The huge story this quarter will undoubtedly be the gigantic $2 billion top-line beat that Apple is likely to dish out when it releases results. This will prove once again how analysts continue to under-estimate just how explosive Apple's growth really is.

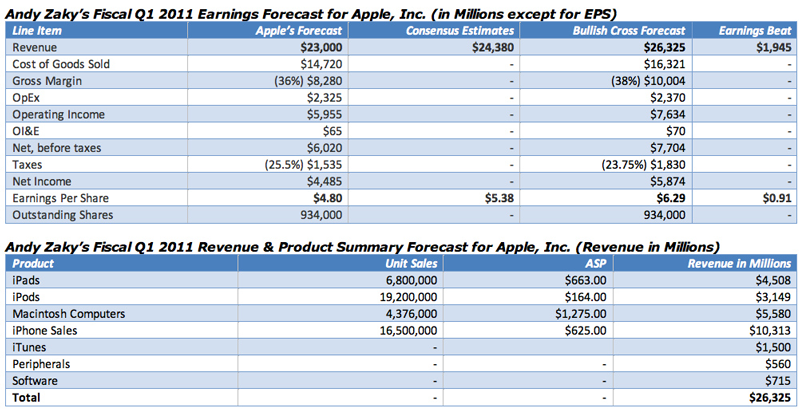

Wall street Analysts polled by Thomson Reuters expect Apple to post $5.38 in earnings per share (EPS) on approximately $24.38 billion in revenue. Yet, bloggers and unaffiliated analysts who tend to almost always outperform Wall Street analysts are looking for significantly stronger numbers out of the company. The spread between analysts and bloggers isn't always necessarily very wide, but when it is, Apple tends to smash all expectations.

Bloggers are looking for Apple to post $6.32 in earnings per share (EPS) on approximately $26.4 billion in revenue. This according to a poll recently taken by Philip Elmer-DeWitt at Fortune. As anyone can see, the bloggers are looking for Apple to beat on the top-line by over $2 billion.

Q1 2011 Earnings Estimates Apple

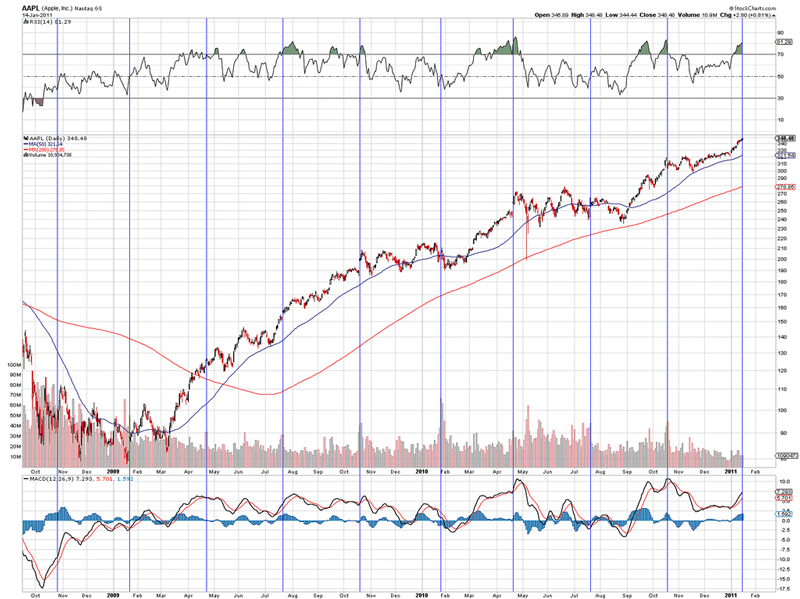

Now while I don't doubt this report is likely to be well received by investors and Apple will probably pop on the report in after-hours despite Jobs' health related leave of absence, I think the stock is likely to sell-off a bit within a day or two after its report. It has tended to be almost always prudent to take profits whenever Apple has run-up big ahead of its earnings report and then gaps-up big in the following trading session. The tendency has been to see Apple trade sideways to down from either its opening price after earnings or the following few trading session.

The Steve Jobs news won't help matters very much either. In fact, I think it's even possible that Apple could be immediately sold-off on great earnings given the humongous run it has had since August. The stock is up over 50% in just 6 months time. So if Apple trades very poorly into the close, I wouldn't be surprised to see further downside on the earnings release. The chart below shows how Apple has tended trade following its past quarterly earnings results.

Apple Earnings Releases

Also the broader market is extremely over-extended and it is now getting increasingly likely that we'll see a 10% or so correction within the next few weeks. Whenever the S&P 500 trades 10% above its 200-day moving average, the broader market tends to see some sort of a pull-back which might present opportunities for those waiting to jump into Apple.

For those who wish to take advantage of hedging strategies or reduce earnings volatility, please refer to my article on how to protect Apple profits ahead of its earnings releases.

Disclosure: No position in Apple.

Andy Zaky is a graduate from the UCLA School of Law, an AppleInsider contributor and the founder and author of Bullish Cross — an online publication that provides in-depth analysis of Apple's financial health.

By Andy M. Zaky, Bullish Cross, Special to AppleInsider

By Andy M. Zaky, Bullish Cross, Special to AppleInsider

-m.jpg)

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Amber Neely

Amber Neely

Andrew O'Hara

Andrew O'Hara

Sponsored Content

Sponsored Content

Charles Martin

Charles Martin

29 Comments

Select:

A) "Now while I don't doubt this report is likely to be well received by investors and Apple will probably pop on the report in after-hours despite Jobs' health related leave of absence,I think the stock is likely to sell-off a bit within a day or two after its report."

or

B) "The Steve Jobs news won't help matters very much either. In fact, I think it's even possible that Apple could be immediately sold-off on great earnings given the humongous run it has had since August."

Given that all bases are covered, in 5 or 10 years you will be able to write that you were correct!

Select:

A) "Now while I don't doubt this report is likely to be well received by investors and Apple will probably pop on the report in after-hours despite Jobs' health related leave of absence,I think the stock is likely to sell-off a bit within a day or two after its report."

or

B) "The Steve Jobs news won't help matters very much either. In fact, I think it's even possible that Apple could be immediately sold-off on great earnings given the humongous run it has had since August."

Given that all bases are covered, in 5 or 10 years you will be able to write that you were correct!

It is a lazy edit job from Andy. The first paragraph, sans mention of Steve was posted Sunday night. The second is new to this story, AFAIK.

Maybe this'll allow them to reduce the Apple Tax just a smidge for us poor commoners...

Whatever happens, please protect us from the wishy-washy Apple of the past in favor of the confident and decisive Apple of these last few years...

UPDATE: Opening bell sees an immediate 5% drop in AAPL, which is not as severe as I thought it would be... (now, after 15 minutes the stock has leveled off at 3% down).

Maybe this'll allow them to reduce the Apple Tax just a smidge for us poor commoners...

this user has nothing better to do with their time than to post persistently anti Apple or anti Jobs statements on AppleInsider despite how foolish or preposterous they turn out to be, just view their last 25 posts.

That's all I'm going to do to feed this troll, don't waste any more time, it's precious as anybody who's been seriously unwell can attest to.