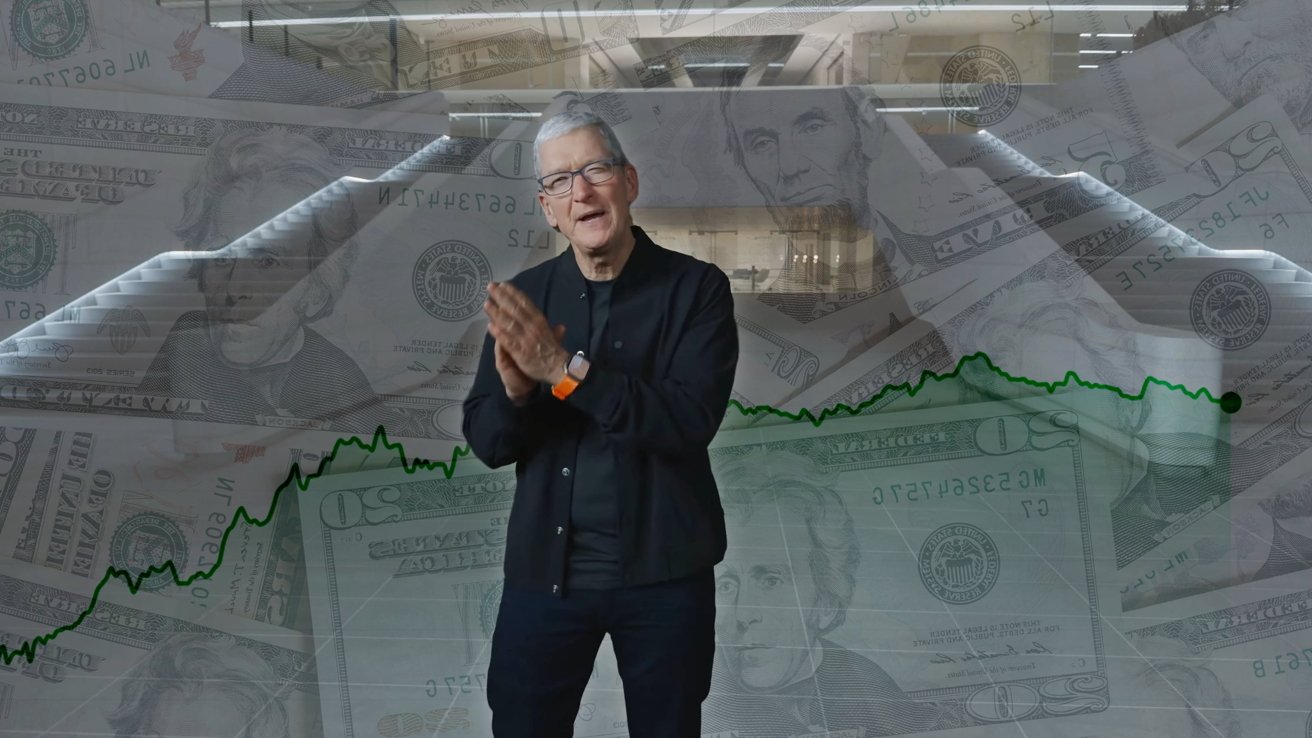

One day after the WWDC 2024 keynote, and the debut of Apple Intelligence, Apple's stock price has hit a record high price, reaching $207.15 at the close of market on Tuesday.

As usual for Wall Street, the stock price for Apple dipped on Monday after the first day of WWDC. But, after closing on Monday 1.9% down, things are turned around considerably on Tuesday.

At the end of the trading day Apple's stock price hit $207.15, a rise of 7.26% from its opening value of $193.65. During trading, the stock price hit a peak of $206.03 about halfway through which was also Apple's 52-week high at the time before the day's closure.

The stock price surge follows after Wall Street and the public had some time to digest Apple's big WWDC announcements.

Arguably the most impactful announcement was Apple Intelligence, the Cupertino tech giant's push to incorporate more machine learning and generative AI into its products and services. Stock analysts had been lamenting for over a year that Apple was quiet in the space, despite it being obvious for just as long that something was coming.

It is also probable that investors are fond of the idea that Apple Intelligence requires Apple Silicon chips, or the A17 Pro, in order to work. This limits Apple Intelligence to Macs made since late 2020, and the iPhone 15 Pro line and future iPhone models with sufficiently powerful chips.

It was just six days ago that Apple regained its $3 trillion valuation, mostly on the promise of what Apple was at the time about to announce at WWDC. The actual valuation remains hazy, as Apple continuously buys back its stock — and is in the process of another big buy-back.

In January 2022, Apple became the first company to reach a $3 trillion market capitalization, but then that market cap figure steadily decrease over the next year.

That decrease brought Apple back under $3 trillion, but it happened chiefly because of what were described as investor jitters.

This pattern repeated itself in June 2023, as Apple's valuation went back up over $3 trillion — only to again fall steadily immediately afterwards.

Apple started the year at $184.93. It had a rough early spring, though, with the stock falling as low as $165.00 on April 19. Those investor sell-offs were over what was perceived to be a lack of interest in iPhone 15 sales, and no visible artificial intelligence plan from Apple.

Just two weeks later, it beat Wall Street expectations for the quarter, increased its dividend, and launched another massive buyback program.

And now, the company has delivered on its promise to release artificial intelligence across the product line, with Apple Intelligence.

Malcolm Owen

Malcolm Owen

-m.jpg)

-m.jpg)

Christine McKee

Christine McKee

Chip Loder

Chip Loder

Oliver Haslam

Oliver Haslam

William Gallagher

William Gallagher

Amber Neely

Amber Neely

Andrew Orr

Andrew Orr

16 Comments

Long on Apple.

Watched the price go down during yesterday's keynote (Apple is doomed!) and then wondered how big the bounce would be today. As it turns out, pretty darn big. My stock account thanks you.

Mission accomplished.

No companies delivered on their presentation, let's see if Apple LLM will be able to.