Lofty expectations were beyond the reach of Apple last quarter, sending shares tumbling more than 7 percent. But a number of bullish analysts see the stock pullback as a buying opportunity for investors, who can get in at a cheaper price before the launch of new iPhones.

Though reactions were mixed after the results of Apple's fiscal 2015 third quarter, high-profile analysts stood by the stock and maintained their optimistic outlook. AppleInsider offers a summary of how Wall Street reacted to the results of Apple's June quarter.

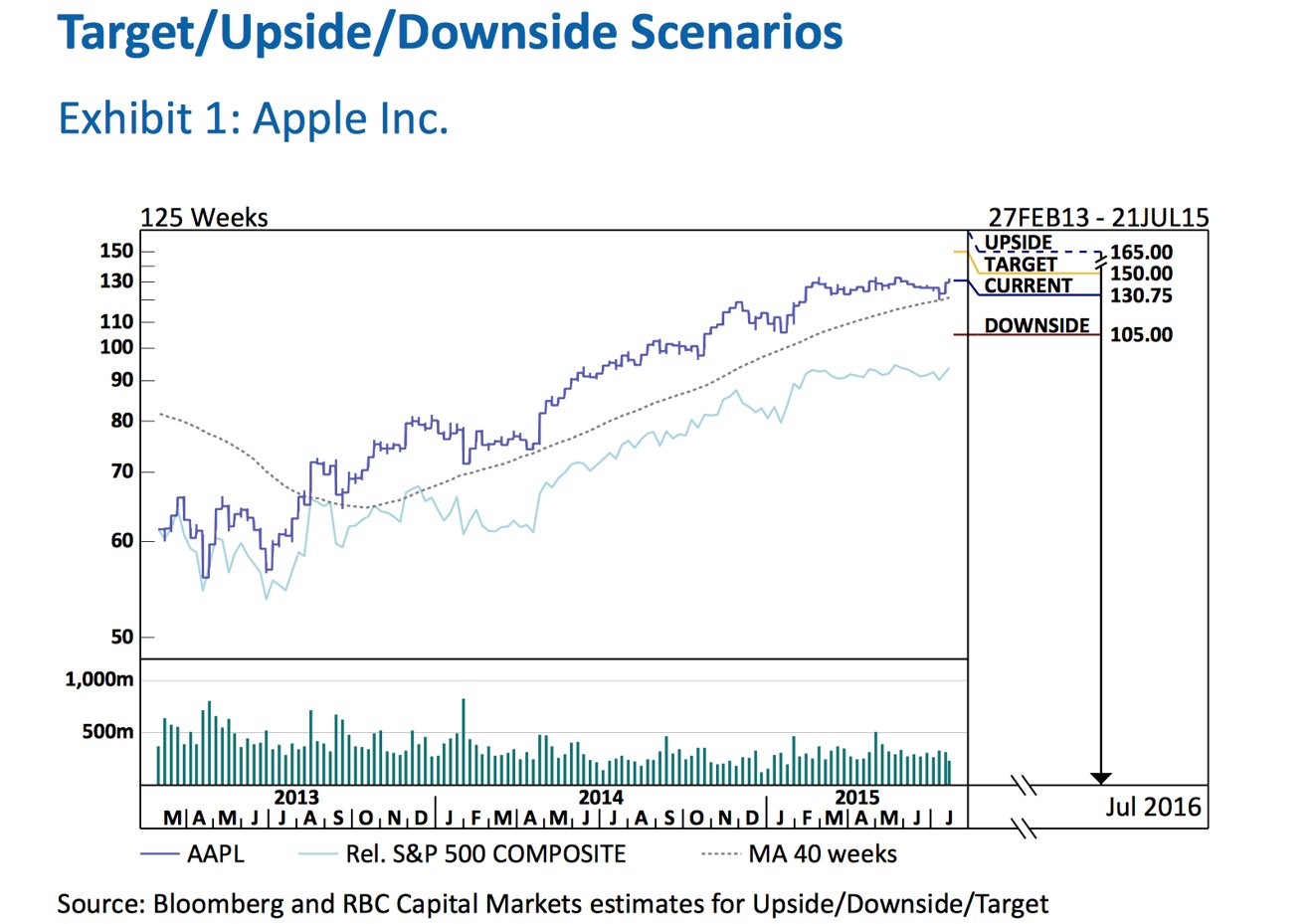

RBC Capital Markets

RBC, Piper Jaffray, Morgan Stanley, UBS, and J.P. Morgan all see an AAPL selloff as an opportunity for investors to buy at a discount.

Apple's June quarter helped to reset market expectations to more realistic levels, in the eyes of analyst Amit Daryanani. He sees a number of data points from the June quarter that should give investors confidence, including:

- Only 27 percent of the iPhone install base has upgraded to the iPhone 6 and iPhone 6 Plus, meaning there is plenty of room for growth for an anticipated "iPhone 6s" series.

- Apple's gross margin guidance was down 70 basis points, but Daryanani said that number is "minimal" given the transition to a new iPhone product line and foreign exchange challenges. He believes margins could return to above 40 percent in fiscal 2016.

- Only 12 percent of China has 4G LTE coverage, which gives even more room for iPhone expansion in the nation of over 1 billion people

- iPhone average selling price remained strong at $660, revealing customers are opting for higher end models with more memory or a larger screen.

RBC Capital Markets has maintained its "overweight" rating for AAPL stock, with a price target of $150.

Piper Jaffray

Analyst Gene Munster also said he's an AAPL buyer on the market pullback after the company's third-quarter results. He believes Apple will continue to gain share in the high-end smartphone market, and that margins will improve in the anticipated "S" iPhone product cycle.

Apple shipped a record 47.5 million iPhones in the quarter, but that came in short of market expectations, some of which were well over 50 million units. But Munster noted that Apple reported significant market share gains in the quarter, and the company also reduced some of its channel inventory ahead of an upcoming product refresh.

"Setting aside that investor expectations for the iPhone were higher than reported, iPhone unit sell-through grew 36 (percent year over year) vs. the overall smartphone market's growth in the low-teens," Munster wrote. "We believe that as with prior quarters, this demonstrates that the iPhone 6 cycle remains strong and it appears the strength should be able to continue into (calendar year 2016)."

Piper Jaffray has maintained its "overweight" rating with a price target of $172.

Morgan Stanley

Following an expectations reset last quarter, analyst Katy Huberty sees an "attractive" investment in Apple. She's particularly encouraged by more realistic iPhone expectations, which she said will help to "de-risk" the second half of calendar 2015.

With strong demand, a $660 average selling price, and 73 percent of the installed base yet to buy a larger-screened iPhone, Huberty believes that Apple can grow iPhone units year over year heading into the "iPhone 6s" product cycle.

Morgan Stanley has maintained its "overweight" rating for AAPL stock with a price target of $155.

J.P. Morgan

The immediate selloff of AAPL shares following its quarterly results was "overdone," in the eyes of analyst Rod Hall. He said that better than expected iPhone average selling prices actually drive a slight increase to his forecasts for the company.

Hall said that investors should use "any weakness in trading to add to holdings."

Hall has increased his fiscal year 2016 earnings per share estimate by 2 percent to $10.35, and has also increased his iPhone average selling price estimate and gross margin assumption. He's also established a December 2016 price target of $145, and reiterated an "overweight" rating.

UBS

Though iPhone shipments were "light," analyst Steven Milunovich sees long-term value being built. In his view, there's no reason for investors to get scared out of the company's stock.

"We see limited downside as long as the gross margin stays in the upper 30s," Milunovich wrote. "stock price appreciation depends on Apple showing some iPhone unit growth in (fiscal year 2016)."

He was particularly bullish on the iPhone average selling price, which was up $99 year over year even with a $24 currency hit from foreign exchange rates.

UBS has maintained its "buy" rating with a 12-month price target of $150.

FBR Capital Markets

As the "gold standard" of technology, Apple is held to a higher standard than its peers, said analyst Daniel Ives. In addition to lower-than-expected iPhone sales, market watchers have also expressed concern about Apple's September quarter guidance.

But Ives remains focused on the growth story in China, where Apple continues to see significant gains. In the last quarter alone, revenues were up 112 percent.

For that reason, Ives said he remains bullish on Apple, and has maintained his "outperform" rating. In light of the stock's losses, however, FBR has reduced its price target on AAPL from $185 to $175.

Cowen and Company

Not all analysts remain bullish on Apple after its June quarter, however. Timothy Arcuri downgraded the stock to "market perform" after its results were disclosed, and trimmed his price target from $140 to $130.

Arcuri cited a "tepid" quarter for iPhones, and also "mounting China demand concerns." The analyst also said his sources in the supply chain suggest that new iPhone builds could be down from the previous product cycle for the first time ever.

"In time, we expect new service offerings will ultimately pull through meaningful hardware sales, but for the near and even medium-term, iPhone units remain the key driver for the stock," Arcuri said.

Wells Fargo

Finally, Apple bear Maynard Um has also maintained his "market perform" rating for the company. He said that while Apple's results may have been good "in a vacuum," they disappointed relative to expectations.

"While management indicated only 27 percent of pre-6/6s active users have upgraded to the newest iPhones, we note that the base likely includes refurbished and hand-me-downs, which we would argue may not be ripe for upgrade," Um said.

Wells Fargo has issued a valuation range of between $125 and $135 for AAPL stock.

Neil Hughes

Neil Hughes

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

61 Comments

Even this headline, that Apple "missed" expectations, is part of the problem. They missed financial analysts expectations, but beat their own guidance. I know I would rather follow what the company says to expect, than to use an outsider's either high or low numbers, which they do mostly to manipulate stock pricing. It's crazy that some companies who perform below expectation, see upward ticks in their stock, but Apple seemingly can't win, as increases in sales and profits still send the stock sliding. Again, it only makes sense if the market is simply trying to manipulate Apple stock price.

Are these the same analysts that set the "lofty expectations" which resulted in the "miss" and caused the dip in the stock, only to recommend a buy the day after?

9.75 out of 10 analysts suffer from head in rectum disease. Won't you please help to find a cure?

[quote name="sog35" url="/t/187315/market-watchers-see-buying-opportunity-as-apple-shares-slide-after-june-quarter-miss#post_2751222"]This is how full of shit these analysis are. When Apple released earnings in April here was the estimates for the June Quarter: [COLOR=000000][B]Q3 revenue forecast:[/B][/COLOR][COLOR=000000] $46-$48 billion versus [SIZE=26px][B]$47 billion expected[/B][/SIZE][/COLOR] [COLOR=000000]Read more: [COLOR=003399][URL=http://www.businessinsider.com/apple-q2-earnings-2015-4#ixzz3gd4LRXDA]http://www.businessinsider.com/apple-q2-earnings-2015-4#ixzz3gd4LRXDA[/URL][/COLOR][/COLOR] [COLOR=000000]So analysists were expecting June quarter revenue to be $47 billion in April.[/COLOR] [COLOR=000000]But as we got to May, Jun, and Jul they kept on raising their revenue expectation until it was impossible for Apple to reach it (over $50 billion)[/COLOR] [COLOR=000000]That right there tells you this is manipulation. Why the HELL did the analysist raise their revenue expectation from $47 billion to $50 billion since April? The only reason is to either save face if Apple had another blowout or to make it impossible for Apple to exceed 'expectation'[/COLOR] [/quote] Yep.

Those low upgrade numbers are curious indeed. In theory just about every iPhone 5 owner is eligible by now, as well as most 4 and 4S owners (assuming they bought new).