Apple has announced that it will be ending its Apple Pay Later program, roughly one year after it launched it.

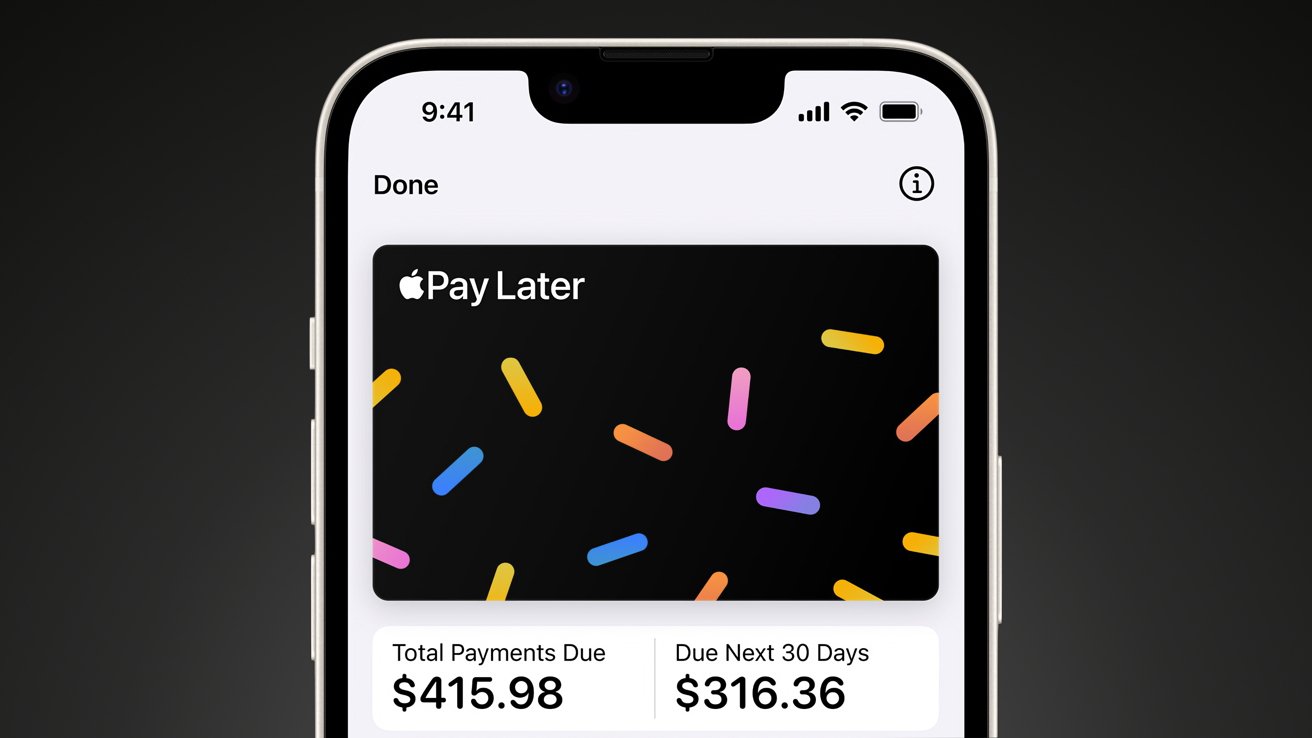

Initially launched in October 2023, Apple Pay Later was Apple's stab at offering Apple users a short-term financing solution that spread payments over six weeks.

Now, despite its success, it seems that the tech giant is killing off the program in favor of new features being launched later this year.

Apple provided a statement to 9to5Mac that said the company would instead be working with existing short-term loan programs, such as Affirm, to integrate those into Apple Pay.

Apple likely decided it didn't want to be in the short-term loan game, for reasons known only to itself right now. While Goldman Sachs issued the Mastercard payment credential, Apple Pay Later loans were actually backed by the tech giant itself.

Users with active Apple Pay Later plans can still manage and pay their loans through the Wallet app. Installment purchase plans for Apple hardware are unrelated, and are unaffected by the closure at this time.

Gains or losses from Apple Card and Apple Pay Later are embedded in Apple's Services revenue reporting. It's never been clear how many Apple Pay Later loans were issued.

In early June, Apple had announced that it would roll out new Apple Pay features in the fall. The announcement even telegraphed that Apple may be preparing to exit the short-term loan space.

The company said Apple Pay would offer greater flexibility and choice for checking out online and in-app. It would allow users to redeem rewards and access installment loan offerings from eligible credit or debit cards when purchasing online or in-app with iPhone and iPad.

The announcement also pointed out that Apple Pay users can apply for pay-later loans directly through Affirm when checking out with Apple Pay.

Amber Neely

Amber Neely

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

Andrew Orr

Andrew Orr

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Bon Adamson

Bon Adamson

-m.jpg)

12 Comments

I’m going to go a different direction. I’m wondering if Apple pulled back because it didn’t want to be accused of trying to push into Banking. They already are getting grief over being too powerful and moving from computers into phones, then music, then media and streaming… Perhaps they didn’t want to open another front for people to accuse them of bad behaviour. It’s not like this side of things is bringing them much money.

I completely forgot this existed.

The EU/DOJ is waiting and they will let us know when next %er in their region needs help.