly original content is that customers don't want to wait for a show to be broadcast on what the company refers to as "linear TV," and they don't want to sit through ads. Most importantly, they're willing to pay for those freedoms.

For decades, television broadcasts scheduled serialized episodic television mostly supported by advertising. By making viewers the product that broadcasters sold to advertisers, audiences could watch for free. In fact, there was no other real alternative.

However, as soon as cable TV enabled a new model for subscribing to premium content in the 1980s, affluent audiences moved from tolerating ad interruptions to paying for subscription services such as HBO.

And as soon as the Internet made streaming possible, audiences also embraced the idea of paying for all-you-can-eat, at any time content with no ads. Netflix has capitalized on this. So has Apple.

The death of "free" linear TV

Production companies liked Netflix because it allowed them to produce a series and make it available an entire season at a time. Viewers could binge-watch the show, recommend it to others, and rapidly build up a fan base.

Legacy broadcasters frequently destroyed good shows by failing to develop audiences' interest. A classic example is Joss Whedon's 2002 "cowboys in space" series Firefly. Fox picked the series up, but chose to broadcast its episodes out of the intended sequence, frequently preempted showings for sports events, and then canceled it before even airing all of the produced shows of the original season.

Despite winning awards and eventually cultivating a cult fan base on DVD, Firefly as a continuing production was effectively destroyed by the nature of "free" linear TV trying to optimize for ads and ratings rather than selling good content.

Ads have similarly destroyed magazines and newspapers online, interrupting access and slowing down users' consumption of content in a ploy to string them through a series of paid messages optimized through the web's surveillance tracking.

The problems of ad-supported, linear TV that killed Firefly simply can't happen when an entire season of a production is made available for streaming all at once.

Netflix has excelled at pursuing this business model, but there's nothing really unique that stops other companies from copying the winning formula of producing and delivering good content, without ads, in a non-linear form that lets subscribers watch what they want, anytime they want, and get captivated with a production by binging an entire series.

Amazon couldn't figure out how to sell a smartphone, but it has been able to pay for popular, acclaimed programming for its Prime Video. Even the legacy TV networks that were killing shows with ads figured out how to launch Hulu.

Apple's advantages in selling subscription content

Apple is actually better suited to deliver the non-linear TV model that Netflix popularized because it has huge cash reserves, has massive cash flow, and has a captive audience of more than a billion users who are already subscribers to other content it offers.

Apple is also quite obviously aware of how iOS users peruse content on their devices. While developing the original Apple TV app, which centralized the content from various apps and streaming channels and let viewers find content by subject rather than by seller, Apple gained a lot of insight into what consumers want and how they want to access it.

Apple has the luxurious advantage of already having a massive audience. Both TV+ and News+ are leveraging Apple's existing TV and News apps, and are already getting attention. By flexing its existing installed base, Apple can commission the production of high-quality content without excessive concern for costs. Like iTunes, it won't be terribly hard to break even, and it's hard to see how Apple could fail to make money here.

Another advantage Apple TV+ has: it's integrated into the TV app, which already presents a series of unbundled channels including HBO, Starz, SHOWTIME, Smithsonian Channel, EPIX, Tastemade, and MTV Hits, as well as existing iTunes movies and rentals.

But Apple also has something else Netflix lacks: control over its distribution hardware. Apple TV+ will stream content to Macs, iOS devices, and Apple TV, as well as Samsung TVs that support Apple's protocols and devices that work with AirPlay 2. Apple can optimize its content specifically for that narrow range of hardware.

Netflix initially chose to support Microsoft's VC-1 and WMA back in 2007, but with the rise of iOS, Android, and various game consoles and set-top boxes, Netflix is now required to create, store, and stream over 50 versions of every episode it carries, each with its own video resolution, audio quality, and codec support.

Apple TV+ is free from having to support every mobile device and any console or USB stick that can be attached to a TV. That means Apple is also capable of creating new forms of content optimized specifically for the future of its hardware, including the latest codecs built into its custom silicon.

Apple TV+ could develop an interactive series of entertainment worlds that blur the lines between television, apps, and games. It can take full advantage of new audio standards and display advances, from Wide Color to advanced resolutions, and it can launch Augmented Reality titles, all without having to wait on the content industry to catch up.

Apple doesn't need to buy Netflix. It just needs to shop for good productions like Netflix, which is a whole lot cheaper anyway.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

Amber Neely

Amber Neely

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

-m.jpg)

28 Comments

Every substantiation mentioned here indicates that they’re simply too late, given their ambitions. Same for Music Streaming, and Project Titan soon.

One more thing …

if you study Apple, you'll come to realize that it is very wary of getting into a position where an accusation that it is a monopolist (as defined by the current interpretation of US anti-trust law) would stick. Sure, it gets accused of being a monopolist — the recent SCOTUS decision allowing users to sue it over App Store prices is the latest example — but has always been able to point to alternatives in the marketplace, which means that the accusations fail. (Yes, I know: eBooks. Let's say no more than that it strengthened their resolve.) Monopolizing the profits without monopolizing the market, on the other hand, is quite another issue. But the law can't get you for that. Buying Netflix could, notwithstanding all the emergent competitors, put Apple in future danger of monopoly charges that would stick. It doesn't want to go there.

We agree that Apple shouldn't buy Netflix. That would be wasteful and unnecessary. A lot of the reasons you listed for not making that acquisition are spot on. Your analysis of Apple's advantages in selling subscription content... there are some assumptions there that don't stand under scrutiny. Nitpicky but relevant, you can't say Apple has an audience of more than a billion users because nothing supports that. You can say Apple has more than a billion active devices. Those two things are not the same and can't be used interchangeably. We both know there's no 1-to-1 correlation. Apple does have a ton of potential subscribers. There's no doubt about that. But they don't have as many potential subscribers as Netflix so their base of users isn't the advantage you make it out to be. Netflix includes Apple's base as potential customers along with users of any device that has streaming ability regardless of ecosystem.

Those huge cash reserves and that massive cash flow... yeah that has content creators licking their chops. A lot of companies are going to be bidding for top quality content. None of it is going to be cheap. Just because Apple has more money than anyone else, doesn't mean they want to part with it wantonly. They're going to win some bids, and they're going to lose some. Either way, that initial billion dollars they earmarked for this venture is going to be in the rearview mirror pretty quickly. It's going to cost -substantially- to play in this arena.

I'm really not sure why you're looking at ATV+ strictly from an ecosystem standpoint. Short term benefits yes. But I'd bet Apple is looking at it long term as it's own version of Netflix. Ubiquitous and available everywhere on every device. The same way it looks at Apple Music which is available on iOS, Mac, PC, and Android. Services don't really benefit from being closed off. That's why Apple has AirPlay 2 spreading like wildfire beyond it's own ecosystem.

You say ATV+ is free from having to support

Apologies for length. Lot to unpack.

...Google spent $15 billion on Motorola and Next... I believe you mean Nest.