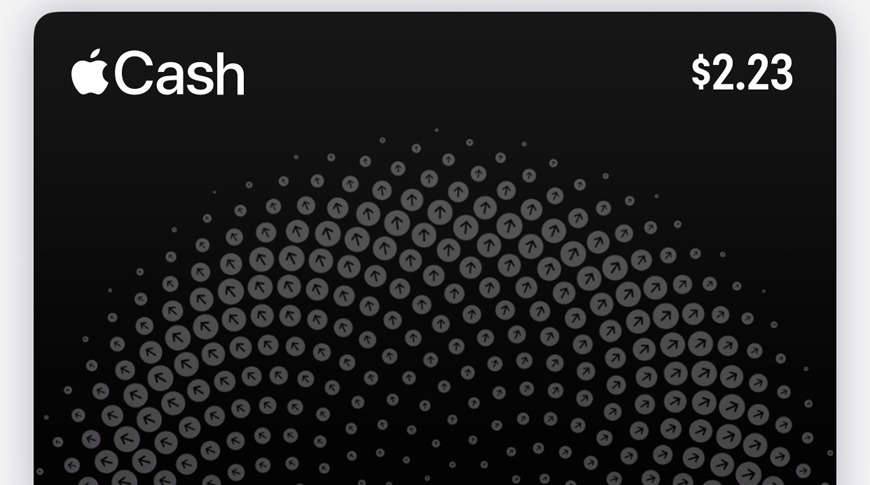

Now that you've got your Apple Card, you might be wondering why you've only been getting 1% back in Daily Cash. As it turns out, like most cards, there's a set of rules you'll need to follow to get the most cash back.

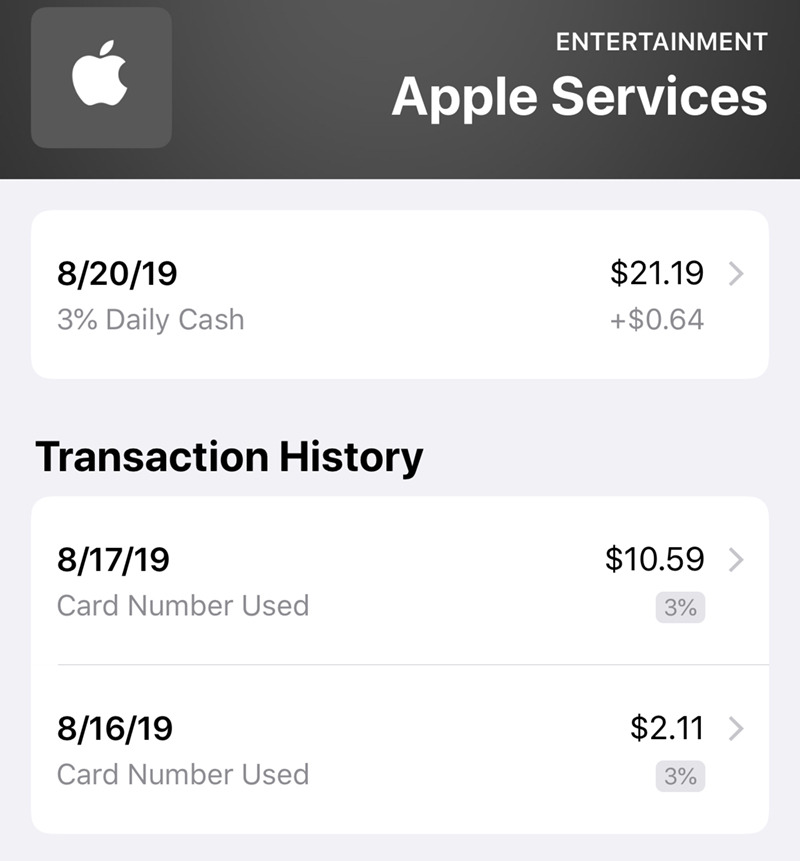

If you're looking to get the full 3% cash back from Apple Card purchases, you'll only be able to get that from buying something from Apple directly. Snagging yourself a new $1,299 MacBook Pro will get you just under $40 in Daily Cash, for example. Notably, purchases from both iTunes and the App Store, as well as your subscription to Apple Music, and likely Apple TV+ and Apple Arcade, will also get you 3% Daily Cash.

Using Apple Pay, on your iPhone or Apple Watch for instance, will net you back 2%. Not only is this great incentive for using Apple Pay, which is fast and convenient, it helps to keep your physical Apple Card in pristine condition.

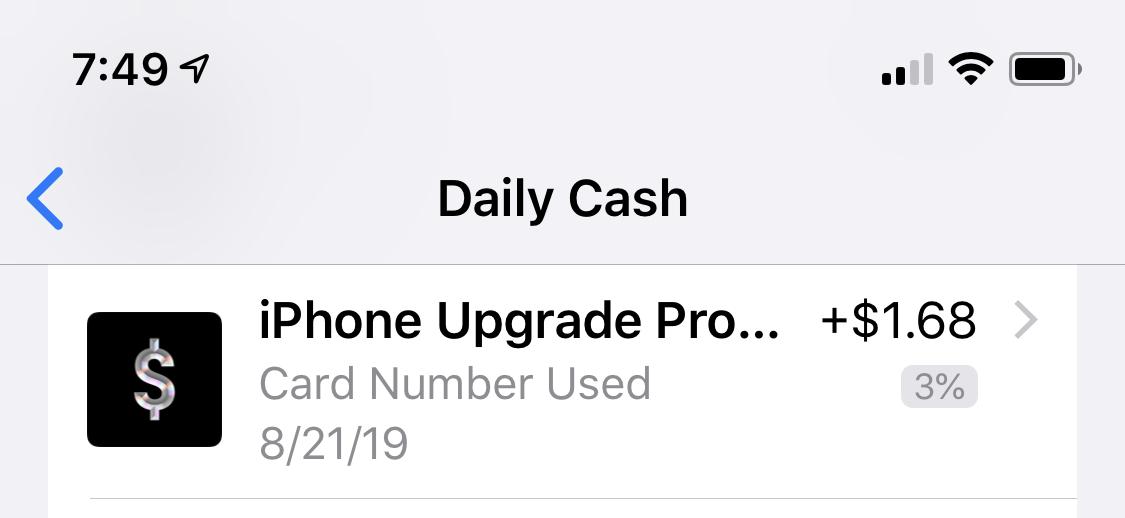

You'll also still get Daily Cash if you use your physical Apple Card, but it will be reduced to 1%, rather than the 2% back you'll get for using Apple Pay. This includes online purchases that require you to enter in your card number. While you're still getting money back, you're getting significantly less back than you would if you were using Apple Pay. As follows, you want to use a different rewards card you own for these purchases, especially if they have a lower interest rate or offer more money for purchases like gas or groceries.

So, if you're planning on upgrading any of your Apple gear, especially larger purchases, it would be beneficial to make the purchase with the Apple Card. You'll be able to get a bit of money back, which is always a bonus when you're already spending that much money.

Otherwise, it's best to try to use your Apple Card exclusively with Apple Pay. Many retail outlets accept Apple Pay, which gives you the most amount of cash back for non-Apple purchases. The Apple Card has many benefits, but it's worth noting that like all credit cards, there are pros and cons to using it.

Amber Neely

Amber Neely

-xl-m.jpg)

-m.jpg)

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Thomas Sibilly

Thomas Sibilly

Wesley Hilliard

Wesley Hilliard

Marko Zivkovic

Marko Zivkovic

38 Comments

You also get 3% cash back if you are in Apple’s iPhone upgrade program and use your Apple Card for your monthly installment payment.

You have to manually update the payment method, though, as the ‘Make Default at Apple’ feature doesn’t reach Citizen One’s system.

You also get 3% back on an Apple purchase if you use Apple Pay on your watch using the Apple Card on your watch.

Not that I disagree with anything the article said, but wasn’t all this obvious? Apple had it all spelled out quite clearly in the marketing/web pages for the card

In my case, even though I made Applecard the default (and it indeed worked with Etsy transaction) all my iTunes and App Store transactions via ApplePay would default to my Former top card, cheating me of additional cash back. Suffice it to say, I'm still working it out. I deleated my secondary card and now ApplePay itself is gone. I'll figure it out soon. But hope this isn't a common problem.