As the halo effect of the iPod reached its maximum potential, reinvigorated Macintosh sales and deep market penetration by the iPhone have completely taken over as the main source of Apple's revenue and earnings. Â Even the iPad in its inaugural quarter will post more revenue and earnings than the iPod, pushing the device to Apple's 4th largest source of income. Â What's more, the iPod as a percentage of Apple's total revenue will drop below 10% in 2011.

A few years ago, I wrote an article detailing the iPod’s diminishing importance to Apple’s revenue growth. As Macintosh sales starting picking up steam, and as the advent of the iPhone assumed the helm of Apple’s future growth prospects, the iPod started a slow descent down from its throne as Apple’s key revenue driver.

In January 2006, when Apple hit all time highs of $86.40, I remember how investors and financial analysts feared Apple’s best years were behind it. This fear, while apparently unfounded in retrospect, stemmed from the perception that the iPod was near market saturation, and that Apple wouldn’t be able to innovate further. And though the market was in the midst of a raging bull market, investors saw Apple’s share price drop from $86.40 to $50.00 by that July.

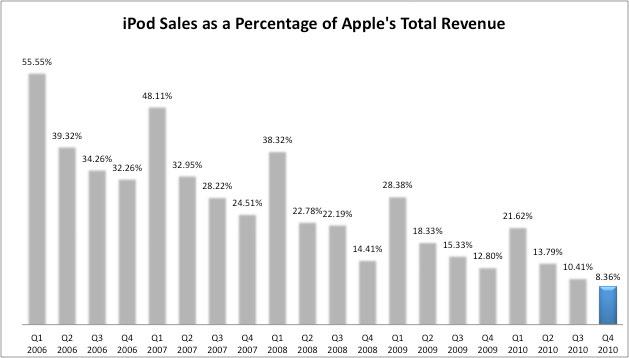

Turn the page to 2010, the iPod is a mere afterthought and Apple has since seen its share price grow almost 6 fold. And while the iPod demonstrated a lot more resilience than anticipated by the financial world, posting record quarter after record quarter through 2008, its significance as a revenue driver has now diminished to the point of being almost irrelevant to Apple’s overall growth. In Q1 2006, the iPod accounted for an astonishing 55.55% — or more than half — of Apple’s total revenue.

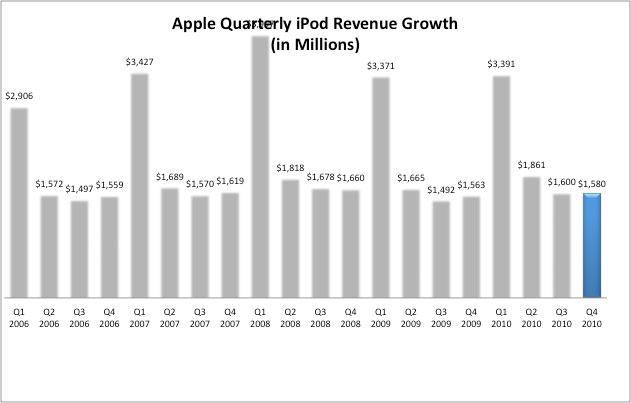

For the 2010 holiday shopping season, though the iPod posted 250% more revenue than it did in 2006, it only accounted for 21.62% or just a fifth of Apple’s total revenue. That right there is a very tangible example of Apple’s ability to innovate in the face of an inevitable and impending slowdown of its main revenue driver, the iPod. The chart below details iPod revenue as a percentage of Apple’s total revenue from 2006 through 2010. Please note that Q3 and Q4 of 2010 are merely estimates based on a detail analysis I’ve published, and that actual results may vary.

Notice how the iPod’s impact to Apple’s total revenue has been on a consistent and continual downtrend since 2006. It is as if the importance of the iPod wanes by the day. In fact, I’m projecting that the iPod as a percentage of Apple’s overall revenue will fall under 10% for the first time in Q4 of this year. And to get an idea of just how significant that really is, I’m expecting iTunes to account for 6.9% of total revenue in the same quarter. That’s an indication that the iPod is becoming just as insignificant of a revenue driver as is iTunes.

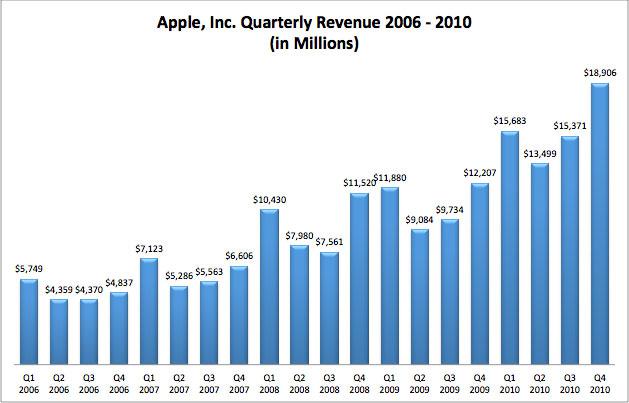

Yet, the chart above is even more impressive when one makes a side by side comparison to Apple’s total revenue in the same period. Even though the iPod has a diminishing impact on Apple’s total sales from 2006 to present, Apple’s revenue has outright exploded.

In Q1 2006, Apple reported $5.75 billion in revenue of which 55% were iPod sales. In 2010, Apple reported $15.7 billion or almost triple what it reported in 2006. Yet iPod sales only accounted for a meager 21.6% of that revenue. Any way you look at it, Apple is no longer dependent on the iPod, and any future signs of weakness should produce nothing more than a yawn. The chart below is a quarterly overview of Apple’s revenue from 2006 to 2010. Please be advised that Q3 and Q4 are merely projections, and that actual results may vary. A detailed look at how I arrived at those estimates can be found here.

Though the iPod is contributing less in terms of percentages, it still makes very hefty contributions in terms of revenue. In fact, while iPod revenue as a percentage of Apple’s overall revenue has been on a constant decline since 2006, the iPod has posted very consistent revenue throughout that period of time. The only thing that has changed is Apple’s product lineup, and an untouchable capacity to innovate. Hopefully this article puts the old adage, “As goes the iPod, so goes the Apple,†definitively the rest. Apple isn’t just the iPod maker or the iPhone maker, it’s a money maker. 2010 marks the end of the iPod era.

Andy Zaky is a graduate from the UCLA School of Law, an AppleInsider contributor and the founder and author of Bullish Cross — an online publication that provides in-depth analysis of Apple's financial health.

Andy M. Zaky, Bullish Cross, Special to AppleInsider

Andy M. Zaky, Bullish Cross, Special to AppleInsider

Andrew Orr

Andrew Orr

Amber Neely

Amber Neely

William Gallagher

William Gallagher

Christine McKee

Christine McKee

AppleInsider Staff

AppleInsider Staff

115 Comments

I generally agree with your point, but I have to ask: Do your figures and charts above include the iPod TOUCH as well as the iPod Classic, Nano and Shuffle?

I ask because I'm pretty sure that the iPod Touch makes up a huge portion of the iOS-based device revenue, and that Touch sales are through the roof.

Now, if you're talking about the NON-iOS based iPods, I agree 100%, but I'd be very surprised if iPod Touch sales/revenue are becoming "irrelevant", as this article would seem to imply. Just wondering...

This is how accountants defraud people. They show charts and graphs based on arbitrary definitions and half-truths to lie without actually lying.

iPhones ARE iPods. iPads are less so, although they do have iPods built in to them.

Considering iPod hardware as a standalone entity is also kind of crazy. The real success was the iPod/iTunes Store ecosystem that really made Apple's solution much more compelling than any of the myriad combinations of me-too hardware and clunky online distribution networks. The iTunes Store is doing brilliantly.

The fact that products that are only iPods are fading is in no way, shape or form that it is dying. It is merely testament that Apple has pushed iPod-related technologies so far that the extended functionality of making phone calls or of being put into a tablet with no moving parts have become the successful children of the venerable device.

I love reading AppleInsider because it feels more like informed journalism and less like off-the-cuff blogging. I also read the too infrequent postings Bullish Cross. It is great to see Andy Zaky writing Apple financial analysis for AppleInsider now. A great match! Looking forward to more.

This is how accountants defraud people. They show charts and graphs based on arbitrary definitions and half-truths to lie without actually lying.

iPhones ARE iPods. iPads are less so, although they do have iPods built in to them.

Considering iPod hardware as a standalone entity is also kind of crazy. The real success was the iPod/iTunes Store ecosystem that really made Apple's solution much more compelling than any of the myriad combinations of me-too hardware and clunky online distribution networks. The iTunes Store is doing brilliantly.

The fact that products that are only iPods are fading is in no way, shape or form that it is dying. It is merely testament that Apple has pushed iPod-related technologies so far that the extended functionality of making phone calls or of being put into a tablet with no moving parts have become the successful children of the venerable device.

Well said, although I think it's a bit harsh to accuse him of being dishonest here; I'm just trying to clarify what his point was.

You said it better than I did, however; yes, of course the iPhone is *also* an iPod, as is the iPod Touch. I *assume* that what he's referring to is the "iPod-only" lines, which include the Classic, Nano and Shuffle.

I think the reality is that Apple got too good at shilling its own products. Innovating at the pace they did - nearly redesigning the unit every year - meant that most people (in the demographic) now own 1 or 2 iPods, some even more. (I've owned 4 myself, because I needed to replace broken models, and I given a few others as gifts.) At this point, there just isn't really an impetus for most users to plunk down $200 for a new iPod... particularly when they already have one that does nearly the same thing. I mean, there's only so many ways to play and store music and, therefore, only so many ways that the company can innovate.

In that light, I'm really curious to see how they treat the Nano this year. It can't get a much bigger screen or smaller form factor without removing the clickwheel altogether. With the addition of FM radio and a camera in the last rev, it addresses nearly every feasible customer request for a unit of that size. A larger capacity would be helpful, but that's tied more to memory prices than anything that Apple's able to control.

If you take a look at the iPhone, it suggests a bit where their brain is at and what we might see from future handhelds, the iPod included. They've managed to innovate that at a staggering pace, because an iPhone is really more like a small computer and thus has room for more bells and whistles. At the very least, they'll probably always be able to give it moderate speed increases, which is enough to get some consumers coming back indefinitely. With an iPod, no such road exists (I really don't want to hear my music played back any faster, thanks.) What we'll probably see, then, is more attention devoted to the iPod touch, which addresses a market directly between casual iPod users and hardcore iPhone users. (Think: Your 12 year old kid.) Apple will be able to innovate there on a pace comparative with the iPhone, and so shouldn't encounter the same the one-trick pony

problem it has with it's dedicated music/video players.

Whatever happens, they've sold a lot of iPods, so even if this is the end it's been a good ride.