Following the publication of results for its third fiscal quarter of 2019, encompassing April through June, Apple provided additional detail surrounding the continuing situation in China, as well as more information about its Services business in an earnings conference call.

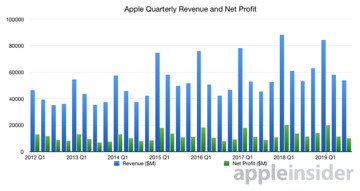

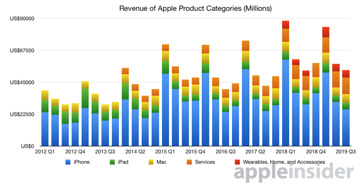

On Tuesday, Apple announced $53.8 billion in revenue, with earnings per share of $2.18. Apple predicted revenue in the range of $52.5 billion to $54.5 billion. Thomson-Reuters predicted $53.7 billion in revenue.

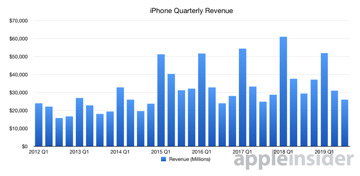

In the year-ago quarter, Apple earned $53.3 billion, with more than half of the revenue from the iPhone.

Participating in Tuesday's call were Apple Chief Executive Tim Cook and Chief Financial Officer Luca Maestri.

Highlights from the earnings report and conference call

Prior to earnings, Apple stock was up a bit in after-hours trading, to $209.40 per share at 4:30 P.M. Eastern timeFollowing release of the earnings numbers, Apple stock jumped to $216.18 at 4:35 P.M. Eastern timeThe June quarter was Apple's largest ever, driven by "all-time record revenue from Services, accelerating growth from Wearables, strong performance from iPad and Mac and significant improvement in iPhone trends"Over $17 billion in stock buybacks completed in the quarterApple is expecting between $61 billion and $64 billion for the fourth quarterApple's board has declared a cash dividend of $0.77 per share, payable on August 15Quarter ended with $211B in cash and securities, $3B in term debt retired. $108B in total debt remains.88 million Apple shares repurchasedAt the conclusion of the call, Apple stock was up $8.92 in after-hours trading, to $217.65iPhone

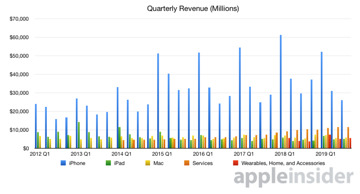

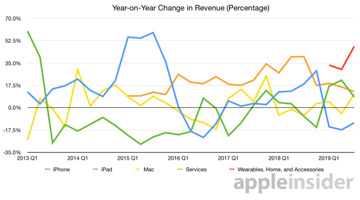

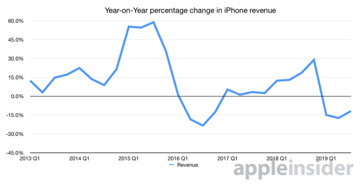

iPhone sales down $3.5 billion from YOY, Mac sales up $500 millionStrong customer response to in-store trade in and exchange programMore than 5x iPhones traded in versus the year-ago quarteriPhone sales in Apple retail returned to growthiPad

iPad sales up $365 million from 2018Third consecutive quarter of iPad sales growthOver half the iPad purchases in June quarter were new to iPadWearables

Wearables, home and accessories up $1.8 billion YOYApple Watch, other wearables the size of a Fortune 200 companyServices

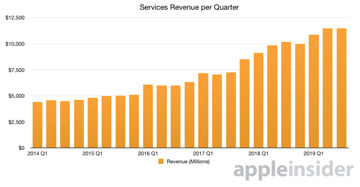

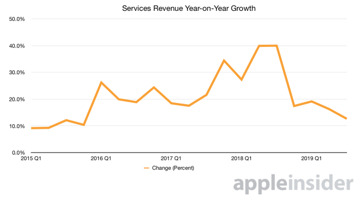

Services up $1.3 billion from YOYServices growth 15% after a one-time benefit last year at this timeApple Care, Apple Music, Search Revenue, App Store all time revenue recordsApple TV app viewership up 40% Year over yearApple Pay 1 billion transactions per month, twice the volume of a year agoApple Pay adding more new users than PayPal, monthly transaction volume growing 4x as fastThousands of Apple employees using Apple Card. Rollout in August.Triple-digit growth in Apple PayServices accounted for 21% of revenue, 36% of gross marginOver 420 million paid subscriptions, will exceed 500 million by 2020Across all third party subscription apps, largest is only 0.25% of services revenue (probably Netflix - MW)Mac

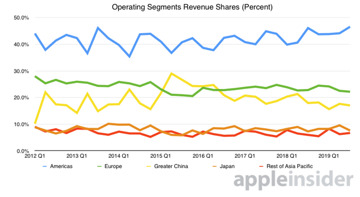

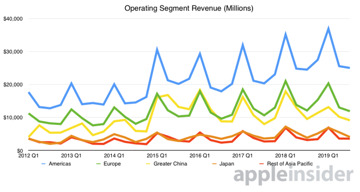

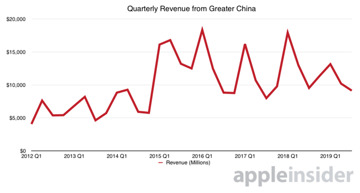

"Enormous amount to be excited about with Mac" - Tim CookMac revenue grew in four of five geographical segments, set records in Japan, US, with overall growth outpacing PC industryActive install base of Macs at all-time highForeign exchange impacted growth, very challenging environment - Luca MaestriSales down in Europe by $200M, greater China by $300M from YOYSales up in U.S. and rest of Asia Pacific by $500M YOYActive iPhone installed base grew to a new all-time high in every operating segmentObservation: Apple's most recent results are about the same as the 2013 holiday quarter - MWTim Cook - Return to growth in mainland ChinaChina - experienced noticeably better YOY growth in China than in the last two quarters, sequential improvementApp Store in China driving force behind Services growthEmerging markets strong double digit growth in India and Brazil, Q3 records in Vietnam, PhilippinesOdds and ends

Intel modem buy second largest by dollar, largest personnel involvementBest June quarter from retail stores2/3 of top banks deploying Apple products90 of the largest 100 banks by assets are installing Apple products"Several new products that we can't wait to show you" - Tim Cook506 stores in 22 countriesQuestion and answer time!

Q: Explain growth in estimates September quarter, more than previous percent growthsMaestri - Continued growth of wearables, Services expected, includes $1B in foreign exchange headwind penaltyQ: What is driving success in China, and why will it continue?Cook - Government stimulus in the form of VAT decreases, pricing action, trading, growing engagement in ecosystem during quarter.Q: Why is Services revenue and growth so strong?(AI Observation, this has already been discussed at some length - MW)Maestri: All-time record revenue, install base is growing, and so will Services alongside that growth."We feel very confident about reaching those targets" - Maestri, in regards to doubling Services by 2020New services are coming soon, including Apple Card, Apple Arcade, Apple TV+ which will also grow ServicesQ: Gross margin guidance for September is 50 points higher than June. Why?Maestri: Headwinds will be negative from forex, cost savings in commoditiesQ: Elaborate on China production, estimates for next quarterCook: We look at all macroeconomic conditions in great detail — with no elaboration to the questionQ: New services a short-term growth, or long-term?(AI Observation, this again has already been discussed at some length - MW)Maestri spelling out new Services launch timetable, "road to monetization takes some time."Q: How effective was the iPhone trade in program>Cook declines to elaborate on numbers, trade-in as a percentage of total sales is "significant"Apple advocating for the exchange program more widelyQ: In three to five years, will Services be tethered to the iPhone?Cook: Many services not tethered to iPhone sales now, "We'll see what we do in the future."Emerging markets with low penetration will drive future ServicesQ: China trade situation fluid, tariff exceptions not granted, potential alternatives to China production?Cook: Don't put a lot of stock into manufacturing moves out of ChinaApple manufacturing all over the place, China, Korea, Japan, EU"We've been making the Mac Pro in the US and we'd like to continue to do that" - which is what the tariff exemption request was aboutQ: Comment on broader channel inventoriesMaestri: In general we decrease inventory during March & June quarter, in 2019 iPhone channel reduction slightly more than 2018Q: How is device retention impacting Apple & Services revenueCook: Install base growing, people are holding onto devices longer, but staying inside the ecosystemComparative landscape in China in regards to 5GCook: Not commenting on unannounced products, and in "Extremely early, early innings of it, and even more so on a global basis."

Mike Wuerthele

Mike Wuerthele

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

Amber Neely

Amber Neely

Wesley Hilliard

Wesley Hilliard

William Gallagher

William Gallagher

6 Comments

What’s YAQ?

Interesting to see this made 'official'.

Excellent call. Conveyed solid results and divulged little to rivals. I half expected Tim Cook, mentioning services plus wearables the size of a FORTUNE 50 company, to add "And you can get that magazine and hundreds of others if you..."

Cook: Not commenting on unannounced products, and in "Extremely early, early innings of it, and even more so on a global basis."

One of the more informed opinions out there.

Thanks for the summary AI!