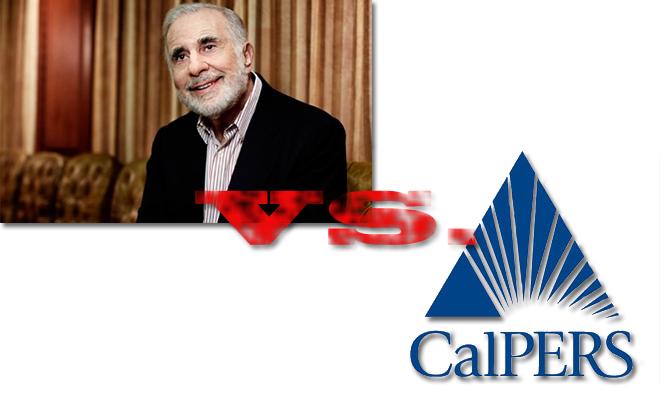

A behind-the-scenes quarrel between APPL shareholders Carl Icahn and the California Public Employees' Retirement System is becoming increasingly public as the two trade barbs over Apple's cash hoard.

With Apple's annual shareholder meeting three weeks away, activist investor Icahn is pushing hard for Apple to use a about one third of its $158 billion cash hoard to buy back stock. He has a $3.6 billion position on the company.

As officially filed in Apple's proxy statement, Icahn has a proposal up for vote that would see Apple buy $50 billion worth of APPL stock, which would in turn boost its price. At least over the short term.

On the other end of the spectrum is the nation's largest state pension fund, the California Public Employees' Retirement System, which has $1.6 billion invested in Apple. CalPERS' senior portfolio manager of investment Anne Simpson has taken a page out of Icahn's playbook and spoke with CNBC on Wednesday.

"Now, standing outside and lobbing a brick through a window really is not a sensible way to engage in the conversation," Simpson said. "We don't think Carl Icahn, who's a relatively small investor with a very short-term agenda, should be steering the board of Apple, which is a very big company, with a long-term future which many people are relying on."

Icahn disagrees, characterizing Simpson as misguided. In the past, Icahn has taken to media outlets, Twitter and even sent out open letter to shareholders to push his agenda, and today's debate is no exception.

"It's a shame that Anne Simpson is more interested in spewing pejoratives than improving corporate governance in this country, which CalPERS is in a position to do," Icahn said, adding that he does not consider himself a short-term investor.

Indeed, Icahn Enterprises owns a number of stocks for which it has long-term positions. However, Icahn's investment style of buying huge chunks of a company's stock and advising the boards of those companies as to how best to manage their business, is seen by some as being detrimental to long-term investors.

CalPERS, on the other hand, is more passive as it manages the pensions of California state employees.

"I think this is more sound and fury than sensible advice, and what really needs to happen is the long-term owners should be there backing Apple in a rational, sensible and efficient deployment of capital.," Simpson said. "We don't want the company to be distracted by short-term noise."

With his aggressive style, Icahn Enterprises has posted an annualized return of 26.6 percent over the past ten years compared to CalPERS' 7.1 percent over the same period, the publication said.

For its part, Apple's board has recommended shareholders vote against Icahn's proposal, noting that the existing plan is to buy back $100 billion worth of stock through 2015, dishing out dividends to shareholders.

Apple's shareholder meeting is slated for Feb. 28.

Mikey Campbell

Mikey Campbell

-m.jpg)

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

Christine McKee

Christine McKee

Chip Loder

Chip Loder

Marko Zivkovic

Marko Zivkovic

90 Comments

This is the clash I want to see on the Apple TV WWF channel.

But, you know, in the ring, in tights, and with ludicrous intros and actual wrestling moves.

The guy owns 0.787% of Apples current market cap, he should come back with some serious money, then he can have a say.

Thanks for the reminder to vote No. Cue the Carl Icahn posts.

Boy, talk about suckers. APPL was de-listed a long time ago; they are still buying shares?! AAPL is likely a better investment.

Yeah, thanks Carl for reminding me to just vote....NO!

When I see an investor's rate of return, I wonder exactly what the true cost was. Companies going under or becoming non-competitive in their markets. People losing their jobs. Great for people like Icahn, but they leave a rather dismal state of things behind them.