On May 15, Apple will pay "shareholders of record" the company's new higher quarterly dividend of $3.29 per share, but investors need to have purchased the company's stock by the market's close on Wednesday in order to qualify.

Apple has been automatically paying its shareholders a dividend about a month and a half after the end of each fiscal quarter ever since it declared its modern dividend plan in the summer of 2012.

At the current stock price of $592 at its close today, the dividend yield is 2.22 percent. Apple recently announced that it would increase its dividend from the previous $3.05, the second increase in two years.

The new dividend amount is an odd $3.29, making it equally divisible by seven. In June, Apple will split its stock 7-1, an action that won't have a direct impact on its share value because the stock price, dividend and outstanding share count will all be adjusted by the same multiple.

AAPL Dividends & Buybacks

The stock market (in Apple's case, NASDAQ) automatically adjusts the value of the company's stock by the value of the dividend, as the dividend reduces the value of the company because it is paid from the company's cash holdings.

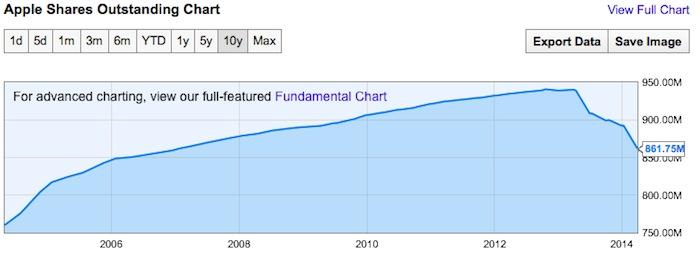

Dividends are a minority portion of Apple's shareholder capital return program, the majority of which has been earmarked for buying back outstanding shares, which increases the scarcity (and therefore value) of Apple's stock by taking shares off the market and retiring them. Removing shares from circulation also enhances the company's closely-watched earnings per share metrics.

Over the past year, Apple has been paying out around $2.8 billion in dividends every quarter, a figure that had increased 15 percent over the $2.5 billion Apple had been paying in 2012, before it first increased its dividend payments last May.

However, Apple has now bought back and retired so many of its shares that its total dividend payment across its outstanding shares has now dropped down to $2.7 billion.

Last quarter, the company spent an additional $18 billion on stock repurchases, and announced the retiring of over 30 million additional shares.

Apple had just $14 billion of its original $90 billion stock buyback plan remaining when it increased the program last month. Since the stock buybacks were initiated, Apple has retired 80 million shares.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

Christine McKee

Christine McKee

Chip Loder

Chip Loder

Marko Zivkovic

Marko Zivkovic

61 Comments

I'm not claiming that this would be a good idea or even profitable, but technically speaking, I assume that somebody could buy some shares of AAPL on Monday, May 12 at 3:59 PM, and then dump all those shares on Tuesday, May 13 at 6:01 AM, and still receive the dividend? Is that correct?

The times listed are EST.

[quote name="Apple ][" url="/t/179197/shares-of-apple-inc-near-ex-dividend-as-it-gears-up-to-distribute-2-7-billion-to-shareholders#post_2529145"]I'm not claiming that this would be a good idea or even profitable, but technically speaking, I assume that somebody could buy some shares of AAPL on Monday, May 12 at 3:59 PM, and then dump all those shares on Tuesday, May 13 at 6:01 AM, and still receive the dividend? Is that correct? The times listed are EST. [/quote] I believe you can yes. But you gotta take into consideration fluctuation and commissions in there as well.

if it was at all possible, i would buy back all of carl ichan's stock. get that guy out before he tries another ridiculous stunt.

I think technically you are correct, but it doesn't really work that way. I think the trade takes 3days to settle before you're the "shareholder of record." And in any event, the shares will open down by about the dividend amount after it's paid.

[quote name="Apple ][" url="/t/179197/shares-of-apple-inc-near-ex-dividend-as-it-gears-up-to-distribute-2-7-billion-to-shareholders#post_2529145"]I'm not claiming that this would be a good idea or even profitable, but technically speaking, I assume that somebody could buy some shares of AAPL on Monday, May 12 at 3:59 PM, and then dump all those shares on Tuesday, May 13 at 6:01 AM, and still receive the dividend? Is that correct? The times listed are EST. [/quote] Overall it's more complex than I'll make it out to be here but the general rule that will apply to everyone(?) on this forum is that you need to purchase the stock 3 days before the record date in order to get counted for that payout. In this case the record date is May 12th so you'd have to buy before the close of the market on May 6th. After the close of business on May 12th you could then sell your shares and still get a dividend payout. [LIST] [*] http://investor.apple.com/dividends.cfm [/LIST] edit: Corrected dates.