China's Ministry of Commerce has floated a retaliation plan intended to punish companies complying with the Trump Administration's Entity List ban on doing business with Huawei. That could have a profound impact on two of the largest software platforms licensed in China: Android and Windows, as well as broadly-licensed silicon intellectual property from ARM and Qualcomm.

China retaliates with a strategy

After the Trump Administration imposed devastating restrictions on Huawei by adding it to the U.S. Entity List, Google, Microsoft, Intel, ARM, Qualcomm and many other technology companies were forced to announce the termination of their business supplying the Chinese networking company. Across the board, observers scrambled to write up hot takes on how this would be bad news for Apple, the only Western company doing massive business in China.

That included Zachary Karabell, a contributor for Wired and Bruce Einhorn of Bloomberg, as well as pundits from IDC and IHS Markit , analysts including JP Morgan, Corwen, and Citi and a variety of click bait headlines shoveled out by bloggers assuming that state reports of boycotts could be taken seriously after at least five years of perpetual reports of "Apple boycotts" in China that all turned out to be horseshit.

However, rather than targeting Apple— the company that employs vast numbers of Chinese workers at plants ranging from Foxconn to Pegatron, and which supports a huge network of Chinese supply chain companies, and which sells the leading share of premium phones in China, which contributes billions in domestic VAT to China on local sales of devices, the P.R.C. has outlined that its retaliation will not be ill-considered and self-destructive, but will instead target the very companies that Trump ordered to stop doing business with Huawei.

China strikes back at the Entity List

According to report by Bloomberg, China outlined plans to "list" foreign enterprises, organizations and individuals that 'do not obey market rules, violate contracts and block, cut off supply for non-commercial reasons or severely damage the legitimate interests of Chinese companies,' a description that would apply to the companies that were forced to terminate their relationships with Huawei to comply with the Entity List.

Because Huawei has already lost all cooperation with these companies, it's quite easy to retaliate against them. China has previously taken similar strategic steps in its tariff reprisals, targeting American farmers and other exporters to China in a bid to narrowly target the pain on Trump's core base of supporters.

The lost of support from Google's Android, Microsoft Windows, and chip IP from ARM and Qualcomm, are all devastating for Huawei. There is no easy way to compete in Western markets— including Europe, where Huawei was making strong gains— without offering compatibility with those platforms. But having lost their support entirely, Huawei and the P.R.C. can best retaliate by working to develop their own domestic technology.

That could include Huawei's own version of an Android-like mobile platform, and potentially a Linux-based replacement for Windows. Additionally, any efforts to develop workalike or competing processor designs that could stand in for licensed IP from Qualcomm and ARM could enable China to emerge stronger and more independent. Huawei already claims to have developed its own 5G silicon, and freed from having to work with Western IP, it could clean-room or even simply appropriate the IP that it has been licensing from Western partners.

Huawei's silicon subsidiary HiSilicon has already produced its own ARM-based processors, but the company continued to sell products using chips from Qualcomm and other suppliers. Without those resources, and without the continuing support from ARM or Qualcomm, HiSilicon could be emboldened to produce infringing IP that Western companies have a reduced ability to fight against, given that they now have no remaining leverage to suspend their normal business relationships.

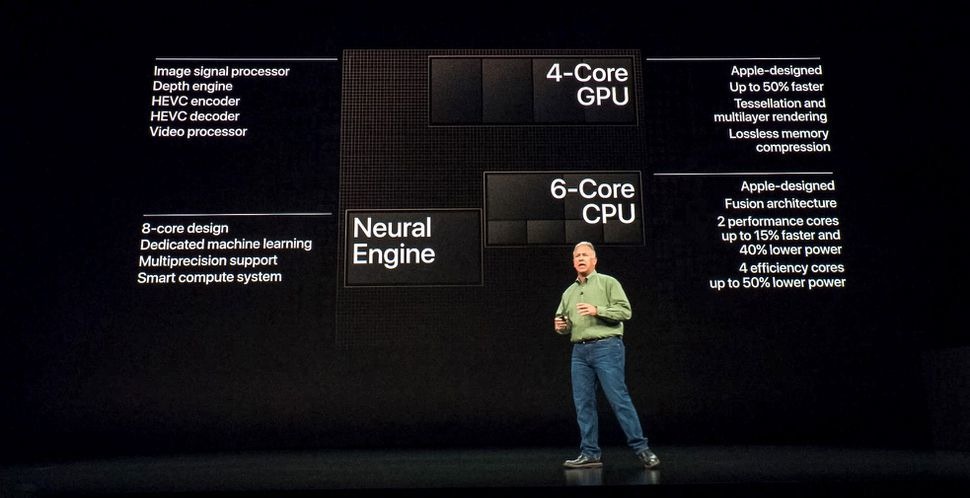

Huawei's HiSilicon Kirin 980 is currently more than a year behind Apple's work, but China could go full rogue in selling existing ARM and Qualcomm infringing chips at a discount until it can produce its own designs, flooding the market and devastating Western markets for ARM and Qualcomm IP.

Huawei's Kirin 980 isn't just behind Apple's A12 Bionic from last year, it's also struggling to keep up with the previous year's A11

Huawei's Kirin 980 isn't just behind Apple's A12 Bionic from last year, it's also struggling to keep up with the previous year's A11In that scenario, China could not only support Huawei's development of independent technology, but could materially force the propagation of alternative OS and silicon platforms across various other domestic companies operating with the scale to establish new standards. The Entity Listing of Huawei has left China with few alternatives.

That could prove devastating for Google and Microsoft, as most of the phones and PCs outside of Apple and Samsung are now produced by Chinese companies. If China can produce its own alternative to Android, it could crush the aspirations of Google to ride its freely distributed Android OS as an advertising-supported services business.

Chinese companies already distribute their own forks of AOSP Android that are connected to domestic Chinese app stores, ad networks, and other services. If they began doing this in other regions including Africa, greater Asia, South America, and Europe, Google's own control over Android would fizzle out completely. That would force Google into greater reliance on iOS, where it already pays Apple billions to for the privilege of serving iPhone and iPad users with its search results.

Similarly, Microsoft's control over Windows could be blindsided by a cooperative segment of Chinese mass producers, including Huawei and the world's largest PC maker Lenovo, working with the Chinese state to produce PCs that don't have to license Windows anymore.

In parallel, China could mandate that its national producers develop their own silicon resources to produce alternative designs that don't require ARM or x86 licensing, creating a new schism that would be devastating for ARM, Intel, and Qualcomm. Those moves would shatter the global economies of scale that are funding the research and development advancing the state of the art in OS and silicon.

The company most isolated from this upheaval: Apple. It could continue to develop iOS and its own custom ARM processors without interference from American restrictions, and without retaliation from China's "unreliable supplier" listings. Such a move would immediately make Apple's platforms the world's largest, and the only ones supported by ongoing sales of more than $200 billion worth of annual global sales of mostly premium hardware.

There's mounting evidence that the supposed boycott of Apple in China is a total fabrication, and that the nation's affluent consumers are continuing to prefer to buy iPhones, Macs, and iPads. If that holds, Apple's weak remaining competition in the form of low-end devices will be dramatically weakened in and outside of China as Apple continues full speed ahead in developing the world's most advanced consumer technology.

Daniel Eran Dilger

Daniel Eran Dilger

-xl-m.jpg)

-m.jpg)

Chip Loder

Chip Loder

Thomas Sibilly

Thomas Sibilly

Wesley Hilliard

Wesley Hilliard

Christine McKee

Christine McKee

Amber Neely

Amber Neely

William Gallagher

William Gallagher

Malcolm Owen

Malcolm Owen

64 Comments

If Chinese companies produce IP infringing chips or software, it would only be for the domestic market and emerging markets with weak IP protections. Those products would certainly be litigated and blocked in Europe, Japan and South Korea. The resulting bifurcation of the market would take a different path than what you describe in this piece. However, the conclusion that China does not have a strong interest or incentive to punish Apple is very true.

It doesn’t make any sense. Then Trump would just add ZTE to the list as well. Both sides are stupid and both sides behave like a spoil kid throwing a tantrum.