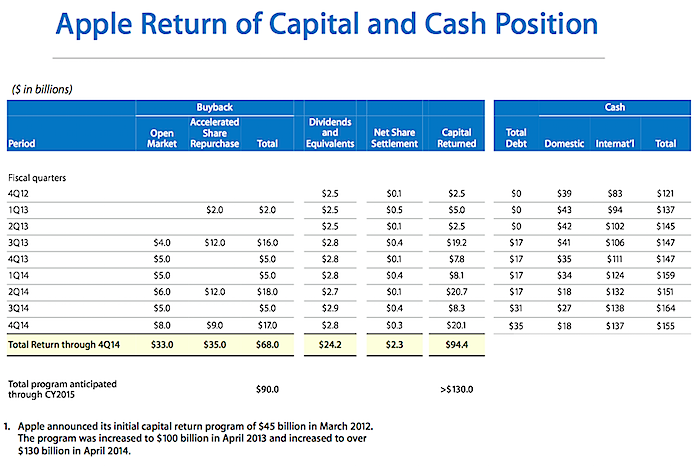

During its fiscal Q4 ending in September, Apple spent an incredible $17 billion to buy up its own stock, increasingly doing so on its own without outside bankers' assistance. Since the beginning of fiscal 2014, Apple has spent an astounding $45 billion to repurchase its stock from fleeing investors at incredible discounts.

A $17 billion windfall for AAPL investors

Apple's chief executive Tim Cook almost casually noted during the company's earnings call this week that Apple had spent another $17 billion on stock buybacks in the September quarter, over three times as much as it spent in either the previous June quarter or its year-ago September quarter.

"Our strong results continue to generate significant cash and we're extremely happy that this has enabled us to make substantial investments in Apple's future, while retaining — while returning cash to our shareholders," Cook stated. "We had executed aggressively against our share repurchase program, spending $17 billion in the September quarter alone and $45 billion in the last year."

The unexpected windfall for shareholders is not only huge, but was also executed differently: rather than relying mostly on banking partners to execute an "Accelerated Share Repurchase" on its behalf, Apple performed almost half of the buybacks on its own, spending an all-time record $8 billion to buy back shares on the open market while issuing a smaller than usual $9 billion on its fourth ASR.

Curiously, Apple's massive quarterly buyback— involving at least three times the capital that the company is purportedly spending on its years long, massive Campus 2 construction project (below)— was all but ignored by the same members of the media who had earlier found it newsworthy that a large man from Canada could destroy an iPhone 6 Plus using only his hands.

Apple's unexpected stock buyback acceleration

Apple's stock is now hovering around an all time high, having appreciated 37 percent over just the past year. However, for half of the last twelve months (and throughout all of 2013), Apple shares have languished at prices from 60 to 75 percent of their current valuation.

Despite recent gains, Apple's current price is only 3 percent higher than it was two years ago at the launch of iPhone 5, even as the company continues to syphon off the majority of all profits in the PC, mobile phone and tablet markets with a series of blockbuster hits that have crushed struggling rivals' beleaguered efforts to follow its lead, from Microsoft's Surface to Google's Moto X to Amazon's Fire Phone and Samsung's Galaxy lineup.

Since initiating its buyback program two years ago, Apple has worked to aggressively use its capital to take advantage of irrational stock market valuations in what has turned out to be the largest stock repurchase program (setting multiple records both per quarter and in trailing twelve-month buyback activity) since the SEC enhanced the transparency of issue repurchases in 2005, and undoubtedly the most successful.

Some shareholders, including vocal activist investor Carl Icahn, have regularly opined that Apple should do even more to buy back its own shares, estimating that the company's appreciation over the last two years is just the beginning and that it is on a trajectory to again double in value in the near term.

"Apple remains dramatically undervalued," Icahn wrote in an 'open letter' to Apple's executive team, stating, "Our valuation analysis tells us that Apple should trade at $203 per share today, and we believe the disconnect between that price and today's price reflects and undervaluation anomaly that will soon disappear."

Apple's liberal spending on buybacks, and its increasing focus on open market purchases, indicates that the company agrees that its stock remains incredibly undervalued by investors.

Apple's 2014: the largest stock buyback, anywhere, ever

If there is any remaining doubt that Apple is greatly undervalued, that it has tremendous piles of cash and that the executive team of the world's most successful company collectively believes that the best investment of its cash is in itself, Apple has erased it with its fiscal 2014 buyback activity.

In the previous fiscal year 2013, Apple spent "just" $23 billion on buybacks, nearly half of what it spent over fiscal 2014. Over the course of both years, Apple's stock has languished at absurd lows after being derailed two years ago on concerns that its growth rate was slowing.

Cook first announced Apple's current dividend and share buyback plan in March 2012. At the time, Apple's share price was around $85 (split adjusted).

Beating stock manipulators at their own game

By the time Apple's buyback program began at the start of fiscal 2013 (beginning in September 2012), Apple's share price began to collapse. The company's shares continued to fall and remain low throughout 2013, dipping as low as $55. That provided Apple with the perfect conditions to buy up its own stock, using its capital to retire shares from the market— an action that concentrated the value of shareholders' stock and polished the company's fundamentals.

In its year-ago Q4 (ending September 2013), Apple "only" spent $5 billion on share buybacks, leading into the company's blockbuster holiday quarter. However, media coverage in January 2014 bizarrely described Apple's record Q1 as "disappointing," resulting in another collapse of the company's share price.

As Apple's stock plunged in value overnight from $78.50 to below $72 (and then continued there through the end of January 2014), the company's executive team took quick action to supercharge its share repurchase program, immediately spending $14 billion of its remaining buyback budget to snatch up its shares at a huge discount.

One week into February, Apple's chief executive Tim Cook revealed that Apple's executive team had jumped at the rare opportunity. The company later officially reported that it spent a total of $18 billion on stock buybacks in fiscal Q2, ending in March.

During the June quarter, Apple reported spending another $5 billion, directly buying back 58.7 million shares off the open market at an average price of $85.23. It appeared Apple would continue to buy back shares at the same $5 billion per quarter pace, as it had in 2013. Instead, Apple more than tripled its pace over the past quarter.

Accelerated share repurchase with less Accelerated Share Repurchase

Apple had historically used Accelerated Share Repurchase (ASR) to spend large amounts of capital rapidly on share buybacks. Under an ASR, a company buys its shares from an investment bank, which essentially shorts the stock by borrowing shares (typically from its clients) which it then delivers to the company for a fixed, upfront price.

Over the term of the ASR agreement, the investment bank then seeks to buy shares to replace those it has borrowed. Buying back shares via an ASR is usually more expensive because the bank wants to profit from the transaction. However, the slight price premium allows the company to spend a fixed amount of money rapidly and immediately reduce its outstanding share count.

While Apple fronted the money right away and retired the initial proceeds of borrowed stock, the company's banking partner continued to buy back shares over the year-long term of the agreements. This quarter, Apple issued its fourth ASR at "just" $9 billion, a steep drop from its previous $12 billion ASRs. At the same time, the company shifted its typical $5 to $6 billion open market buybacks into an $8 billion spend, a move that appears aimed at getting the best price without paying bankers for their help.

Apple has $36 billion remaining in its currently articulated capital return program. Apple's chief financial officer Luca Maestri reiterated during the Q4 conference call this week that "we review our capital allocation regularly. We have solicited feedback on our capital return program from shareholders in the past and we will continue to do so. We plan to report on our conclusions in a timeframe similar to last year."

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Christine McKee

Christine McKee

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Amber Neely

Amber Neely

Sponsored Content

Sponsored Content

Wesley Hilliard

Wesley Hilliard

53 Comments

In surprised Apple is not being investigated for that, if for no reason other than, [I]because[/I]

$17B for one quarter for one company is a stunning figure -- that's probably close to one-seventh of the entire value of share buybacks by US companies last quarter.

I hope Apple loaded upon its own shares last week as well. (I did, with whatever cash I could spare.)

Experts say to 'study success,' then emulate its formula. Using this model, maybe GT Technologies people should buy up as much stock as they can while it is low & then...well, then....then, they'd really have something! Especially so, if Apple took it over & ran it successfully for a huge profit & share gains.

In surprised Apple is not being investigated for that, if for no reason other than, because

"Members of Congress, the NSA, the FBI and the New York Stock exchange all swarmed Apple's headquarters today demanding answers...and a free iPhone 6."

Experts say to 'study success,' then emulate its formula. Using this model, maybe GT Technologies people should buy up as much stock as they can while it is low & then...well, then....then, they'd really have something! Especially so, if Apple took it over & ran it successfully for a huge profit & share gains.

GTAT has been withdrawn from transactions if i'm not mistaken.