Apple broke records during the September quarter, even though it missed Wall Street expectations. Here's how Apple's Q4 2021 stacks up versus the company's previous quarters and years.

The iPhone maker announced its quarterly earnings on Thursday. Although it set a new overall revenue record for the September quarter, it missed Wall Street's consensus forecast for the period, largely because of supply constraints.

Here's what the quarter looks like in numbers compared to previous earnings results.

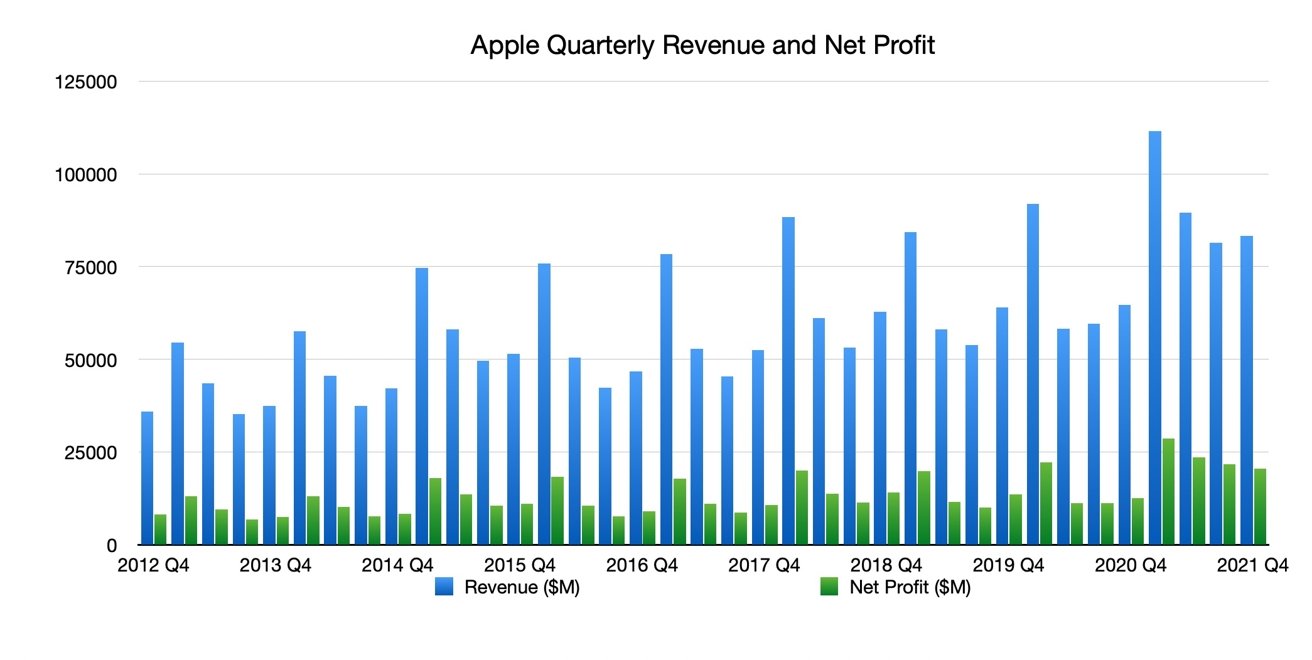

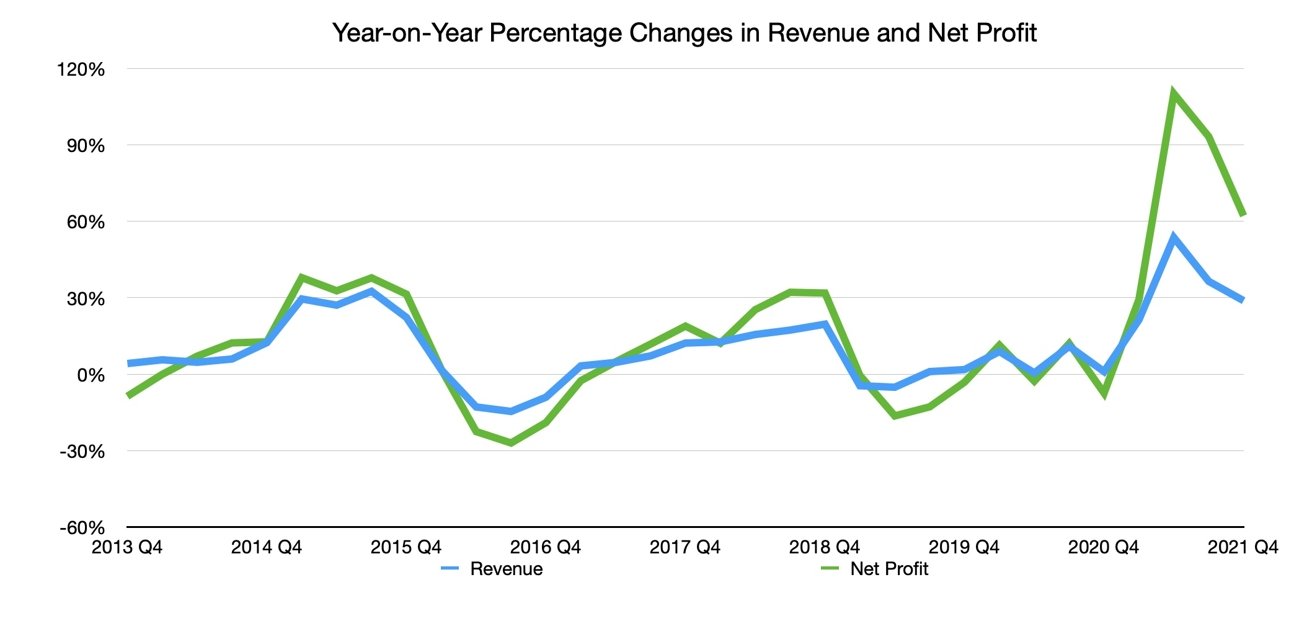

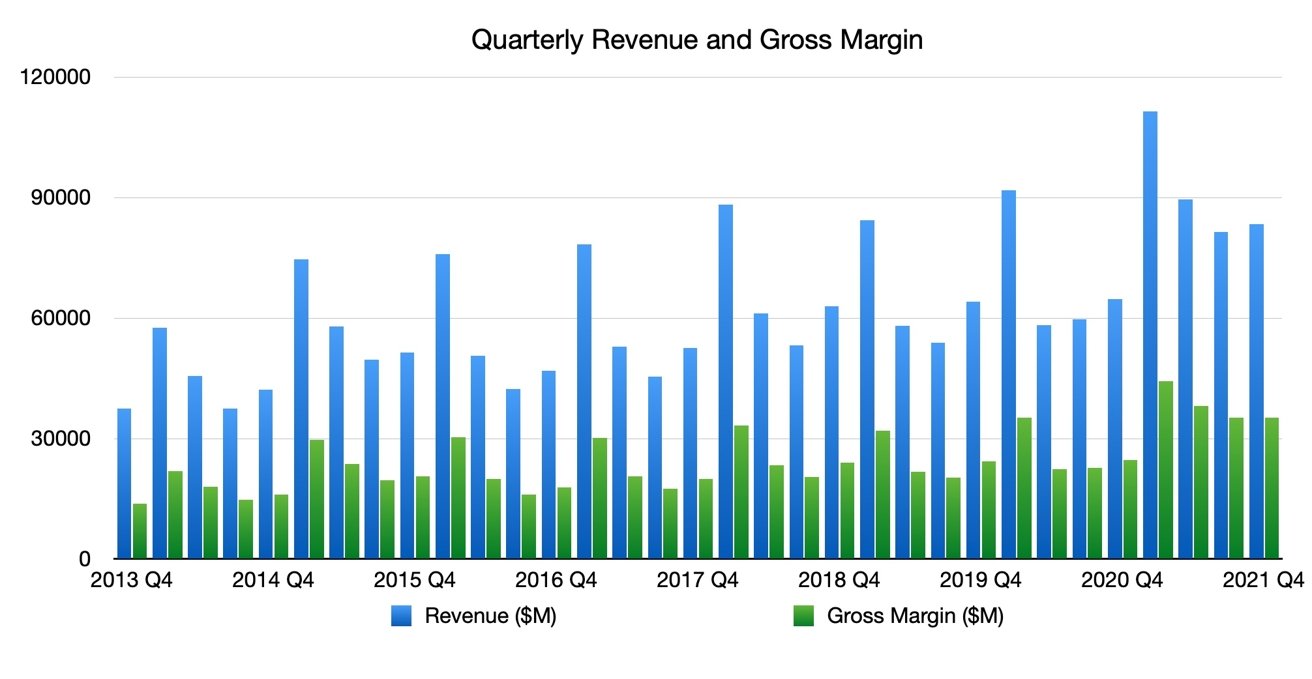

Revenue and Net Profit

Apple reported total revenue of $83.4 billion for the September quarter, up 29% year-over-year. Although that number missed Wall Street expectations, it represented a new record high for Apple's Q4, which corresponds to the calendar's third quarter.

Net profit for the company reached $20.6 billion, up 47.5% year-over-year from the $12.6 billion in net profit tracked in Q4 2020.

Earnings-per-share reached $1.24, up 51.7% from $0.73 cents in the year-ago quarter.

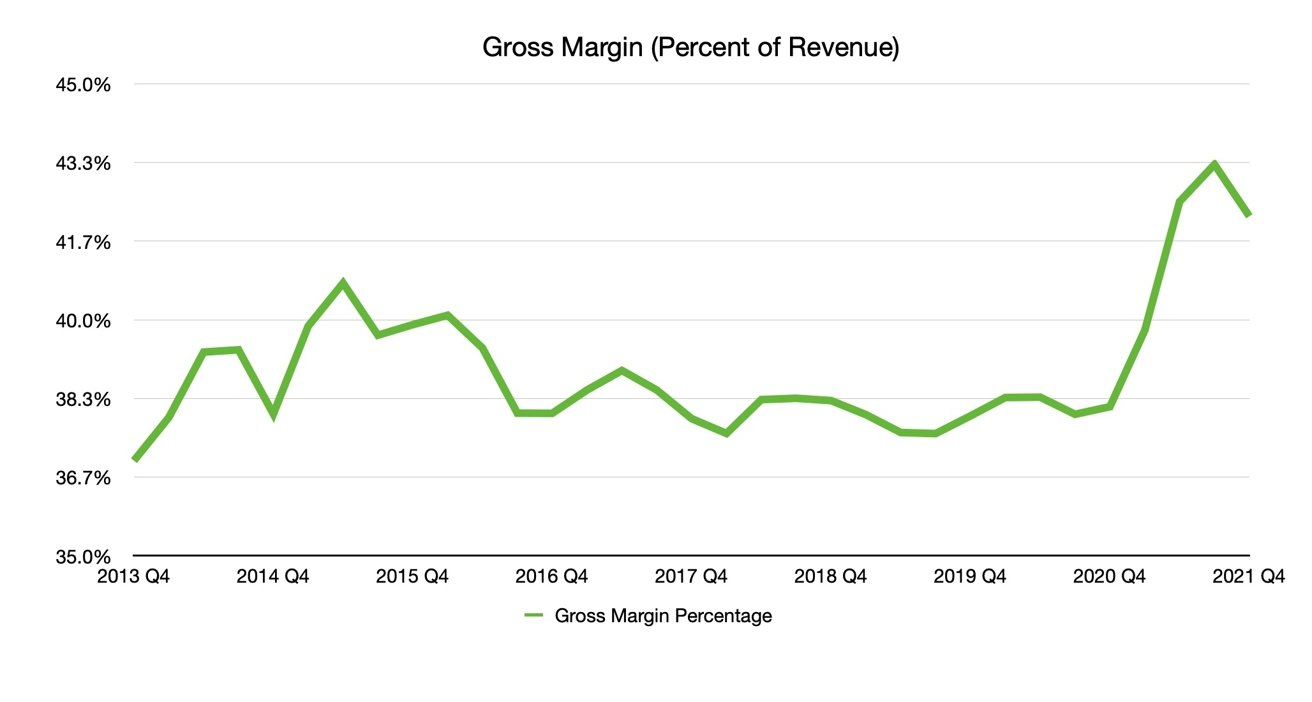

Gross Margins

Gross margins, which are typically a good indicator of Apple's profitability, reached 42.2% in Q4 2021, up from 38.2% in the fourth quarter of 2020.

The number isn't record-breaking — the current high is 47.37% in Q2 2012 — but it still represents healthy gross margins for the company.

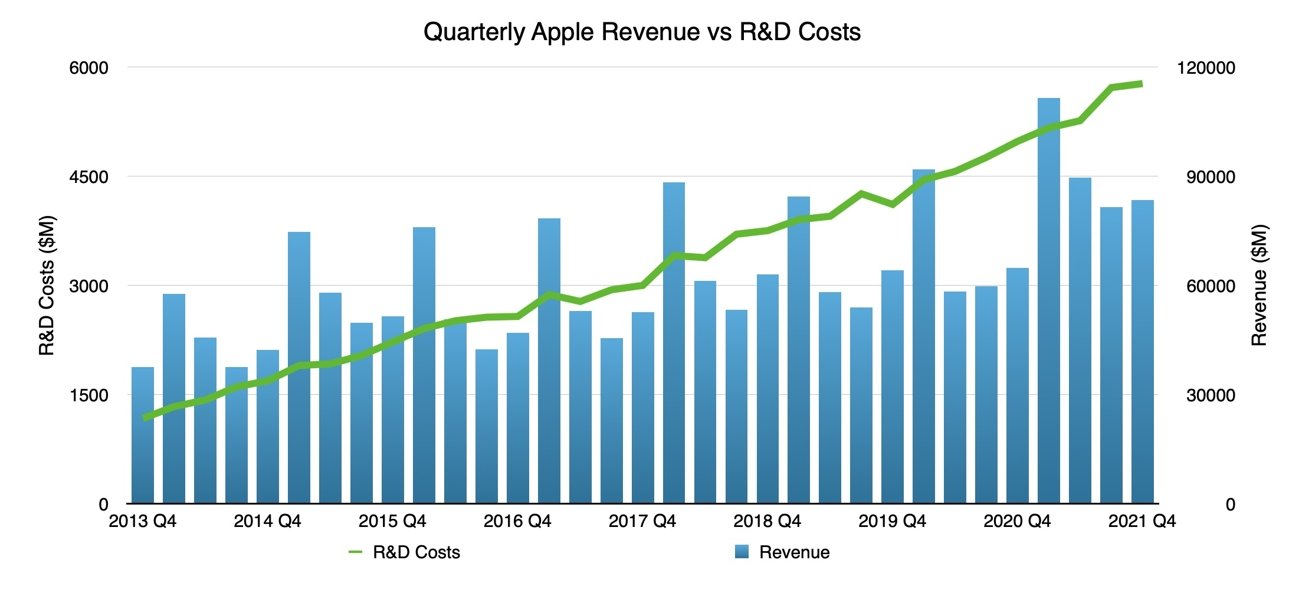

R&D

Apple, like other technology companies, spends a lot of money on research and development. That money goes toward the creation of new products and technologies.

R&D costs continued to rise for Apple, although when you contextualize the R&D numbers with the company's overall revenue, it makes sense why the company is spending so much.

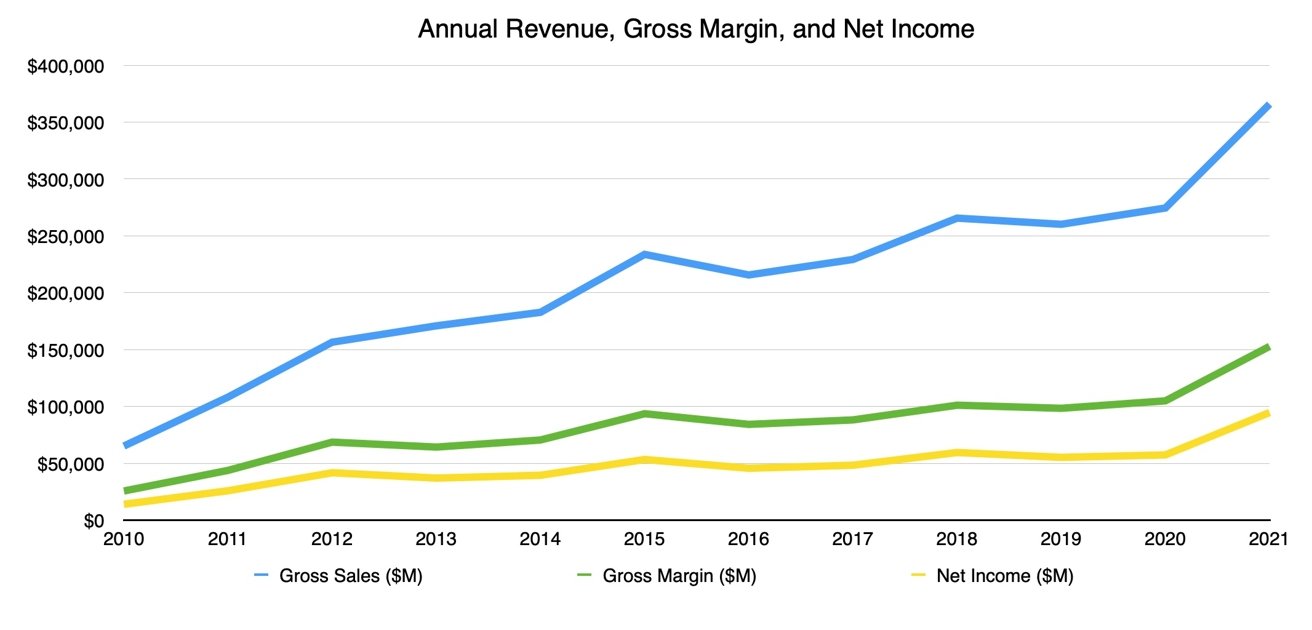

Annual revenue, gross margin, net income

Apple reported total annual sales for 2021 of $365.8 billion, up a significant 33% from the $274.5 billion it reported in 2020. Gross margins for the 2021 year were up 45.6% from the year ago.

Apple's costs also rose during 2021. Operating expenses were up 13.5% during the year, and R&D costs rose 16.9%.

However, Apple's income also saw increases. The company's operating income was up 64.4% in 2021, and its net income was up 64.9%.

Fun facts on annual: Gross sales up 33% YoY for full year. Gross margin up 45.6%, Operating Expenses up 13.5%, R&D up 16.9%, Operating Income up 64.4%, Net Income up 64.9%.

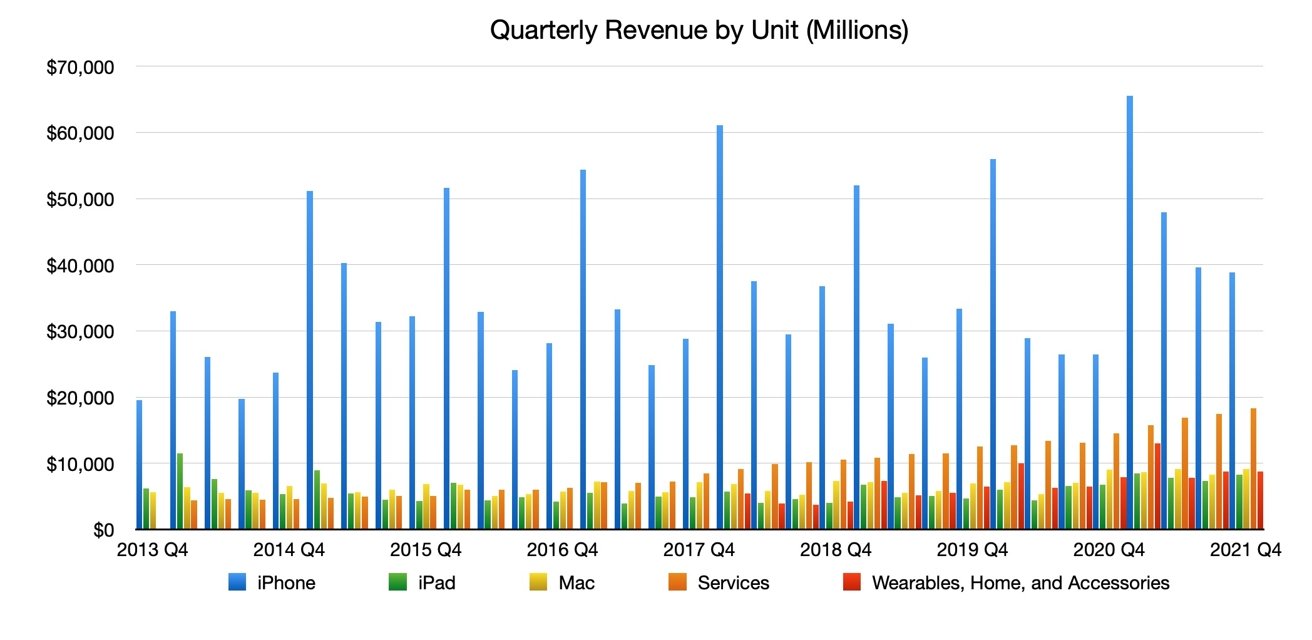

Products

Taking a broad view of Apple's product categories, it appears that virtually every segment of the company's business grew year-over-year from 2020.

Per the chart, 2020 appeared to be an outlier in terms of iPhone revenue growth. It appeared that the Apple flagship product was contributing less to the company's revenue as time went on.

However, it now appears that the trend is normalizing, with iPhone revenue still seeing healthy growth alongside every other product in Apple's lineup.

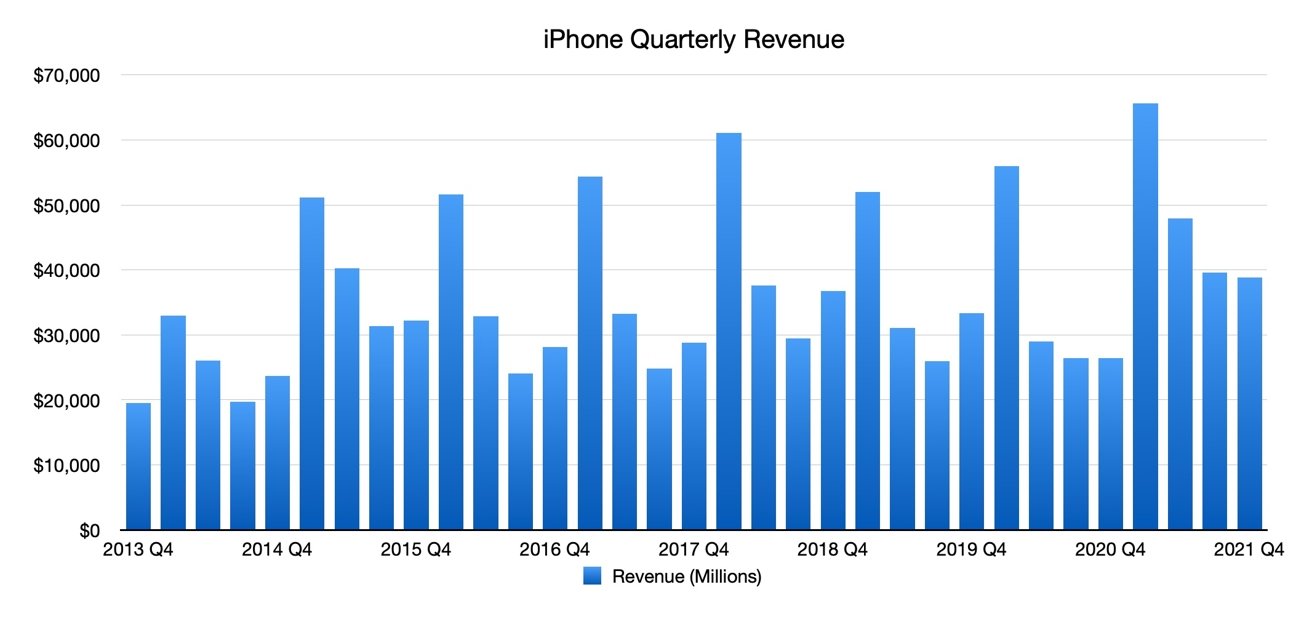

iPhone

Apple reported iPhone revenue of $38.9 billion in the company's fourth quarter, a healthy increase from $26.4 billion in the year-ago quarter.

On the other hand, the graphs reveal an interesting decline in Apple's iPhone revenue from Q3 2021. Typically, Apple's third quarter is its slowest in terms of iPhone sales. In 2021, however, iPhone revenue actually declined between Q3 and Q4.

It's worth noting that the lower-than-seasonal performance is attributable to ongoing chip shortages and supply constraints, which Apple says could affect the December holiday quarter. As you can tell by the graph, the holiday quarter is Apple's busiest for iPhones — and it isn't clear how much of a hit the product will take during the period.

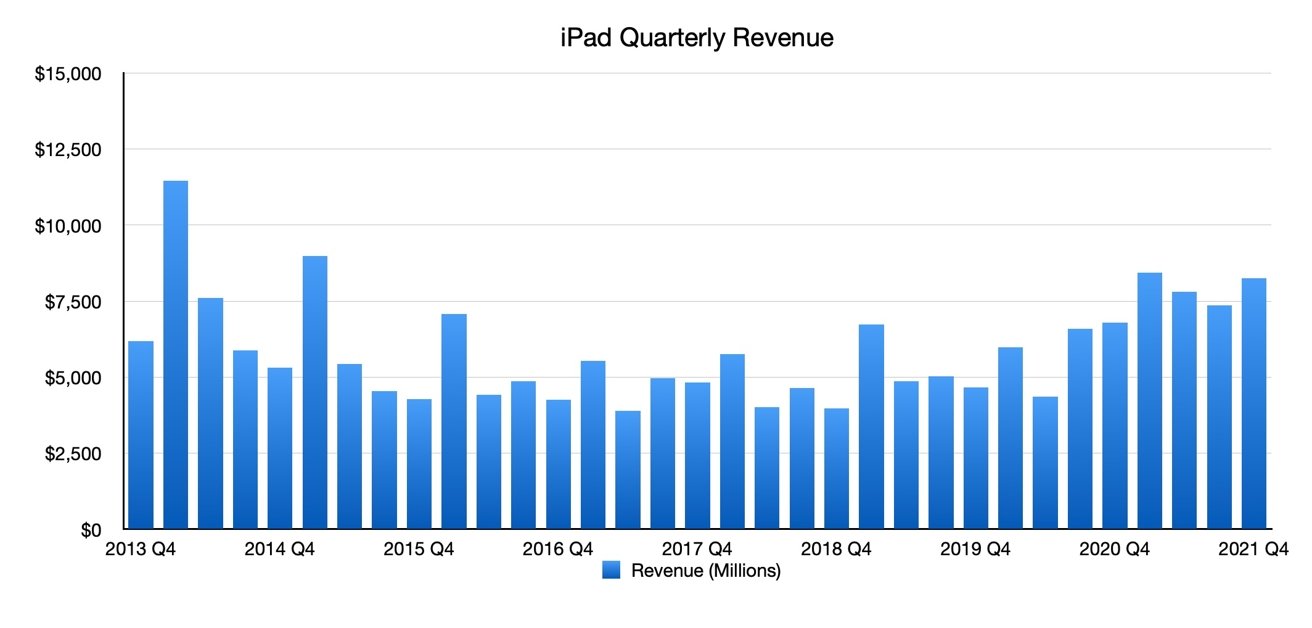

iPad

Apple's iPad revenue reached $8.3 billion during the quarter, up 21% year-over-year from the company's $6.8 billion in iPad revenue in 2019.

It's likely that the iPad is continuing to benefit from pandemic-driven remote work and education trends. Apple also launched new iPad mini and 10.2-inch iPad models during the quarter, though they were unveiled too late to have a substantial impact.

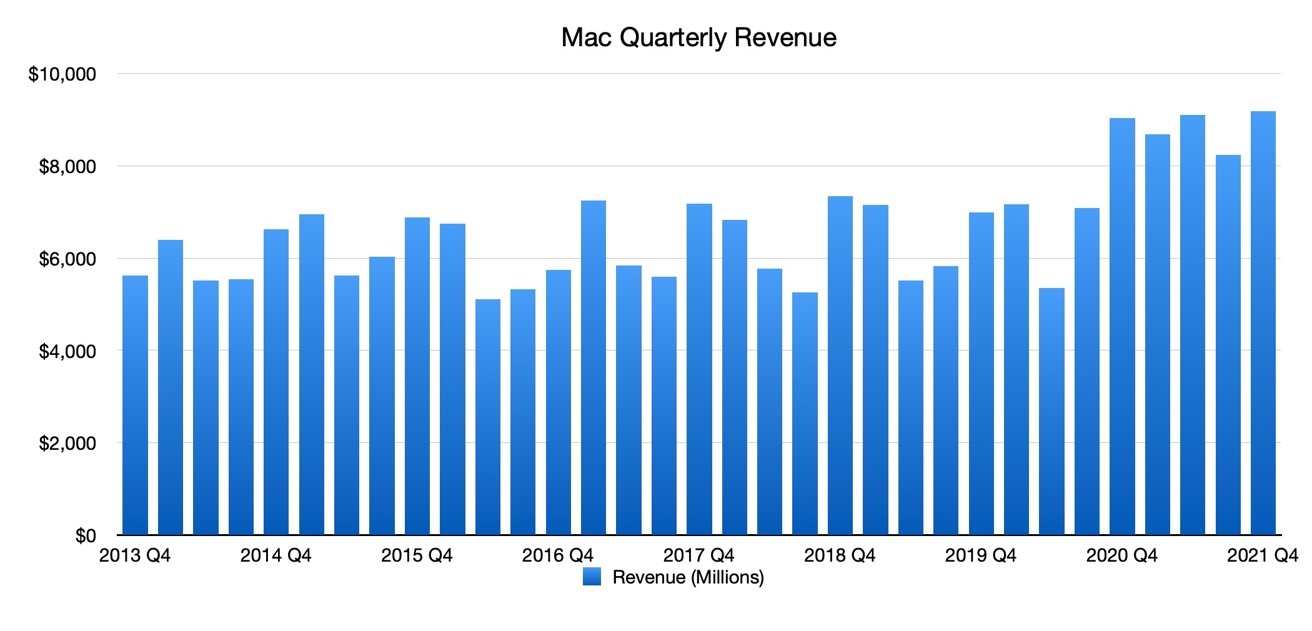

Mac

Mac revenue for Q4 2021 was nearly flat from the year-ago quarter. Apple reported Mac revenue of $9.2 billion, up from $9 billion in Q4 2020.

Despite the relatively muted growth, the $9.2 billion still represents an all-time high for the Mac.

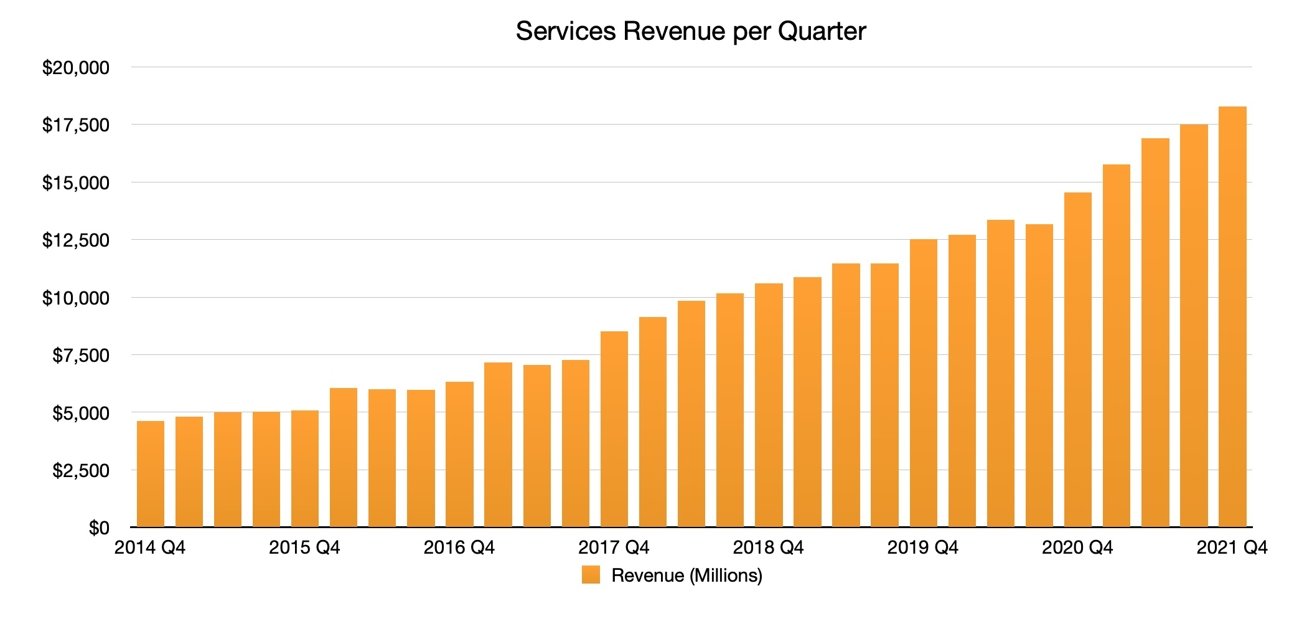

Services

Apple's Services revenue also hit a new record high of $8.8 billion in the September quarter, representing 26% year-over-year growth.

Services has been a reliable growth driver for the company, with revenue increasing steadily nearly every quarter.

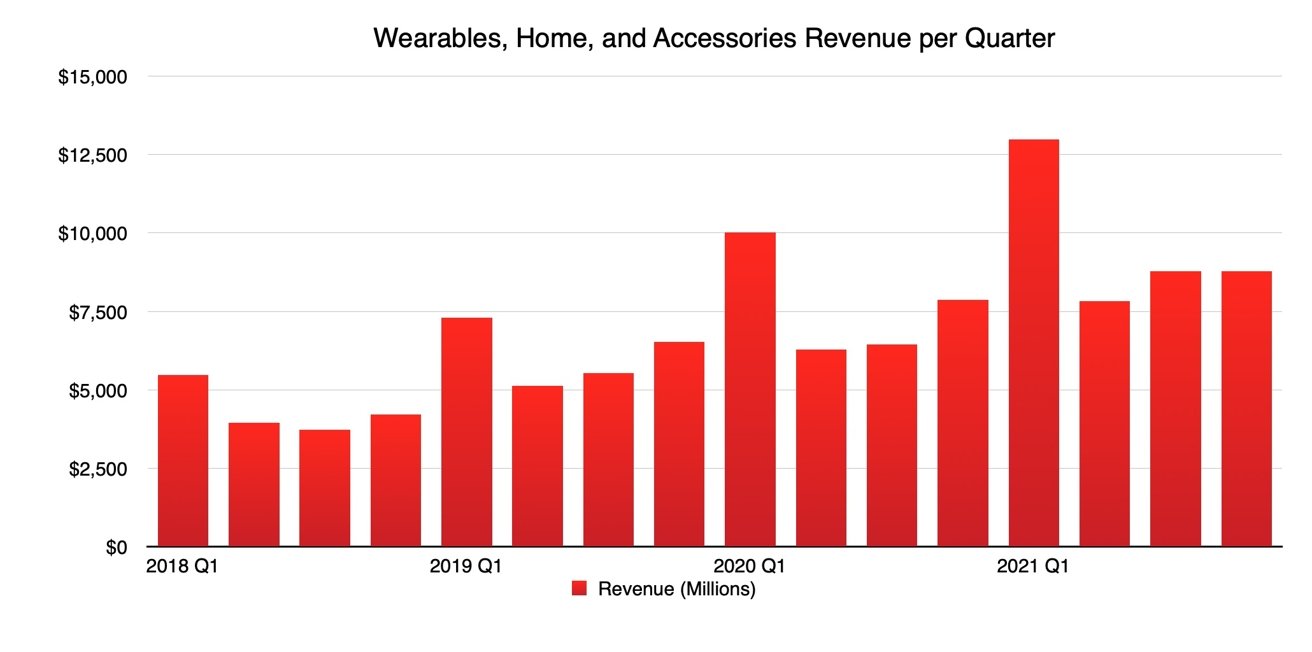

Wearables, Home, and Accessories

Wearables, Home, and Accessories — which comprises the Apple Watch, AirPods, HomePod mini, and other products — reached revenues of $8.8 billion in Q4 2021, up 11% from the year prior.

Apple's AirPods and Apple Watches are consumer success stories, and undoubtedly drive the majority of the Wearables, Home, and Accessories product segment.

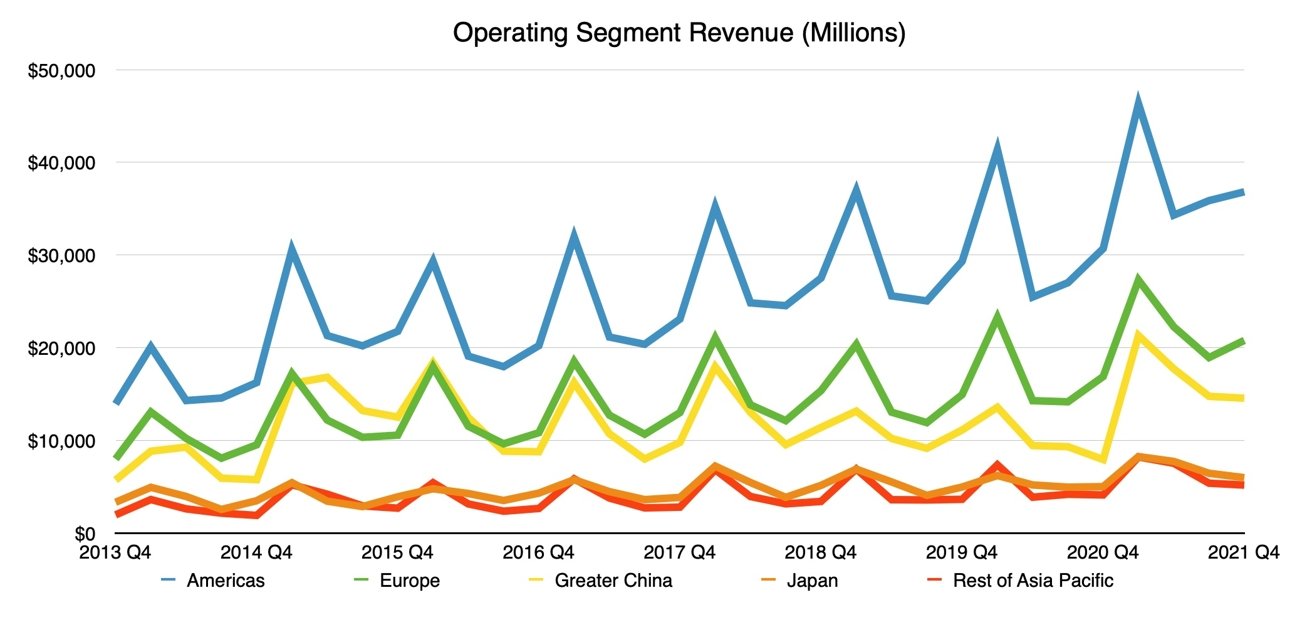

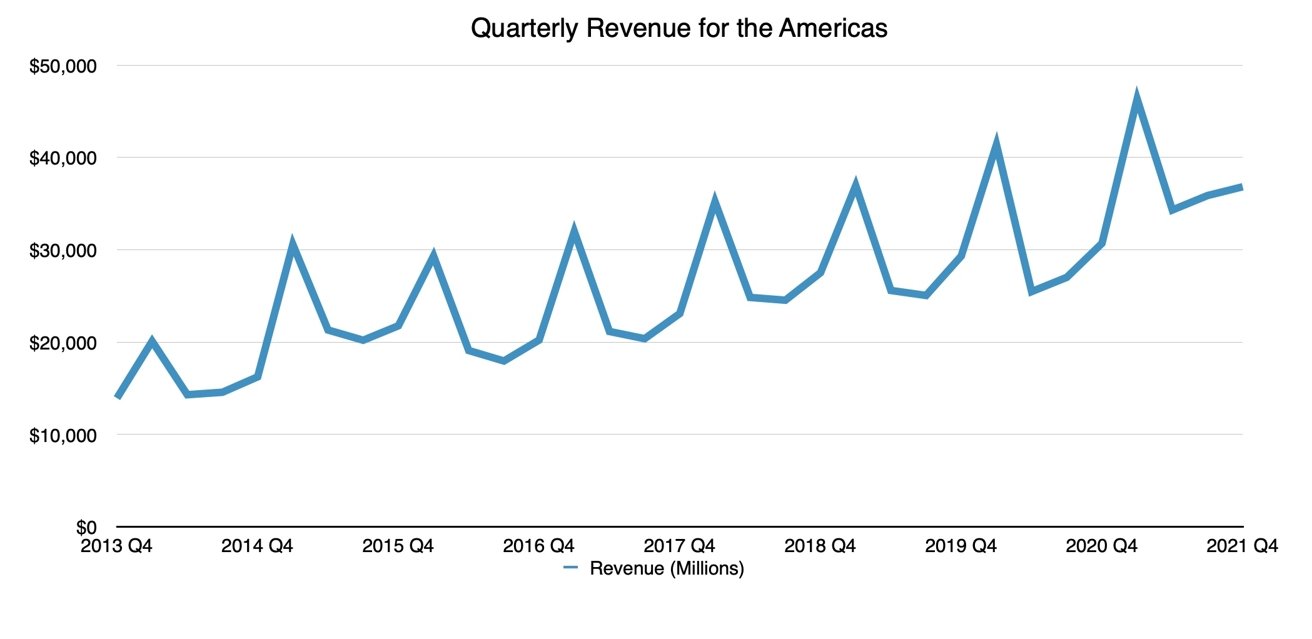

Regional revenue

Apple saw growth across most of the regions in which it operates, with some regions seeing much more substantial year-over-year increases than others.

The company reported revenue of $36.8 billion in the Americas, $20.7 billion in Europe, $14.5 billion in Greater China, $5.9 billion in Japan, and $5.1 billion in the rest of Asia Pacific.

After a considerable drop in revenue in China, it appears that Apple's performance in the country has recovered. Apple saw exceptional growth in China representing nearly a doubling in revenue between Q4 2020 and Q4 2021.

Mike Peterson

Mike Peterson

-m.jpg)

Thomas Sibilly

Thomas Sibilly

Andrew O'Hara

Andrew O'Hara

Amber Neely

Amber Neely

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

4 Comments

One of Apple suppliers stops production for a few days per week due to electricity cutoff in September.

While investors will punish companies for missing expectations the stock market is forward looking.

Apple did not provide guidance; it hasn’t since the pandemic. Senior management are the ones in the best position to guess what will happen in the future. The stock market has similarly punished other companies who withhold guidance.

Today’s share price correction is essentially the market resetting the bar a little lower. When Q1 FY 2022 results are reported we will see it the market predictions hit the mark. The market is baking in future uncertainties into the price.

This is not exclusive to Apple. Every publicly traded company is subject to this. Apple is closely scrutinized due to it high profile.

So because Apple didn’t give them any guidance, they cast shade on Apple stock? Apple set records, but, that wasn’t good enough for Wall Street! …

They keep pressing down on Apple, because Apple doesn’t play by their “ rules”..