Hoping to persuade possible Mac buyers that Apple charges an arbitrary "tax" for its computers, Microsoft has paid one analyst to create a report that portrays Windows PCs as less expensive — even if it has to artificially pad the Mac's price and hide Windows' costs to get there.

In the study, Kay claims that Apple has marginalized itself and its market share by producing a closed ecosystem that only allows users to buy Mac OS systems from Apple and thus prevents them from buying models that are potentially cheaper or in more appropriate configurations. The company has deliberately chosen to ask a premium for a small range of computers and, as a consequence, locked itself out of the wider market — a boon when the economy was doing well and Windows Vista poorly, but not in the current financial climate, the analyst says.

"Apple’s premium pricing strategy actually enhanced the products’ appeal (for a select few). As in, only I can afford this fancy stuff," Kay writes. "[But] by holding a price umbrella over the entire market, even with arguably better products, Apple allowed the entire Windows ecosystem to establish itself underneath... Mac users may be paying more for image than substance and investing heavily in coolness that’s cooling off."

He also echoes Microsoft's recent marketing lines by questioning whether Apple systems are "really so cool" given the alleged extra overhead. Coincidentally, Microsoft has released a third anti-Apple ad which sees a mother and son that go to Best Buy to look for a gaming-capable notebook below $1,500. They dismiss Macs as too expensive and too small, ultimately buying a 16-inch Sony VAIO FW instead.

To illustrate his point, Kay draws comparisons between Macs and purportedly equivalent systems, but it's here that Microsoft's position as the source for the report manifests itself in multiple factual errors as well as calculated additions or omissions.

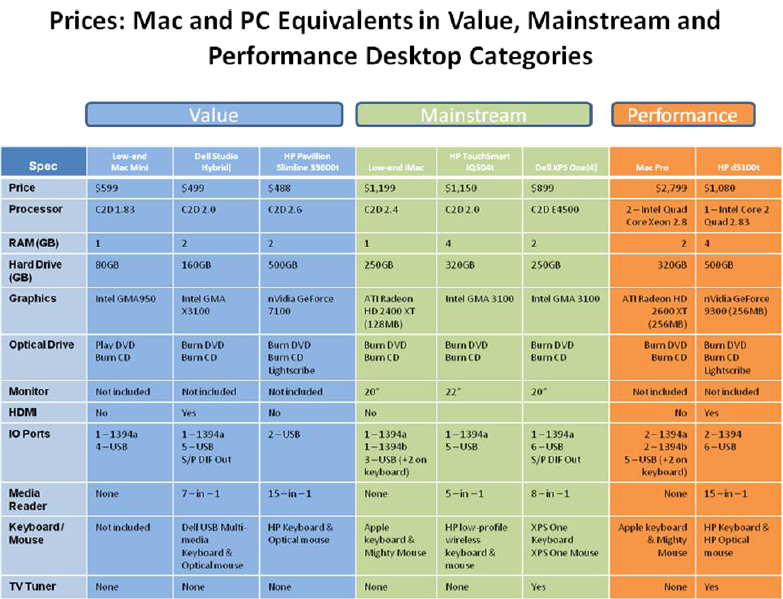

Roger Kay's notebook comparison: note the obsolete MacBook used as an example.

While pointing out that Apple's MacBooks lack memory card readers or HDMI video output, Kay uses an already-obsolete version of the white, $999 MacBook to portray the system as slower than less expensive PCs from Dell and HP. And while certain features such as the amount of memory and hard drive space are unambiguously in the Windows PCs' favor, he also consciously overlooks other figures when they would tilt in favor of Apple, such as newer processor generations or faster graphics chipsets.

The presences of Bluetooth or faster 802.11n Wi-Fi support, as well as portability considerations such as battery life and system weight, are also excluded from the available data.

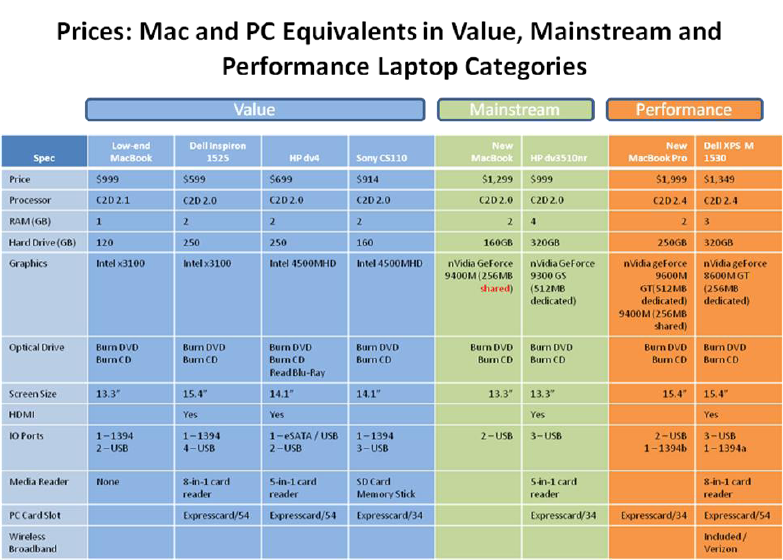

Many of the same errors are repeated and at times magnified for desktops. Even when discounting glaring mistakes made in describing only discontinued Macs in charts but new models in text, the analyst dismisses the relevance of significantly faster graphics in the Mac mini, iMac and Mac Pro while simultaneously trumpeting relatively small advantages in the Windows PCs, like card readers and TV tuners. The processors, amount of memory, and storage in current-generation Macs are now equal to and sometimes better than the Dell and HP systems chosen by Kay and Microsoft for the comparison chart.

Unusually, Kay and Microsoft also choose to sidestep Apple's higher-end iMacs altogether and try to equate a Mac Pro with a HP Pavilion desktop; according to the paper, a modern Xeon workstation is feature-equivalent to a mid-range home system with a previous-generation Core 2 Quad processor and slower graphics.

Roger Kay's desktop comparison; all the Macs illustrated are obsolete and now outmatch rivals in some areas.

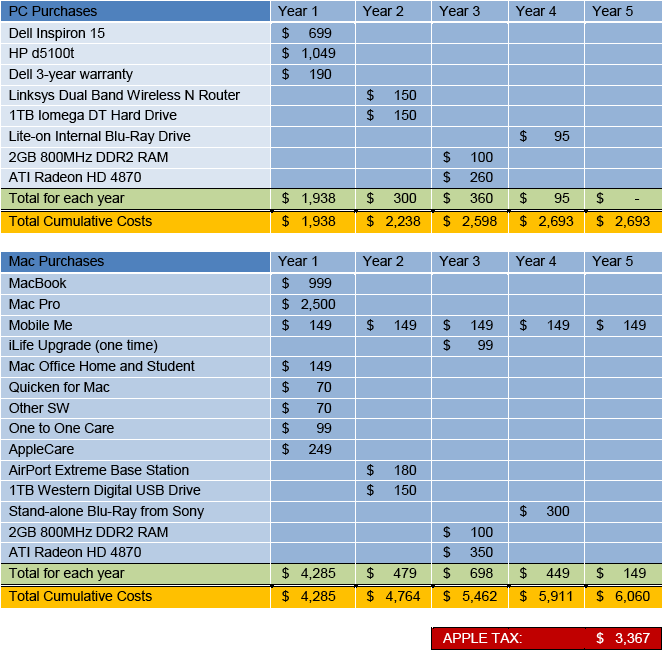

The Endpoint researcher further attempts to exaggerate any difference by attempting to portray a real-world scenario for buying a high-end desktop, a low-end notebook, accessories and software over a five-year span. Here, he claims a $3,367 "Apple tax" over the period but pushes the cost of the Apple system upwards by selectively adding systems and add-ons to the Mac that are unnecessary. Aside from picking the significantly more expensive Mac Pro instead of a 24-inch iMac, Kay forces the Mac buyer to maintain a 5-year subscription to MobileMe, a year of One-to-One service at an Apple retail store, an upgrade copy of iLife, and to buy copies of Microsoft Office and Quicken that he presumes the Windows user already owns.

Moreover, he insists that the Mac buyer must also make stranger and arbitrarily more expensive hardware purchases to equal the Windows sample. Rather than buy the equally Mac-compatible Linksys wireless router, the Mac owner is pushed to buy a more expensive Airport Extreme unit, and is told that a stand-alone Sony Blu-ray movie player meant for TVs is equivalent to an internal Blu-ray drive for computers, adding $205 to the price.

All told, the Mac user in a typical situation is asked in the study to pay $2,517 more than would be necessary over the period, assuming the example shopper buys a $1,799 iMac. While a gap still exists, the difference closes to just $850 and assumes not only that the systems are equivalent but that the Windows user has no other hidden costs, such yearly subscriptions to security suites (which remain more common than free alternatives) or the bundled trial software used to subsidize the actual cost of the PC.

Kay's five-year plan for Macs and Windows PCs. Note the Mac Pro, Sony movie player and unequal purchases of services and software.

Kay has already had an opportunity to present his point of view on the report since its publication and told CNET on Thursday that Microsoft had padded costs even further in the information it initially hand-fed to him to produce the report; if he hadn't excluded these, the portrayed gap between the Apple and Windows purchases would have been even higher. Still, he contends that it "wouldn't change things much" if he found some additional costs to pare back.

Endpoint's author also maintains that, despite the obvious discrepancies, Microsoft's core argument remains: since Apple only offers a relatively small collection of systems, buyers are less likely to get the exact systems they want or to know they're being charged fair prices.

"That particular piece of the economics seems to hold up pretty well," he claims.

Katie Marsal

Katie Marsal

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

Christine McKee

Christine McKee

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Andrew O'Hara

Andrew O'Hara

343 Comments

Microsoft's on a roll

Funny thing is that had they done a "fair" comparison, there would STILL be an Apple tax, and Microsoft wouldn't have to lie about what Apple charges for products. But being greedy completely destroys the validity of the study and thus it's complete trash.

Granted, even I have a MacBook Pro and I try to avoid the "Apple" tax as best I can by buying on eBay or refurbished. Plus, everyone seems to forget that Apple products sell MUCH better on the 2nd hand market than any PC EVER will. This is probably because of the premium charged on Apple products.I wouldn't call it an Apple "tax", it's more like an Apple "investment" that you could potentially get a positive return on if you play your cards right.

Damn these guys are desperate, seems Apple has them scared sh!tless.

Why they don't address their Microsoft tax?

I'm guessing the shill, er author, left out any mention of resale value.

If Kay or any Microsoft employee owns a single product that is more expensive than the cheapest example that does the same thing, they have completely invalidated this report (and much of their marketing strategy recently). This includes their brand of cars, furnishings, clothes, and food. They would have us believe that Microsoft is an ascetic paradise.

So why aren't they all running Linux if that's the game they want to play?