This week, Apple announced plans to change the way it outlines guidance, an effort apparently intended to thwart excessively enthusiastic analyst expectations that have resulted in a series of "misses" ultimately blamed upon the company itself.

"In recent years," Apple's chief financial officer Peter Oppenheimer noted in his prepared comments in the company's earnings call, "our guidance reflected a conservative point estimate of results every quarter that we had reasonable confidence in achieving.

"Going forward, we plan to provide a range of guidance that reflects our belief of what we are likely to achieve. While we cannot forecast with complete accuracy, we believe we are likely to report within the range of guidance we provide. Therefore, for the March quarter, we're providing revenue guidance of between $41 billion and $43 billion compared to $39.2 billion in the year ago quarter."

Fool me once, Can't get fooled again

For years, Apple has offered forward looking guidance outlining the minimum performance that company executives were reasonably confident they could reach over the coming quarter.

As the company's performance has accelerated over the past several years of rapidly increasing sales of iPods and then iPhones, iPads and new Macs, Apple has consistently trampled its own guidance, resulting in the cynical perception that the company's forward looking figures were excessively conservative, to the point where critics began describing them as "sandbagging."

Sandbagging figuratively suggests an effort to misrepresent one's own abilities early on in order to throw off one's competition. The term is often applied to billiard, chess or poker players who deceptively play under their true skill level in order to fool opponents into betting against them in a subsequent, higher stakes game.

While Apple certainly benefits from providing conservative guidance it can be fully confident about delivering, it would be absurd to suggest the company is attempting to hustle the market over the long term in a series of quarterly guidance "sandbagging," any more than card shark could repeatedly fool the same naive players to bet against it after a series of expert hands of card playing.

Raising the bar too high

On the contrary, Apple's consistent ability to exceed its stated guidance objectives has resulted in analysts setting their own expectations for the company, at a level significantly above what Apple has stated it is reasonably confident that it can achieve.

Thus, despite a series of record quarterly results Apple has set and then shattered as the company consistently outperforms the rest of the PC industry, the smartphone industry and other players in the media and mobile software markets, Apple has not consistently hit the inflated expectations of the market set by analysts hoping to guess by exactly how much the company will exceed its own guidance.

To stop this cycle of reported "misses," Apple will now provide a range of guidance, something many other companies already provide. By providing a realistic range, rather than a conservative minimum, Apple can effectively limit the expectations analysts can set.

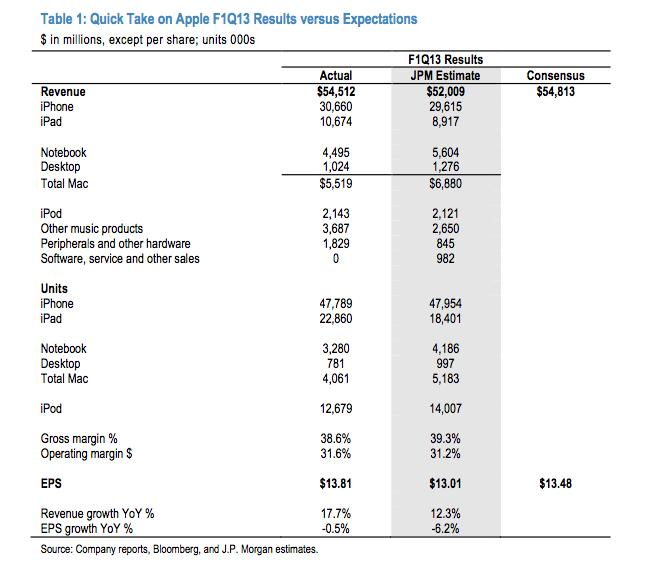

Following the announcement, a research note by J.P. Morgan analyst Mark Moskowitz observed, "we think the new guidance commentary is not much of a change and could restore beat-and-raise potential to the model."

Moskowitz added that the recent "sharp decline" in Apple's stock "was driven by a widening chasm between Apple’s fundamentals and investor expectations. The new guidance commentary did not help either. Investors are fearful that iPhone growth has peaked and consolidated gross margin is going to collapse. In contrast, we believe a still-ramping iPhone 5 can drive reaccelerating revenue growth, particularly as more wireless networks roll out LTE. While increasing sales of iPad mini could drag on gross margin, improving yields on iPhone 5 should provide a partial offset."

He also described Apple's new guidance approach as "no need to be frustrated," and stated, "Initially, the introduction of Apple’s new guidance approach of offering a range versus a single point of reference confused and frustrated investors last night. As the dust settles, though, we think that not much has changed. The mid-point of the new guidance range results in a similar % delta versus consensus estimates as had been exhibited in prior quarters when only a single point was offered."

Moskowitz's report added, "we think the company’s introduction of more explicit guidance commentary related to gross margin signals there is no cause for alarm. In recent weeks, there has been increasing bear mongering in the investor base that gross margin could collapse this year. In our view, the Mar-Q guidance for gross margin of 37.5% to 38.5% should dispel those bearish concerns. Equally important, we also think that the new guidance approach is intended to reset some of the more outlandish estimates across the sell-side and buy-side bases, which stands to set the stage for restoring beat-and-raise potential in the model."

Restoring reality to expectations

Under Apple's new approach to guidance, if an analyst sets expectations well outside the guidance range Apple outlines, it will be more clear that the "miss" is the fault of the analyst's math, not in Apple's ability to deliver upon performance targets.

Of course, for the strategy to be an effective deterrent to stop analysts from throwing out excessively unrealistic expectations that are not supported by facts, Apple will have to offer realistic guidance ranges and then not exceed its own stated objectives by too great of a margin.

If it can do this, the company stands a good chance of breaking the cycle of "misses" that have been recorded without regard for Apple's own guidance figures. Were Apple to simply begin offering a less conservative guidance target number, analysts would be induced to just raise their own expectations even higher, based on Apple's historical practice of handily beating its own guidance.

On the other hand, if Apple continues to offer a lowball guidance range and then shatter the upper end of that range with barnstorming results, analysts will likely continue using Apple's own guidance as a foundation for building their own lofty expectations. And as in the past, Apple will have a hard time meeting those external expectations simply because they are not realistically attainable, even by the world's most successful tech company.

Providing a range of guidance isn't the only change Apple has made in reporting its financials, as another Apple analyst has detailed to AppleInsider. Tomorrow, we will outline what other changes Apple has made, and the long term significance this analyst believes is behind the changes.

Daniel Eran Dilger

Daniel Eran Dilger

AppleInsider Staff

AppleInsider Staff

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Wesley Hilliard

Wesley Hilliard

Bon Adamson

Bon Adamson

Thomas Sibilly

Thomas Sibilly

75 Comments

The trouble wasn't Apples numbers but the analysts raising theirs way too high. Often off the rumors of what Apple might release etc. Then when their guess at the new whatever's features ones not come true they poopoo the sales estimates and rig the stock down

I'm thinking that this might end up being a good thing. The pundits, the analyst douchebags and other people who think that they know what they're talking about have been setting Apple up to fail, with their unrealistic expectations for Apple. I was looking at this historical Apple guidance chart last week, which I can't seem to find now, and it seems that this is nothing new for Apple, because they have reported this way in the past. Instead of just giving out one figure, they provided a range. And the interesting thing is that I don't believe that they had a single earnings miss, while they were using that method.

So, it seems like Apple is merely going back to their old system which they had used in the past. I wasn't following Apple's stock that far back, so maybe some old timers might remember it.

I'm going to see if I can find that chart which I came across last week.

Instead of Apple offering a prediction and a hundred analysts offering a prediction, why don't we all just wait and see what the sales actually were. It would save a lot of effort by a lot of smart people that could be put to better use.

Apple used to blow away the rosiest of expectations; how about returning to that?

I didn't find the exact chart which I was looking for, but I found a similar one, which shows what I was mentioning about Apple's guidance. Isn't Q1 2010 - Q3 2010 similar to what Apple has implemented now again? You can see how Apple provides a range, instead of just one figure.