Apple has reported its results for the fourth quarter of 2024, with revenue of $94.93 beating Wall Street expectations mostly on the strength of iPhone sales.

The final quarter of Apple's fiscal year, Thursday saw Apple release its results for the three-month period that concluded at the end of September. As the end-of-year results, it was also the opportunity for Apple to report its full-year results.

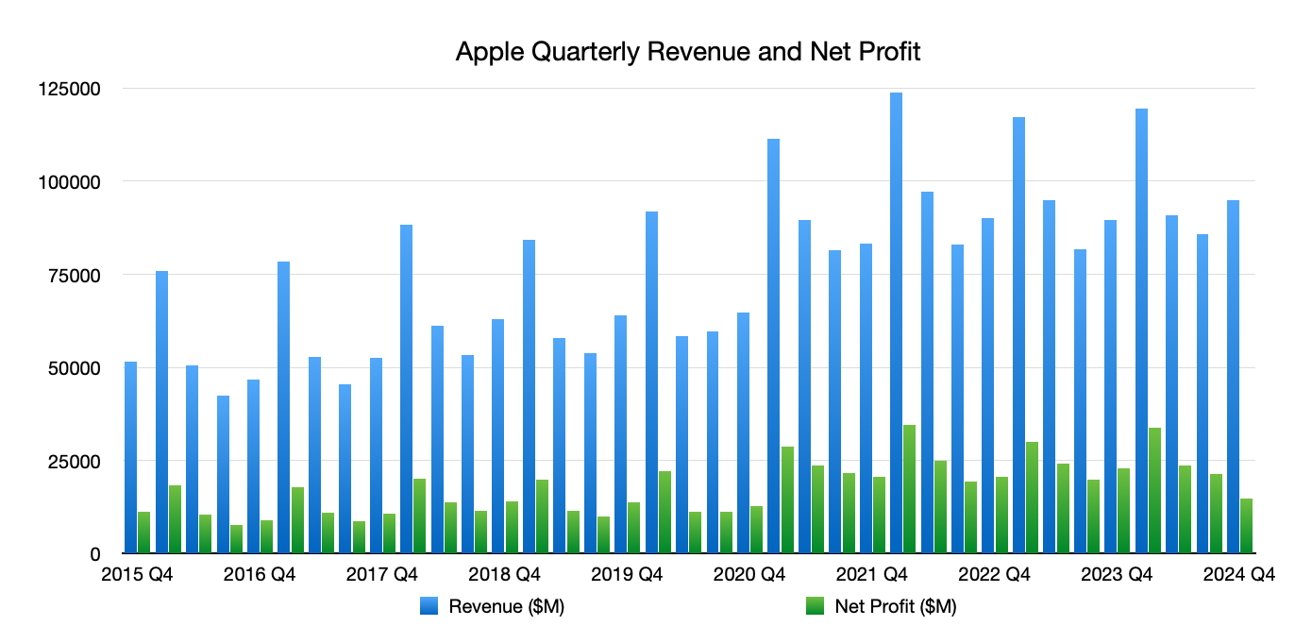

In the fourth quarter, Apple achieved $94.93 billion in revenue, up from the $89.5 billion it reported in Q4 2023. The earnings per share was also declared at $1.64.

The Wall Street consensus was for $94.4 billion in revenue and $1.55 for the earnings per share.

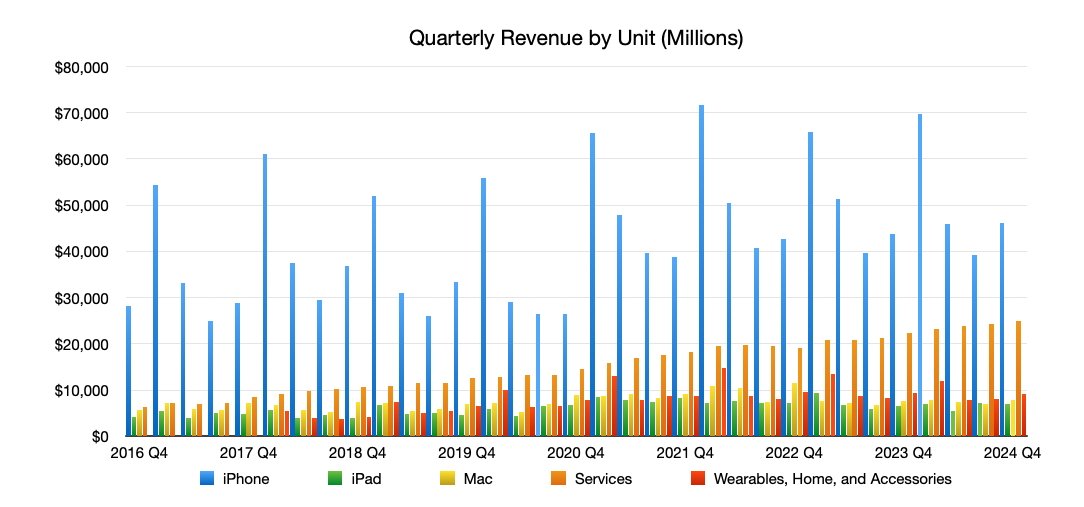

Revenue from iPhone was $46.22 billion, up 5.5% from $43.8 billion in the same quarter last year. Sales from iPad was $6.95 billion, an increase of 7.9% from $6.43 billion in the year-ago quarter, while Mac revenue rose from $7.6 billion one year ago to $7.74 billion this year, up 1.7%.

Services, a continually reliable source of growth for the company, continued its upward march from $22.3 billion in Q4 2023 to $24.7 billion this quarter, up 11.9%. Wearables, Home, and Accessories hit $9.04 billion, the only blemish in the figures, as it's down from $9.32 billion, a 3% decrease.

The product launches in the quarter include the iPhone 16 range, AirPods Max with USB-C, the Apple Watch Series 10, and a new black colorway for the Apple Watch Ultra 2. However, their launches will benefit Apple more in Q1 2025 since they launched late in Q4.

Third-quarter launches will make more of an impact on Apple's financials, due to there being an entire quarter of sales for them. That list includes the iPad Pro on M4, the iPad Air with M2, and the Apple Pencil Pro.

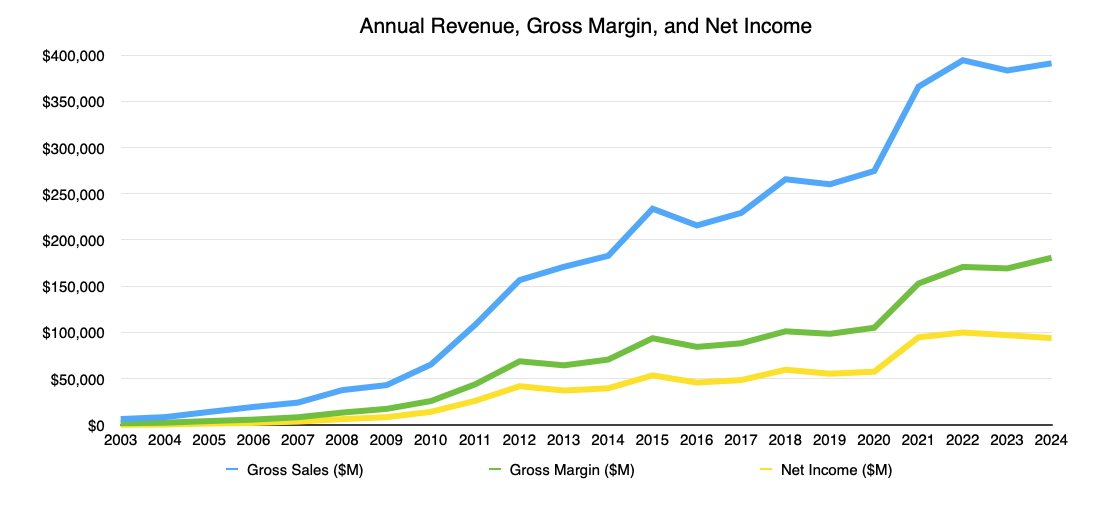

For Apple's full-year results for 2024, gross sales reached $391 billion, up from 2023's $383.3 billion. The gross margin hit $180.7 billion, up from 2023's level.

The results, and the following call with analysts, will be CFO Luca Maestri's last alongside CEO Tim Cook. Maestri is stepping down from his role in January, with VP of Financial Planning and Analysis Kevan Parekh taking over.

"Today Apple is reporting a new September quarter revenue record of $94.9 billion, up 6 percent from a year ago," said Cook.

"Our record business performance during the September quarter drove nearly $27 billion in operating cash flow, allowing us to return over $29 billion to our shareholders," said Maestri.

The outgoing CFO continued "We are very pleased that our active installed base of devices reached a new all-time high across all products and all geographic segments, thanks to our high levels of customer satisfaction and loyalty."

Malcolm Owen

Malcolm Owen

-m.jpg)

Chip Loder

Chip Loder

Wesley Hilliard

Wesley Hilliard

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

Amber Neely

Amber Neely

29 Comments

I keep telling people to not listen to the negative analysts. Three predicted disappointing iPhone sales this quarter, while two reported very good iPhone sales.

meanwhile, the stick went down $4.19during the day and is about $4.50 down after hours. I know the market is down today (Microsoft was down over $26, for example), but still

And once again, CIRP, Kuo and all the rest of the Apple naysayers who claim to have secret, proprietary knowledge about Apple sales GOT. IT. WRONG. Quelle surprise with these clueless clowns, so frequently headlined by AppleInsider. Turns out that looking at delivery wait times on Apple's website to predict how actual sales are doing is as stupid and unreliable as it sounds.

Plus consider this: early iPhone 16 sales outpaced those of the 15 last year, and the 16 didn't even ship with its marquee feature, Apple Intelligence. Analysts who actually know what they're talking about foresee unprecedented sustained strength in iPhone 16 sales as more AI features continue to roll out, creating another wave of buzz every time they drop. But yeah, Apple is doomed.

But...but... iPhone16 sales are "struggling".... that's what they said.