A class action lawsuit alleging Apple Pay is violating antitrust law by coercing consumers to use the Wallet app got the go-ahead from a California judge Wednesday.

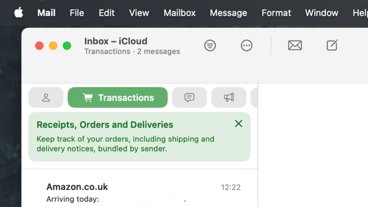

Apple Pay is an important part of Apple's ecosystem and is offered during device setup. The prominence of the Apple Wallet and its features have gained antitrust attention before.

According to a report from Reuters, Illinois' Consumers Co-op Credit Union and Iowa's Affinity Credit Union and GreenState Credit Union are accusing Apple of antitrust practices with Apple Pay and have proposed a class action lawsuit. The lawsuit made it through U.S. District Judge Jeffrey White with little change, meaning Apple will have to face the charges in court.

The judge threw out a tying claim that accused Apple of requiring iPhone owners to use Apple Pay and forego other wallets. The lawsuit is focused on the prominence of Apple Pay on iPhone versus the customer choice found on Android.

"We are happy with this ruling," Steve Berman, a lawyer for the plaintiffs, said in an email. "There are billions at stake so getting by the motion (to dismiss) largely intact was huge for the class."

The class action lawsuit uses the Sherman antitrust law as the basis for the proposal. It means the court must determine that Apple is enforcing a 100% monopoly over the domestic market for tap-and-pay wallets on iPhone, iPad, and Apple Watch.

The complaint alleges Apple's conduct forces more than 4,000 banks and credit unions that use Apple Pay to pay at least $1 billion in excess fees. This harms the consumers by minimizing the incentive to make Apple Pay safer and easier to use — which would occur if Apple allowed wallet competition.

The report states that Apple sought a dismissal of the lawsuit and failed. The company said it charged "nominal" fees to smaller card issuers and that the plaintiffs ignored the "competitive reality" that consumers could pay with cash, card, or other means.

Wesley Hilliard

Wesley Hilliard

-m.jpg)

Thomas Sibilly

Thomas Sibilly

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

-xl-m.jpg)

12 Comments

This is another of those delusional lawsuits. No one forces me or any other iPhone/Apple Watch owner to use Apple Pay! This, in part at least, has occurred because of the excess number of ambulance chasers (lawyers) in the US who lay in wait to seduce naive and foolish consumers into a lawsuit whose fees will only be paid if they "win". There are more lawyers per capita in the US than in any other country in the world and Apple, because of its success, has the biggest target painted on its back that any company has ever had!. Any payment system that collects and remits payments deserves to earn a small fee. The idea that because Apple has made such large profits that anything it does MUST be anticompetitive and a violation of Sherman antitrust laws - a law that is so out of date for the times that it ought to be repealed or at least modernized - is delusional. I am not sure the same doesn't apply to the judge who was foolish enough to allow the suit to proceed. It is absolutely disgusting!

I think consumers should sue law schools for putting out a lousy product and driving costs up for everyone be sure companies like Apple have to defend these stupid suits all habe time.

You spend billions in R&D to build an enticing product line and ecosystem.