In spite of concerns touted around the web this week that Apple has arbitrarily padded its margins with the release of its latest iPod, a new teardown from iSuppli obtained in full by AppleInsider reveals that the third-generation iPod shuffle costs the same amount of money to manufacture as its predecessor did two years ago.

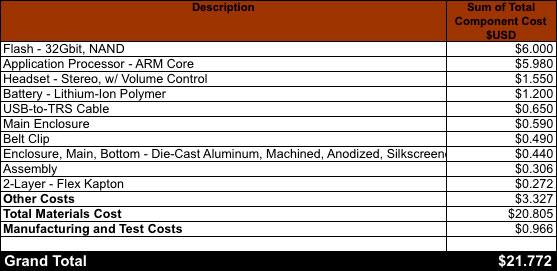

As a result of this and other fluctuations in component prices, a standard version of the shuffle costs virtually the same to make as it did in the past: the pure manufacturing and part costs of the 2009 update are $21.77, or just three cents lower than what was needed in 2007. The stability of the price comes even as Apple has complicated the interface by adding voiced song titles and an audio menu system for choosing from playlists. iSuppli believes the balance was achieved by having a purity of purpose, where virtually every minor part is ultimately just a slave to the media processor or the flash memory.

"Apple has managed to take the lowest end of the iPod line and actually further downsize it, while adding features to what had been a virtually featureless device," the research firm's teardown director Andrew Rassweiler says. "Beyond the memory and controller, all the other components basically provide power, interface and interconnect functions for the memory and media-player chips."

iFixit's dissection of the third-generation iPod shuffle.

Of the parts in the iPod, Samsung has the greatest influence over the price as it's responsible for both the processor and the storage. These combined represent about $11.98, or 55 percent of the total price after assembly is included.

iSuppli is quick to head off accusations that Apple is charging a roughly 200 percent profit margin, noting that the $21.77 manufacturing price doesn't account for licensing, marketing, shipping, and other efforts needed to actually bring the iPod shuffle to a store. It also doesn't reflect expenses at Apple as a whole.

Nonetheless, the analysts believe Apple is still building in a significant amount of headroom into the $79 price tag that may give it a more than healthy return with each unit sold, even if solely in the ratio of costs rather than the actual money.

"At a retail price of $79, the Shuffle has to be one of the most profitable Apple products in its entire line, on a percentage basis," Rassweiler points out.

Katie Marsal

Katie Marsal

-m.jpg)

Christine McKee

Christine McKee

Malcolm Owen

Malcolm Owen

Sponsored Content

Sponsored Content

Amber Neely

Amber Neely

21 Comments

In spite of fears that Apple was suddenly inflating its margins......

Fears?

For us AAPL shareholders (and non-shuffle consumers) the correct word would have been 'hopes.'

iSuppli

I don't place that much stock in their breakdowns. I think they gloss over what they don't know and that hampers accuracy.

Why does Apple put a dime in the iPod Shuffle? It seems like that would only serve to decrease their profit by 10 cents, where any piece of conductive metal could surely perform that function of a dumb dime.

[QUOTE=iSuppli is quick to head off accusations that Apple is charging a roughly 200 percent profit margin, noting that the $21.77 manufacturing price doesn't account for licensing, marketing, shipping, and other efforts needed to actually bring the iPod shuffle to a store.[/QUOTE]

With costs of $21.77 and revenue of $79, Apple's gross profit margin (not accounting for licensing, marketing, shipping, etc., is not 'roughly 200%', it is (79 - 21.77) / 79 = 72.4%.

Gross profit margin = gross profit / total revenue, and as such cannot be higher than 100%. To have a gross profit margin > 100% you would have to have made more money than you received revenue, and that just doesn't make sense.

Markup can easily be well over 100% and perhaps that's what the article was referring to? Assuming costs of $21.77 and a selling price of $79, the percentage markup of the shuffle (barring the previously mentioned costs) would be: 79 - 21.77 / 21.77 = 263% of cost.

With costs of $21.77 and revenue of $79, Apple's gross profit margin (not accounting for licensing, marketing, shipping, etc., is not 'roughly 200%', it is (79 - 21.77) / 79 = 72.4%.

Gross profit margin = gross profit / total revenue, and as such cannot be higher than 100%. To have a gross profit margin > 100% you would have to have made more money than you received revenue, and that just doesn't make sense.

Markup can easily be well over 100% and perhaps that's what the article was referring to? Assuming costs of $21.77 and a selling price of $79, the percentage markup of the shuffle (barring the previously mentioned costs) would be: 79 - 21.77 / 21.77 = 263% of cost.