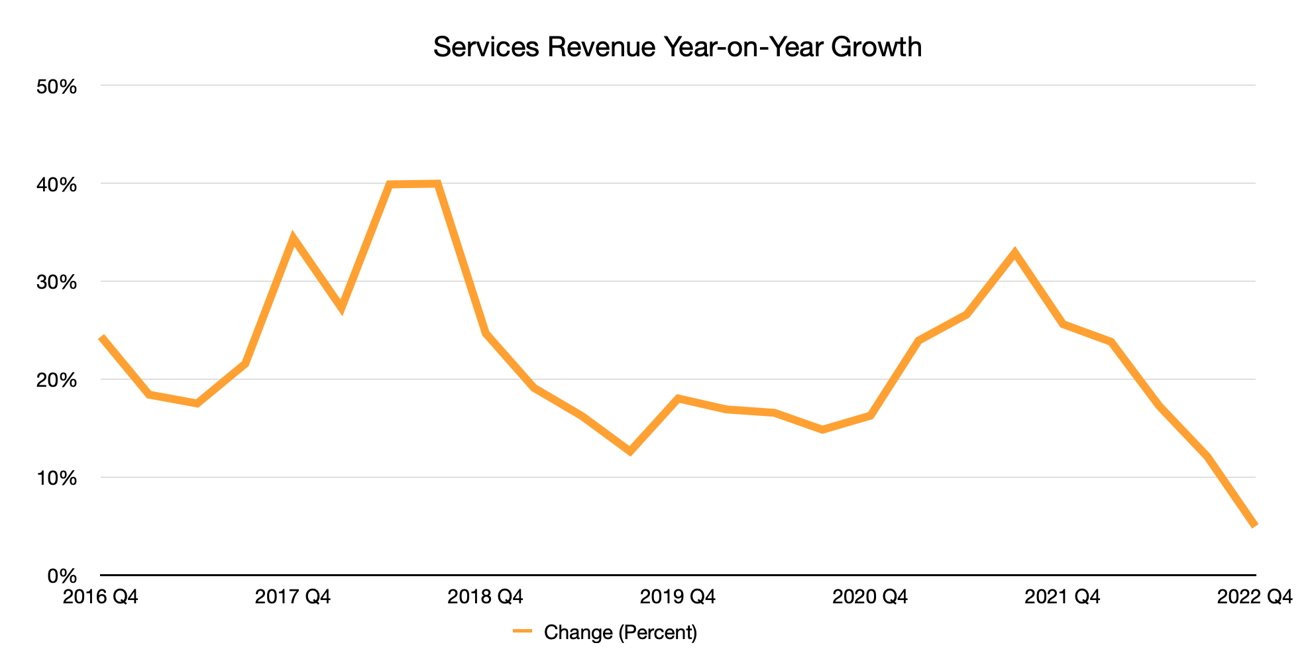

Apple services growth has slowed to single-digit percentages, all while the company seeks new revenue sources from subscription price hikes, advertisements, and new developer fees.

Services have become one of Apple's most important segments since it began reporting the number in 2015. It has consistently grown by double-digit percentages since Q3 2015, until now.

According to Apple's earnings report for Q4 2022, services grew by only 5% overall. There has been a consistent quarter-over-quarter decline in services growth since Q3 2021.

Note that this is still a growing segment, and it is bringing in more revenue than the iPad and Mac combined. However, any reduction in growth potential is seen as a weakness in the segment by investors and analysts.

This decline in growth also comes at a time when Apple's services are under intense scrutiny by analysts and customers alike. The company recently raised prices on Apple TV+, Apple Music, and Apple One. Also, the blowback from increased advertising in the App Store has caused Apple to pull back on its efforts in advertising, though temporarily.

Apple is obviously looking to strengthen its services segment. It counts revenue gained from any subscription, paid app, in-app purchase, and now from social media boosts.

Commentary surrounding services on the earnings call remains confident. Apple CFO Luca Maestri says that Apple's customer base is growing and continues to be loyal, causing services to grow by 5%.

Wesley Hilliard

Wesley Hilliard

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Andrew O'Hara

Andrew O'Hara

Sponsored Content

Sponsored Content

Thomas Sibilly

Thomas Sibilly

Mike Wuerthele

Mike Wuerthele

4 Comments

In the conference call, Maestri did say, “

In other words, if you average out the growth percentage in each region, it’s still in the double digits, it just looks worse when you convert the non-dollar amounts to USD. It still impacts the dollar-denominated bottom line, of course, but if you’re gauging customer interest, these numbers understate a pretty impressive result.

Any “analyst” not able to see the currency exchange impact is not worth its money.

well, i for one just cancelled ATV+ after realising I hadn’t watched any of its content for a couple of months, and that was because there still isn’t a lot there , and most of what is there is not my cup of tea.

the ability to easily do that is the major reason I didn’t go for an Apple One subscription, despite having an Apple Music family account and max tier on iCloud.

”

This is, once again, what’s wrong with the currently accepted rules of capitalism. Consistent profitability is considered failure without growth in excess of unelected analysts’ predictions.